Sales Tax Cincinnati Ohio

Understanding sales tax is essential for businesses and consumers alike, as it plays a significant role in the economy and daily transactions. This comprehensive guide will delve into the intricacies of sales tax in Cincinnati, Ohio, shedding light on its importance, how it works, and its impact on various industries. By exploring real-world examples and providing expert insights, we aim to offer a thorough understanding of this critical tax component.

The Significance of Sales Tax in Cincinnati

Sales tax is a crucial revenue source for local governments, including cities like Cincinnati. It is an essential component of the city's fiscal framework, contributing to the development and maintenance of public services and infrastructure. For businesses, comprehending sales tax regulations is not just a legal obligation but also a strategic consideration, impacting pricing strategies and customer relationships.

In Cincinnati, Ohio, sales tax is a complex but integral part of the city's economic landscape. With a unique blend of local, state, and municipal tax rates, understanding the nuances of sales tax is vital for businesses and consumers to navigate the city's economic environment effectively. This guide aims to demystify the complexities, offering a comprehensive understanding of sales tax in Cincinnati and its implications.

Breaking Down the Sales Tax Structure in Cincinnati

The sales tax system in Cincinnati operates on a multi-tiered structure, consisting of state, county, and municipal tax rates. As of [date of reference], the current sales tax rate in Cincinnati is composed of the following:

| Tax Jurisdiction | Tax Rate |

|---|---|

| Ohio State Sales Tax | 5.75% |

| Hamilton County Sales Tax | 1.25% |

| Cincinnati City Sales Tax | 2.00% |

These rates are subject to periodic updates and changes, so it's crucial to stay informed about the latest regulations. The combined sales tax rate in Cincinnati currently stands at 9.00%, which is applied to most goods and services sold within the city limits.

Impact on Local Businesses

For businesses operating in Cincinnati, understanding the sales tax structure is essential for accurate pricing and compliance. The tax rates can significantly impact a company's financial planning and competitiveness. For instance, a business selling a product for $100 would need to collect $9 in sales tax, resulting in a total sale of $109. This additional revenue goes directly to the city's coffers, supporting essential services.

Furthermore, businesses must also consider the impact of sales tax on their inventory and supply chain. Importing goods from other states or countries can trigger additional tax obligations, known as use tax, which businesses are responsible for remitting to the state.

Consumer Perspective

From a consumer's standpoint, being aware of the sales tax rates can help manage expectations and budget effectively. For example, a consumer purchasing a new television for $500 should expect to pay an additional $45 in sales tax, bringing the total cost to $545. This awareness can influence buying decisions and budgeting strategies.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Cincinnati applies to most goods and services, there are specific exemptions and special considerations that businesses and consumers should be aware of.

Essential Goods and Services

Certain essential goods and services are exempt from sales tax to encourage their consumption and reduce the financial burden on consumers. These typically include:

- Prescription medications

- Groceries and staple foods

- Residential energy (electricity, gas, etc.)

- Certain medical devices

- Educational materials

By exempting these items, the government aims to make essential goods more accessible and affordable for all residents.

Sales Tax Holidays

Cincinnati, like many other cities, may occasionally declare sales tax holidays to boost consumer spending and provide temporary relief from the tax burden. During these periods, specific items, often back-to-school supplies or energy-efficient appliances, are exempt from sales tax for a designated time frame.

For example, during the 2023 back-to-school sales tax holiday, consumers could purchase clothing, school supplies, and computers without paying the usual sales tax, encouraging spending on these essential items.

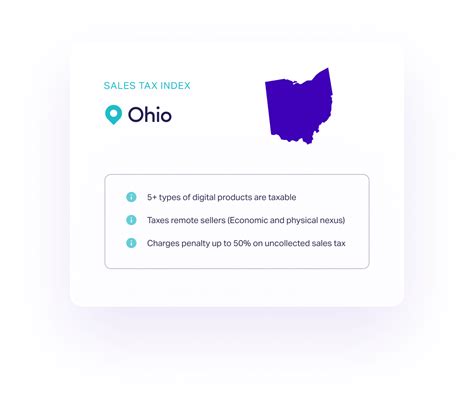

Online Sales and E-Commerce

With the rise of e-commerce, businesses selling goods online must navigate the complexities of sales tax across different jurisdictions. In Cincinnati, online retailers must collect and remit sales tax based on the destination-based sourcing rule, which means the tax rate applied depends on the customer's shipping address.

