Cashapp Taxes

In the ever-evolving world of financial technology, Cash App has emerged as a prominent player, offering a seamless and user-friendly platform for digital payments and money transfers. However, as with any financial tool, understanding the tax implications is crucial. This article aims to provide a comprehensive guide to Cash App Taxes, helping users navigate the complex world of taxation with ease and confidence.

Unraveling Cash App Taxes: A Comprehensive Guide

Cash App, developed by Square, Inc., has revolutionized the way we manage our finances, especially when it comes to peer-to-peer transactions. With its intuitive interface and widespread adoption, it has become a go-to choice for many individuals and businesses alike. However, the tax landscape can be daunting, especially for those new to the platform. In this guide, we’ll explore the ins and outs of Cash App Taxes, ensuring you stay compliant and make the most of your financial activities.

Understanding Cash App’s Tax Structure

Cash App operates within the framework of the Internal Revenue Service (IRS) guidelines, which means it adheres to the standard tax regulations applicable to digital payment platforms. Here’s a breakdown of the key aspects:

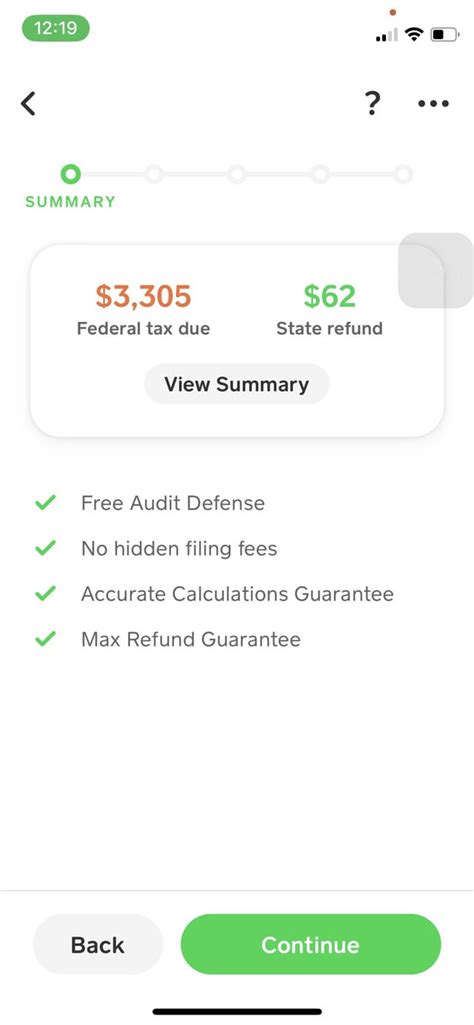

- Taxable Transactions: Cash App considers various activities as taxable events, including peer-to-peer payments, business transactions, and investments made through Cash App Investing. Each of these activities may trigger tax obligations, and it's essential to understand which ones apply to your specific usage.

- Reporting Requirements: The platform maintains detailed records of all financial activities, which are essential for tax reporting. Cash App provides users with the necessary tools and information to ensure accurate reporting, including transaction histories and relevant tax forms.

- Withholding and Remittance: For certain transactions, Cash App may be required to withhold taxes on behalf of users. This typically applies to business transactions and investment activities. The platform ensures timely remittance of these taxes to the appropriate authorities, making it a crucial aspect of compliance.

It's important to note that while Cash App provides a user-friendly experience, it's ultimately the responsibility of the user to understand and comply with tax regulations. This guide aims to empower users with the knowledge they need to navigate this complex landscape successfully.

Taxable Activities on Cash App

Cash App offers a range of services, and not all of them are created equal when it comes to tax implications. Let’s explore the different activities and their tax considerations:

| Activity | Tax Status |

|---|---|

| Peer-to-Peer Payments | Generally not taxable, unless used for business purposes or part of a barter-type arrangement. |

| Business Transactions | Subject to business income tax and may require additional reporting, such as 1099-K forms. |

| Cash App Investing | Capital gains and losses from investments are taxable. Cash App provides users with a 1099-B form for reporting purposes. |

| Bitcoin Transactions | Bitcoin transactions are treated as property for tax purposes, meaning gains or losses are subject to capital gains tax. Cash App provides a 1099-B form for Bitcoin transactions as well. |

Understanding these tax implications is crucial for accurate reporting and compliance. It's recommended to consult with a tax professional for personalized guidance based on your specific activities and circumstances.

