Income Tax Slabs In India

Income tax in India is a crucial aspect of the country's financial system, playing a significant role in the development and growth of the nation. The Indian government levies income tax on individuals and businesses, and the revenue generated is utilized for various developmental projects, infrastructure, and social welfare schemes. The income tax slabs in India determine the tax liability of individuals based on their annual income. Understanding these slabs is essential for taxpayers to plan their finances effectively and ensure compliance with the tax laws.

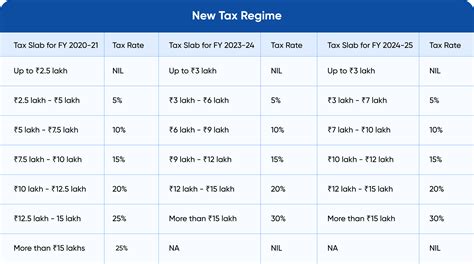

Income Tax Slabs for the Assessment Year 2023-24

The Indian government announces the income tax slabs annually, and the latest tax rates for the assessment year 2023-24 (financial year 2022-23) were introduced as part of the Union Budget 2022. These tax slabs are applicable to individuals, Hindu Undivided Families (HUFs), and other non-corporate entities.

Tax Slabs for Resident Individuals (below 60 years of age)

The tax slabs for resident individuals below 60 years of age are as follows:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹2,50,000 | No Tax |

| ₹2,50,001 to ₹5,00,000 | 5% |

| ₹5,00,001 to ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

It's important to note that individuals in this category are eligible for a standard deduction of ₹50,000, which can be claimed against their total income.

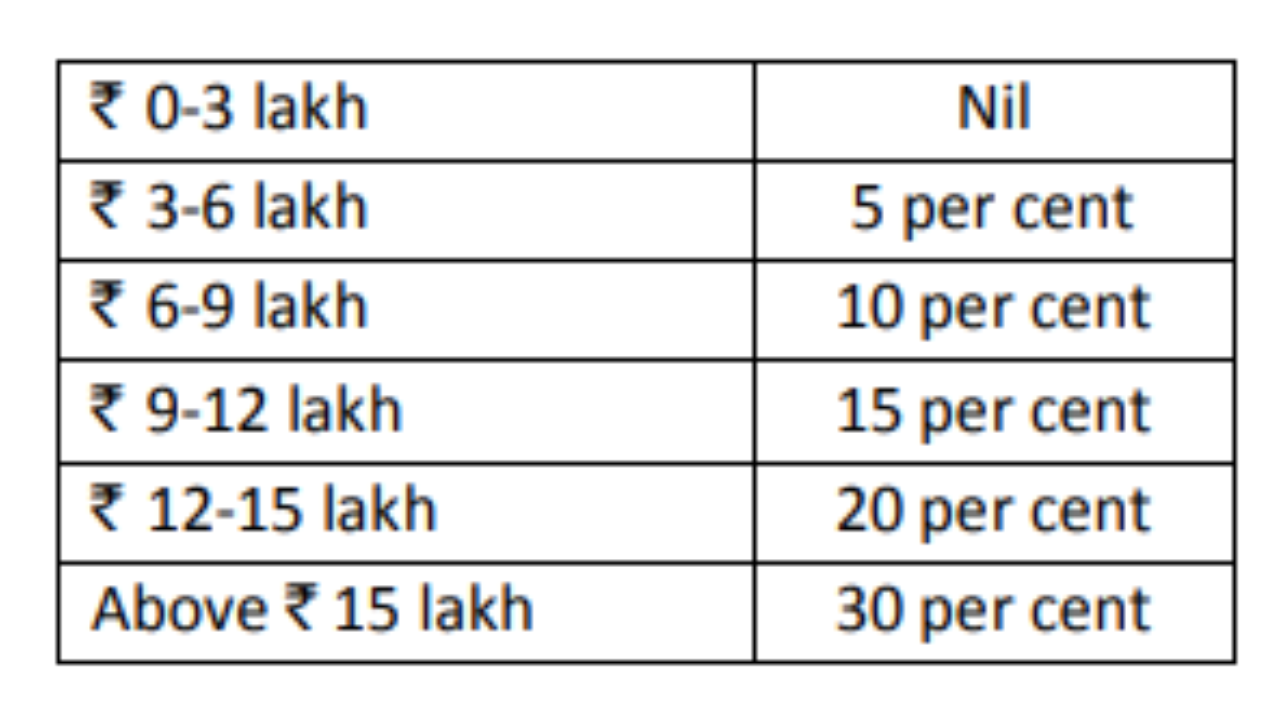

Tax Slabs for Senior Citizens (60 years and above)