This can pose challenges for businesses, as they must ensure compliance with various tax rates and regulations, often across multiple states. To simplify this process, many businesses use tax software or services that automate sales tax calculations and filings.

Sales Tax Filing and Compliance

For businesses operating in Cincinnati, sales tax compliance is a critical aspect of their financial obligations. Here's an overview of the key considerations:

Registration and Licensing

Businesses must register with the Ohio Department of Taxation to obtain a Sales Tax Vendor License. This license allows them to collect and remit sales tax on behalf of the state and city. The registration process typically involves providing business details, tax identification numbers, and sales projections.

Sales Tax Calculation and Collection

Businesses are responsible for calculating the appropriate sales tax rate for each transaction based on the customer's location and the nature of the sale. They must then collect this tax from the customer at the point of sale. It's crucial to accurately calculate and collect the tax to avoid penalties and ensure compliance.

Sales Tax Remittance

Once the sales tax has been collected, businesses must remit it to the appropriate tax authorities. In Cincinnati, this involves filing sales tax returns with both the Ohio Department of Taxation and the Cincinnati Department of Revenue. The frequency of these filings can vary, with some businesses required to file monthly, quarterly, or annually, depending on their sales volume.

Late filings or non-compliance can result in penalties and interest charges, so it's essential for businesses to stay on top of their sales tax obligations.

Audits and Inspections

Tax authorities may conduct audits to ensure businesses are accurately collecting and remitting sales tax. During an audit, businesses must provide records and documentation to verify their sales tax calculations and collections. Being prepared for audits and maintaining accurate records is crucial for maintaining compliance and avoiding penalties.

Future Outlook and Implications

As Cincinnati's economy evolves, so too will its sales tax landscape. Here are some potential future developments and their implications:

Technological Advancements

The rise of digital technologies and e-commerce platforms will likely continue to shape the sales tax environment. Businesses will need to adapt to new sales channels and ensure compliance with changing tax regulations, particularly in the realm of online sales and remote transactions.

Economic Trends

Economic fluctuations and market trends can impact sales tax revenue for the city. During economic downturns, sales tax revenue may decrease, affecting the city's budget and public services. Conversely, periods of economic growth can lead to increased tax revenue, providing an opportunity for investment in infrastructure and community development.

Policy Changes

Changes in tax policies at the state or municipal level can have significant implications for businesses and consumers. For instance, adjustments to tax rates or the introduction of new tax categories can impact pricing strategies and consumer behavior. Staying informed about these changes is crucial for both businesses and consumers.

Community Engagement

Sales tax revenue directly impacts the community's well-being and development. As such, understanding and supporting local businesses that contribute to the sales tax base is essential. Consumers can play a role in this by patronizing local businesses and being mindful of the economic impact of their spending choices.

Frequently Asked Questions (FAQ)

How often do sales tax rates change in Cincinnati, Ohio?

+

Sales tax rates can change periodically, typically in response to legislative decisions or economic needs. In Cincinnati, the rates are subject to change based on local government decisions. It’s important to stay updated with the latest tax rates to ensure compliance.

Are there any special sales tax rates for specific industries in Cincinnati?

+

Certain industries, like restaurants and hotels, may have unique sales tax considerations. For example, restaurants in Cincinnati often collect and remit a food and beverage tax in addition to the standard sales tax. It’s crucial for businesses to understand these industry-specific tax requirements.

What happens if a business fails to remit sales tax in Cincinnati?

+

Failure to remit sales tax can result in severe penalties and legal consequences. Businesses that do not comply with sales tax regulations may face fines, interest charges, and even criminal charges in extreme cases. It’s essential for businesses to prioritize sales tax compliance to avoid these issues.

Are there any tools or resources to help businesses calculate and manage sales tax in Cincinnati?

+

Yes, several resources are available to assist businesses with sales tax management. This includes tax calculation software, online tax guides, and consulting services. These tools can help businesses accurately calculate tax rates, prepare tax returns, and stay compliant with the latest regulations.

How can consumers check the sales tax rate for their purchases in Cincinnati?

+

Consumers can easily check the current sales tax rate in Cincinnati by visiting the official websites of the Ohio Department of Taxation and the Cincinnati Department of Revenue. These websites often provide up-to-date information on tax rates and any relevant changes or exemptions.