Cash App’s Tax Reporting Features

Cash App recognizes the importance of tax compliance and has developed a range of features to assist users in their reporting obligations. Here’s an overview:

- Transaction History: Users can access a detailed history of all their financial activities on Cash App. This includes the date, amount, and nature of each transaction, providing the necessary data for tax reporting.

- Tax Forms: Cash App generates relevant tax forms based on a user's activities. For instance, if you engage in business transactions or investments, Cash App will provide you with a 1099-K or 1099-B form, respectively. These forms are crucial for accurate tax reporting and can be downloaded directly from the app.

- Tax Resources: Cash App offers a dedicated Tax Resource Center, providing users with valuable information and guidance on tax-related matters. This includes articles, tutorials, and FAQs, helping users understand their tax obligations and navigate the platform's tax features effectively.

By leveraging these tools, users can ensure they have the necessary information and resources to meet their tax reporting requirements. It's a testament to Cash App's commitment to user education and compliance.

Staying Compliant: Best Practices for Cash App Taxes

While Cash App provides a seamless experience, it’s essential to maintain compliance with tax regulations. Here are some best practices to ensure you stay on the right side of the law:

- Keep Accurate Records: Maintain a detailed record of all your Cash App activities, including the date, amount, and purpose of each transaction. This practice simplifies the process of tax reporting and ensures you have the necessary data when needed.

- Understand Tax Obligations: Take the time to understand your specific tax obligations based on your Cash App activities. Whether it's business transactions, investments, or Bitcoin trades, each activity carries its own set of tax implications. Stay informed and consult with tax professionals when necessary.

- Utilize Cash App's Features: Leverage the platform's tax reporting features, such as transaction history and tax forms. These tools are designed to assist users in their compliance efforts and make tax reporting more accessible and straightforward.

- Seek Professional Advice: If you're unsure about your tax obligations or have complex financial activities, it's always best to consult with a tax professional. They can provide personalized guidance based on your specific circumstances and ensure you meet all your tax requirements.

By following these best practices, users can navigate the world of Cash App Taxes with confidence, ensuring a smooth and compliant financial journey.

The Future of Cash App Taxes

As Cash App continues to innovate and expand its services, the tax landscape is likely to evolve as well. Here are some potential future developments and their implications:

- Enhanced Tax Integration: Cash App may further integrate its tax features, making it even easier for users to understand and meet their tax obligations. This could include automated tax calculations, improved reporting tools, and more comprehensive tax resources.

- Regulatory Changes: The tax regulations surrounding digital payment platforms are subject to change. Cash App will need to adapt to any new rules and guidelines, ensuring it remains compliant and provides users with the necessary updates and guidance.

- International Expansion: As Cash App expands its presence globally, it will need to navigate different tax systems and regulations in various countries. This presents a unique challenge and opportunity, as the platform adapts to meet the diverse needs of its international user base.

Staying informed about these potential developments will be crucial for users to ensure they remain compliant and make the most of Cash App's evolving features and services.

Conclusion

Cash App Taxes may seem complex, but with the right knowledge and tools, users can navigate this landscape with confidence. By understanding the tax implications of their activities, utilizing Cash App’s tax features, and staying informed about regulatory changes, users can ensure a smooth and compliant financial journey. As the platform continues to innovate and expand, it’s essential to stay ahead of the curve and make the most of the opportunities it presents.

How do I access my Cash App tax forms?

+To access your Cash App tax forms, log in to your Cash App account and navigate to the “Activity” tab. From there, you can filter your transactions based on the type of tax form you need (e.g., 1099-K or 1099-B). Once you’ve identified the relevant transactions, click on the “Tax Forms” button to download the necessary forms.

Are peer-to-peer payments on Cash App taxable?

+Generally, peer-to-peer payments on Cash App are not taxable unless they are used for business purposes or part of a barter-type arrangement. However, it’s always best to consult with a tax professional to ensure you’re compliant with your specific circumstances.

What happens if I don’t report my Cash App business transactions correctly?

+Failing to report business transactions on Cash App correctly can have serious consequences. You may face penalties, interest charges, or even legal action for tax evasion. It’s crucial to maintain accurate records and report your business transactions honestly to avoid any issues.