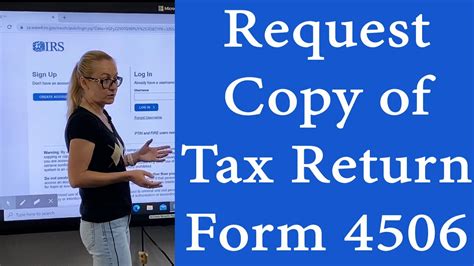

How To Get A Copy Of Tax Return

Tax returns are essential documents that provide a record of an individual's or business entity's financial transactions and tax obligations for a specific tax year. These documents are crucial for various purposes, such as verifying income, applying for loans, resolving tax-related issues, or simply maintaining personal financial records. While the process of obtaining a copy of a tax return can vary depending on your location and the tax authority involved, there are generally standardized procedures to ensure accessibility and transparency.

In this comprehensive guide, we will explore the steps and strategies to acquire a copy of your tax return, offering practical insights and expert advice. Whether you need to retrieve past tax filings, verify your records, or assist in resolving a tax-related matter, this article will equip you with the knowledge to navigate the process efficiently.

Understanding the Importance of Tax Returns

Before delving into the specifics of obtaining a tax return copy, it’s essential to recognize the significance of these documents in the context of personal finance and tax compliance.

Tax returns serve as a comprehensive record of an individual's or entity's financial activities, including income, deductions, credits, and tax payments. They are vital for several reasons:

- Income Verification: Tax returns are often required when applying for loans, mortgages, or other financial services. Lenders and financial institutions use these documents to assess an individual's financial stability and creditworthiness.

- Tax Compliance: Maintaining accurate tax records is essential for ensuring compliance with tax laws. Tax returns provide a historical overview of your tax obligations and can be crucial during audits or tax investigations.

- Personal Financial Management: Having access to past tax returns allows individuals to review their financial history, identify trends, and make informed decisions regarding savings, investments, and tax planning.

- Legal and Business Purposes: Tax returns are sometimes requested in legal proceedings, business transactions, or when dealing with government agencies. They serve as official documentation of financial transactions.

The Process of Retrieving Tax Return Copies

The process of obtaining a copy of your tax return may vary based on your location and the tax authority responsible for collecting and storing tax information. However, the general steps and considerations remain consistent.

Step 1: Determine the Relevant Tax Authority

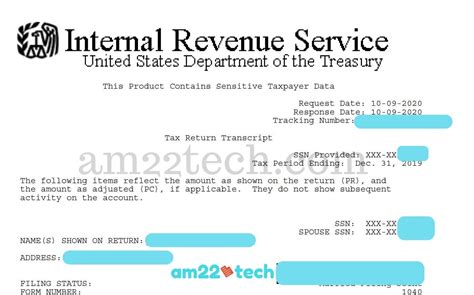

The first step is to identify the tax authority that handles tax returns in your jurisdiction. This could be a federal, state, or provincial tax agency, depending on your location. Common examples include the Internal Revenue Service (IRS) in the United States, the Canada Revenue Agency (CRA) in Canada, or the Inland Revenue Service (IRS) in the United Kingdom.

Research the official website of the relevant tax authority to familiarize yourself with their procedures and services. They often provide detailed information on accessing tax records and requesting copies.

Step 2: Understand the Available Options for Retrieving Tax Returns

Tax authorities typically offer multiple methods for individuals to access their tax return information. The specific options may vary, but they often include the following:

- Online Retrieval: Many tax agencies provide online portals or platforms where registered users can securely access and download their tax return information. This is often the fastest and most convenient method.

- Request by Mail: If online access is not an option, individuals can request tax return copies by submitting a written request to the tax authority. This process may involve filling out specific forms and providing necessary identification and tax information.

- In-Person Visit: In some cases, tax authorities may allow individuals to visit their local offices to request and obtain tax return copies. This option may be suitable for those who prefer face-to-face interactions or have immediate needs.

