Co Sales Tax

In the dynamic world of e-commerce and online retail, the topic of sales tax has become increasingly complex and significant. With the growth of cross-border trade and the rise of digital marketplaces, understanding the intricacies of sales tax compliance has never been more crucial for businesses. This article aims to delve into the specifics of Co Sales Tax, providing an in-depth analysis and expert insights to navigate this intricate landscape.

The Complexity of Co Sales Tax: Navigating a Multi-State Environment

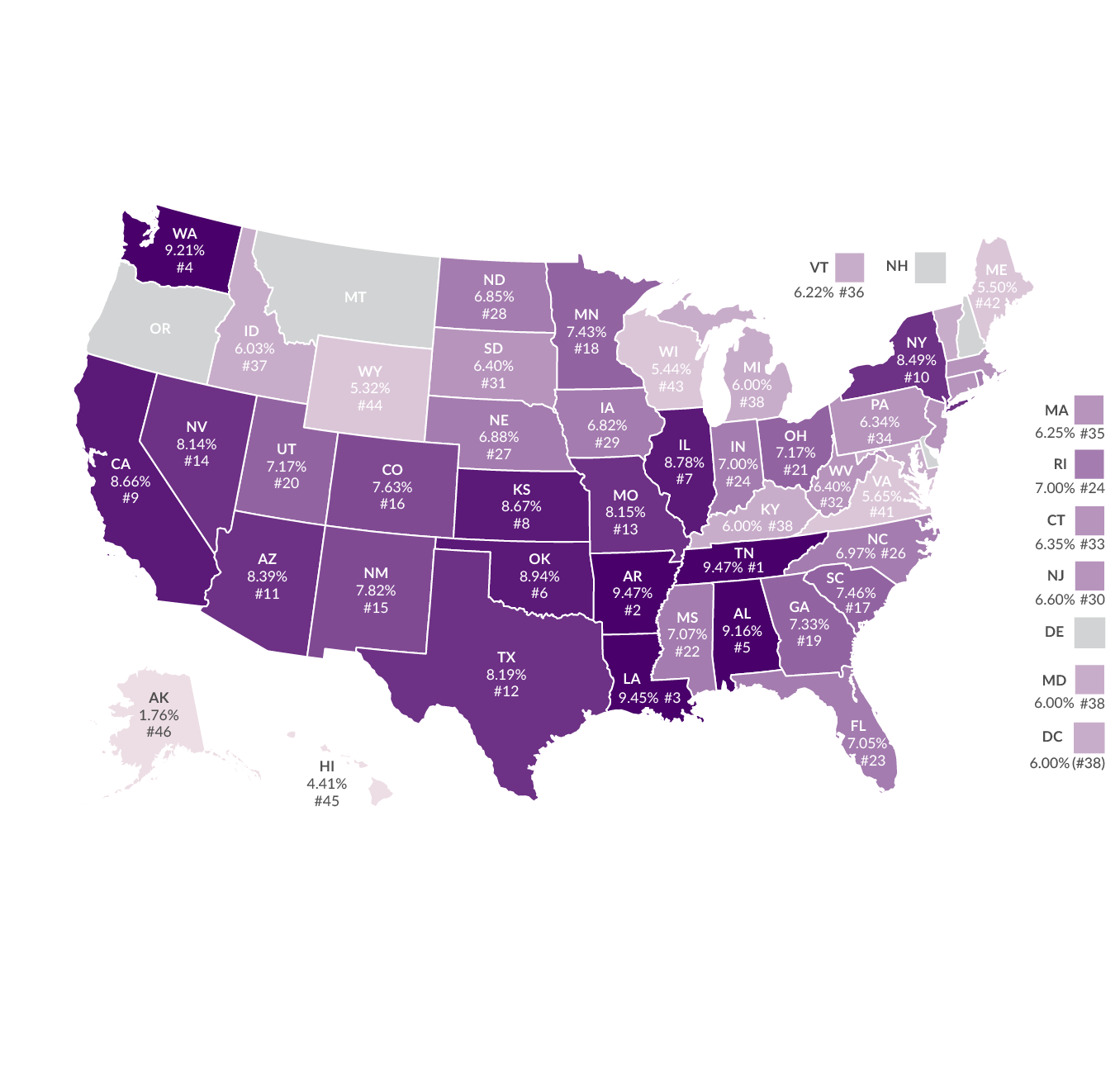

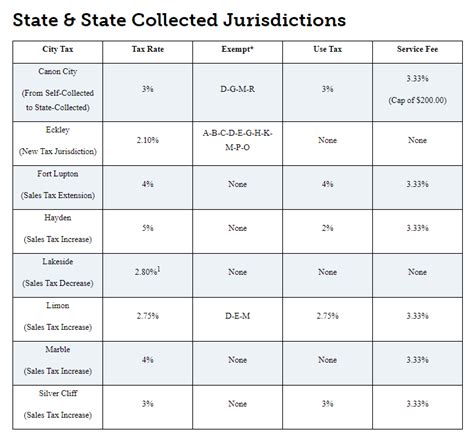

Co Sales Tax, a crucial component of doing business in the United States, presents a unique challenge due to the country’s diverse tax environment. With each state having its own set of sales tax regulations, rates, and exemptions, businesses operating in multiple states must navigate a complex web of compliance requirements. This is particularly pertinent for e-commerce platforms, which often serve customers across the country, making it imperative to understand and adhere to each state’s specific sales tax rules.

Understanding the State-Specific Sales Tax Landscape

The United States boasts a diverse range of sales tax rates and regulations. For instance, while some states like Delaware and Montana have no sales tax, others like California impose a higher rate with additional local taxes. This variability poses a significant challenge for businesses, especially those engaged in e-commerce, as they must ensure compliance with the unique tax laws of each state they operate in or serve.

To illustrate, consider a business based in California selling products to customers in various states. This business would need to account for the varying sales tax rates, ensure compliance with each state's unique tax laws, and accurately calculate and collect the appropriate tax amounts. The complexity of this process only increases with the addition of local taxes, special districts, and varying product taxability rules across different states.

| State | Sales Tax Rate | Additional Notes |

|---|---|---|

| California | 7.25% | Varies by county, with some areas imposing higher rates |

| Texas | 6.25% | Cities and counties may add additional taxes |

| New York | 4% | Varies by county, with some areas imposing higher rates; city and state taxes may apply |

| Florida | 6% | Varies by county; some areas have additional local taxes |

| Illinois | 6.25% | May vary by county and city; additional taxes may apply |

This table provides a glimpse into the variability of sales tax rates across just a few states. In reality, the landscape is far more intricate, with each state having its own set of regulations and potential for additional local taxes.

Challenges and Strategies for Compliance