For senior citizens aged 60 years and above, the tax slabs are as follows:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹3,00,000 | No Tax |

| ₹3,00,001 to ₹5,00,000 | 5% |

| ₹5,00,001 to ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Senior citizens also benefit from a higher standard deduction of ₹50,000.

Tax Slabs for Super Senior Citizens (80 years and above)

Individuals aged 80 years and above, known as super senior citizens, have the following tax slabs:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹5,00,000 | No Tax |

| ₹5,00,001 and above | 30% |

Super senior citizens receive a higher tax exemption limit of ₹5,00,000 and are subject to a flat tax rate of 30% on income above this limit.

Tax Deductions and Exemptions

In addition to the standard deductions mentioned earlier, individuals can claim various tax deductions under different sections of the Income Tax Act. Some common deductions include:

- Section 80C: Deductions for investments in ELSS funds, PPF, EPF, life insurance premiums, and principal repayment of home loans.

- Section 80D: Deductions for health insurance premiums for self, spouse, and dependent parents.

- Section 80E: Deductions for interest on education loans.

- Section 80G: Deductions for donations to eligible charitable organizations.

Tax Rates for Corporate Entities

The tax rates for corporate entities, such as companies, are different from those for individuals. The corporate tax slabs for the assessment year 2023-24 are as follows:

| Income Slab | Tax Rate |

|---|---|

| Up to ₹10,000,000 | 25% |

| Above ₹10,000,000 | 30% |

Additionally, there are provisions for Minimum Alternate Tax (MAT) and surcharge for corporate entities based on their income levels.

Impact of Income Tax Slabs on the Economy

The income tax slabs in India have a significant impact on the economy and the financial well-being of individuals and businesses. They influence savings and investment patterns, as taxpayers often plan their financial strategies to maximize deductions and minimize tax liabilities. The tax structure also encourages individuals to invest in various savings schemes and contribute to the country’s economic growth.

Moreover, the tax revenues generated from these slabs are crucial for the government's developmental initiatives. The funds are allocated for infrastructure development, education, healthcare, and various social welfare programs, ultimately benefiting the overall welfare of the nation.

Future Outlook and Potential Changes

The income tax slabs in India are subject to periodic revisions, and the government may introduce changes to align with the evolving economic landscape and the needs of the country. Over the years, there have been debates and proposals to simplify the tax structure, merge slabs, or introduce a flat tax rate. While such reforms could bring about efficiency and ease of compliance, they also raise concerns about the potential impact on revenue generation and income distribution.

As the Indian economy continues to grow and evolve, it is essential for taxpayers to stay updated with the latest tax laws and utilize available deductions and exemptions effectively. By understanding the income tax slabs and planning their finances accordingly, individuals and businesses can contribute to the nation's growth while also ensuring their financial stability.

When were the latest income tax slabs introduced in India?

+

The latest income tax slabs for the assessment year 2023-24 were introduced as part of the Union Budget 2022, which was presented by the Finance Minister of India.

Are there any tax benefits for investing in mutual funds or equity shares in India?

+

Yes, investments in Equity Linked Savings Schemes (ELSS) funds and certain equity-oriented mutual funds are eligible for tax deductions under Section 80C of the Income Tax Act.

Can senior citizens claim tax deductions for medical expenses?

+

Senior citizens can claim deductions for medical expenses incurred for themselves, their spouse, and dependent parents under Section 80D of the Income Tax Act. The deduction limit varies based on the age and type of medical treatment.