Tax Form 5498

In the complex world of tax filings, the Internal Revenue Service (IRS) provides a range of forms to help taxpayers report their financial activities accurately. One such form, the Tax Form 5498, is a critical component in the US tax system, offering benefits and reporting requirements that impact millions of taxpayers each year. This article delves into the intricacies of Form 5498, exploring its purpose, the types of accounts it covers, and the key deadlines taxpayers should be aware of.

Understanding Tax Form 5498

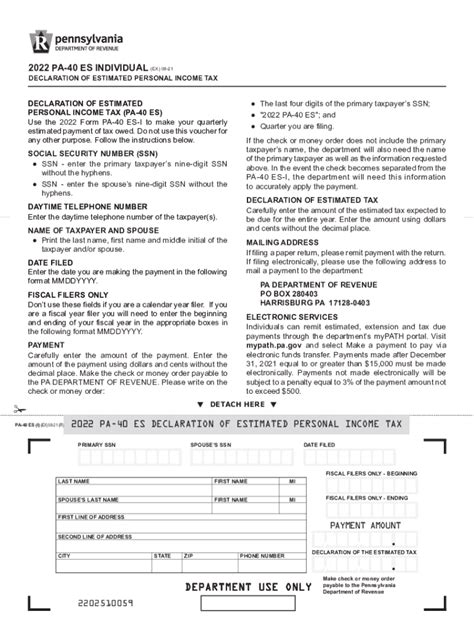

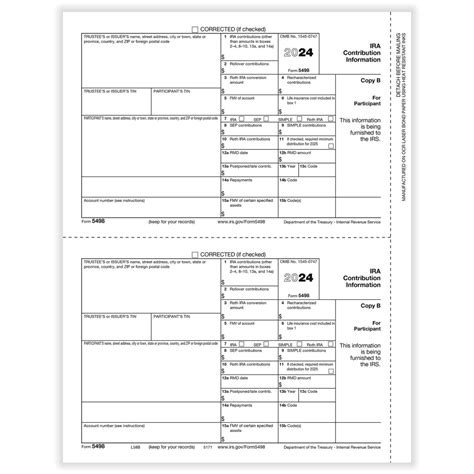

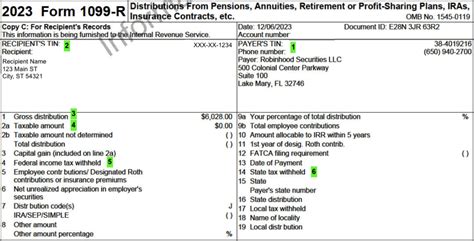

Tax Form 5498, officially known as the IRA Contribution Information, is a tax document used to report various types of Individual Retirement Account (IRA) contributions to the IRS. It is typically issued by financial institutions, such as banks, brokerage firms, or custodians, to their customers who have made contributions to their IRAs. The form provides important details about the contributions made during the tax year, including the type of IRA, the amount contributed, and any rollover or transfer activity.

The primary purpose of Form 5498 is to ensure accurate reporting of IRA contributions and to provide transparency to both taxpayers and the IRS. It serves as a record-keeping tool, helping taxpayers keep track of their IRA contributions and ensuring that they do not exceed the annual contribution limits set by the IRS. Additionally, the form plays a crucial role in tax planning, as it can impact the taxpayer's eligibility for certain tax deductions and credits.

Types of Accounts Covered by Form 5498

Form 5498 applies to several types of IRAs, each offering unique tax benefits and contribution rules. These include:

- Traditional IRA: Contributions to a Traditional IRA may be tax-deductible, depending on the taxpayer's income and participation in an employer-sponsored retirement plan. Earnings within the account grow tax-deferred until withdrawal.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, but qualified distributions are tax-free. This type of IRA offers the potential for tax-free growth and tax-free withdrawals.

- SEP IRA: Simplified Employee Pension (SEP) IRAs are designed for self-employed individuals and small business owners. Contributions to a SEP IRA are tax-deductible and can be higher than traditional or Roth IRAs.

- SIMPLE IRA: Savings Incentive Match Plan for Employees (SIMPLE) IRAs are for small businesses with 100 or fewer employees. They offer both employer and employee contributions, with tax benefits similar to a 401(k) plan.

It's important to note that Form 5498 is specifically used for reporting contributions to these types of IRAs. Other types of retirement accounts, such as 401(k)s or defined benefit plans, use different forms for reporting purposes.

Key Deadlines for Form 5498

Taxpayers and financial institutions must adhere to specific deadlines when it comes to Form 5498:

- Contribution Deadline: The deadline for making IRA contributions for a given tax year is typically April 15th of the following year. For example, contributions for the 2023 tax year must be made by April 15, 2024.

- Form Filing Deadline: Financial institutions are required to file Form 5498 with the IRS by May 31st of the year following the tax year in question. For the 2023 tax year, the filing deadline would be May 31, 2024.

- Taxpayer Reporting: Taxpayers are not required to attach Form 5498 to their tax return, but they should review the form for accuracy and ensure that it reflects their contributions accurately. In cases of discrepancies, taxpayers should contact their financial institution.

FAQs

Can I make IRA contributions after the April 15th deadline?

+While you can’t make IRA contributions for a specific tax year after April 15th, you can still contribute to your IRA for the current tax year. For example, if it’s April 2024, you can still make contributions for the 2024 tax year, but not for 2023.

What happens if I receive a Form 5498 with incorrect information?

+If you notice any discrepancies or errors on your Form 5498, it’s crucial to contact your financial institution promptly. They can issue a corrected form, which you should retain for your records.

Do I need to keep my Form 5498 after filing my taxes?

+Yes, it’s a good practice to keep all tax-related documents, including Form 5498, for at least three years. This allows you to have a record of your contributions and facilitates any necessary tax adjustments or audits.

Form 5498 plays a vital role in the US tax system, ensuring the accurate reporting of IRA contributions and providing taxpayers with valuable information for their tax planning. By understanding the purpose, types of accounts covered, and key deadlines associated with this form, taxpayers can navigate their retirement savings and tax obligations with greater ease and confidence.