Ensuring compliance with Co Sales Tax regulations is a significant challenge for businesses, particularly those operating in multiple states. The variability in sales tax rates, the complexity of tax laws, and the potential for audits and penalties all contribute to the difficulty of maintaining compliance. To address these challenges, businesses can employ several strategies, including:

- Utilizing sales tax automation tools: These tools can help businesses accurately calculate and collect the correct sales tax amounts, ensuring compliance with each state's unique tax laws.

- Staying informed about tax law changes: Sales tax laws are subject to frequent changes, so businesses must stay updated to avoid non-compliance. Regularly checking for updates and changes in tax laws can help businesses stay ahead of the curve.

- Establishing a robust tax compliance process: Developing a well-defined process for calculating, collecting, and remitting sales tax can help businesses maintain consistency and accuracy. This process should be regularly reviewed and updated to account for any changes in tax laws or business operations.

- Seeking professional advice: Engaging the services of tax professionals or consulting firms with expertise in sales tax compliance can provide valuable guidance and support. These experts can help businesses navigate the complexities of Co Sales Tax, ensuring they remain compliant and avoid potential penalties.

The Impact of E-Commerce on Co Sales Tax

The rise of e-commerce has had a significant impact on Co Sales Tax. With the ability to reach customers across the country, e-commerce businesses face the challenge of navigating the complex sales tax landscape of multiple states. This is further complicated by the fact that many states are now requiring online retailers to collect sales tax, even if they don’t have a physical presence in the state.

E-Commerce and the Economic Nexus

The concept of economic nexus has had a significant impact on the sales tax landscape for e-commerce businesses. Economic nexus refers to the threshold at which a business is required to collect and remit sales tax in a state, typically based on a certain level of economic activity in that state. This can include a minimum number of transactions, sales volume, or even having a certain number of employees or affiliates in the state.

For instance, a business that sells products online and ships them to customers in various states may be required to collect and remit sales tax in those states if they meet the economic nexus threshold. This has led to a significant increase in the number of businesses that are required to collect sales tax, especially in the e-commerce sector.

To illustrate, consider an online retailer based in California that ships products to customers in New York. If the retailer meets the economic nexus threshold in New York, they would be required to collect and remit sales tax to the state, even though they don't have a physical presence there. This adds an additional layer of complexity to the sales tax compliance process for e-commerce businesses.

Sales Tax Automation for E-Commerce

Sales tax automation has become a critical tool for e-commerce businesses to manage their Co Sales Tax obligations. These tools can integrate with e-commerce platforms, automatically calculating and applying the appropriate sales tax rates based on the customer’s location. They can also handle the remittance of sales tax to the relevant state tax authorities, ensuring compliance and reducing the risk of penalties.

For example, an e-commerce business using a sales tax automation tool can ensure that customers in different states are charged the correct sales tax rate. The tool can automatically determine the state, county, and city where the customer is located, and apply the corresponding sales tax rate. This not only simplifies the sales tax compliance process but also enhances the customer experience by providing accurate pricing information at checkout.

Furthermore, sales tax automation tools can also assist with filing and remitting sales tax returns. These tools can generate the necessary tax forms and submit them to the appropriate tax authorities, saving businesses time and effort. This is particularly beneficial for e-commerce businesses that operate in multiple states, as it streamlines the sales tax filing process and reduces the risk of errors or late filings.

The Future of Co Sales Tax: Trends and Implications

Looking ahead, several trends are likely to shape the future of Co Sales Tax. The continued growth of e-commerce and the increasing use of online marketplaces will further complicate the sales tax landscape, especially with the ongoing debates and court cases surrounding economic nexus and sales tax collection.

Expected Changes in Sales Tax Laws

Sales tax laws are subject to change, and businesses must stay informed about any upcoming changes that could impact their operations. Here are some potential changes to watch out for:

- Expansion of economic nexus rules: As more states seek to capture revenue from e-commerce businesses, we can expect an expansion of economic nexus rules, with lower thresholds for businesses to start collecting sales tax.

- Increased focus on marketplace facilitators: With the rise of online marketplaces, states are likely to place more responsibility on marketplace facilitators to collect and remit sales tax on behalf of their sellers.

- Simplification of sales tax rates: Some states may move towards simplifying their sales tax rates and structures, making it easier for businesses to calculate and collect the correct amount of tax.

- Enhanced enforcement of sales tax compliance: States are likely to increase their efforts to enforce sales tax compliance, with more audits and penalties for non-compliant businesses.

The Role of Technology in Sales Tax Compliance

Technology will continue to play a crucial role in helping businesses navigate the complexities of Co Sales Tax. Sales tax automation software, for instance, will become even more sophisticated, offering advanced features like real-time tax rate updates and automated tax filing. This will enable businesses to stay compliant more efficiently and effectively.

Additionally, the integration of artificial intelligence and machine learning into sales tax software will enhance its capabilities. These technologies can analyze vast amounts of data to identify trends, predict changes in sales tax laws, and provide real-time compliance advice. This will empower businesses to make more informed decisions and stay ahead of any potential changes in the sales tax landscape.

Furthermore, the use of blockchain technology could revolutionize sales tax compliance. Blockchain's ability to provide a secure, transparent, and tamper-proof record of transactions could enhance the accuracy and traceability of sales tax data. This could streamline the sales tax collection and remittance process, reducing the risk of errors and fraud.

What is Co Sales Tax?

+Co Sales Tax refers to the sales tax obligations that businesses have when operating in multiple states in the United States. Each state has its own sales tax laws, rates, and regulations, making it complex for businesses to ensure compliance across all states they operate in.

How can businesses stay compliant with Co Sales Tax regulations?

+Businesses can stay compliant by utilizing sales tax automation tools, staying informed about tax law changes, establishing robust tax compliance processes, and seeking professional advice from tax experts.

What is the impact of e-commerce on Co Sales Tax?

+The rise of e-commerce has increased the complexity of Co Sales Tax, as e-commerce businesses often serve customers across multiple states. This has led to the concept of economic nexus, where businesses are required to collect and remit sales tax in states where they have a certain level of economic activity, even without a physical presence.

How can sales tax automation benefit e-commerce businesses?

+Sales tax automation tools can help e-commerce businesses accurately calculate and apply the correct sales tax rates based on the customer's location. They can also handle the remittance of sales tax to the relevant state tax authorities, ensuring compliance and reducing the risk of penalties.

What are some expected changes in sales tax laws in the future?

+Expected changes include the expansion of economic nexus rules, increased focus on marketplace facilitators, simplification of sales tax rates, and enhanced enforcement of sales tax compliance. Businesses should stay informed about these potential changes to ensure they remain compliant.

In conclusion, navigating the complex world of Co Sales Tax requires a deep understanding of the unique tax laws and regulations of each state. With the continued growth of e-commerce and the increasing use of online marketplaces, businesses must stay ahead of the curve by utilizing technology and staying informed about potential changes in sales tax laws. By adopting a proactive approach to sales tax compliance, businesses can ensure they remain compliant and avoid potential penalties.