Step 3: Prepare the Necessary Documentation and Information

Regardless of the retrieval method you choose, you will need to provide certain documentation and information to verify your identity and tax records.

Common requirements include:

- Personal Identification: Government-issued identification, such as a driver's license, passport, or national ID card, may be necessary to verify your identity.

- Tax Information: You will need to provide details about the tax year and the type of tax return you are requesting. This may include your tax filing status (single, married filing jointly, etc.) and your Social Security Number (or equivalent) for identification purposes.

- Contact Information: Ensure you have accurate and up-to-date contact details, including your mailing address, phone number, and email address, to receive any communications or notifications from the tax authority.

Step 4: Follow the Specific Procedures for Your Chosen Retrieval Method

Once you have gathered the necessary documentation and information, follow the instructions provided by the tax authority for your chosen retrieval method. This may involve:

- Online Retrieval: Logging into the tax authority's secure online portal, navigating to the tax return section, and downloading the desired tax return.

- Request by Mail: Completing the required forms, attaching supporting documents, and mailing the package to the specified address.

- In-Person Visit: Visiting the tax authority's office, bringing your identification and tax-related documents, and requesting assistance from their staff.

It's important to note that the processing time for tax return requests can vary. Online retrieval methods are often the fastest, while mail or in-person requests may take several days or weeks to process.

Step 5: Review and Secure Your Tax Return Copy

Once you have obtained your tax return copy, carefully review the document to ensure its accuracy and completeness. Compare it with your original records or other financial statements to verify the information.

It's crucial to keep your tax return copy in a secure location, such as a locked filing cabinet or a digital storage system with robust security measures. Tax returns contain sensitive financial information, and safeguarding them is essential to prevent identity theft or unauthorized access.

Advanced Strategies and Considerations

While the basic process for obtaining a tax return copy is straightforward, there are some advanced strategies and considerations to keep in mind, especially for complex situations or specific scenarios.

Accessing Past Tax Returns

If you need to retrieve tax returns from previous years, the process remains largely the same. However, it’s essential to keep in mind that tax authorities may only retain records for a limited period, typically ranging from 3 to 7 years, depending on the jurisdiction.

For older tax returns that fall outside this retention period, you may need to contact the tax authority directly to inquire about their policies for accessing historical tax records. In some cases, they may still have the information available, but it may require additional steps or fees.

Dealing with Lost or Misplaced Tax Records

In the event that you have lost or misplaced your tax records, including tax returns, the tax authority can still assist you in retrieving the necessary information.

Contact the tax authority and explain your situation. They may request additional information, such as prior tax return details or other financial records, to verify your identity and tax history. Once your identity is confirmed, they can provide you with copies of the missing tax returns.

Assistance for Businesses and Corporations

The process for obtaining tax return copies for businesses and corporations may vary slightly from that of individuals. Business tax returns often involve more complex documentation and filing requirements.

Businesses should consult with their tax advisors or accountants to determine the best approach for accessing their tax return information. The tax authority may require additional forms or documentation to verify the business's identity and tax status.

International Tax Returns

If you have tax obligations in multiple countries or have filed tax returns internationally, the process of obtaining copies may become more complex.

Each country's tax authority operates independently, so you will need to research and follow the specific procedures for each jurisdiction. Some countries may have reciprocal agreements that allow for the sharing of tax information, but others may require separate requests to each tax authority.

Security and Privacy Concerns

When dealing with sensitive tax information, security and privacy should be top priorities. Tax authorities implement various measures to protect taxpayer data, but it’s essential to take additional precautions as well.

Always use secure connections when accessing tax return information online. Avoid public Wi-Fi networks or unsecured devices when handling sensitive financial data. Additionally, be cautious of potential scams or phishing attempts that may try to trick you into revealing your tax information.

Conclusion: Empowering Taxpayers with Knowledge

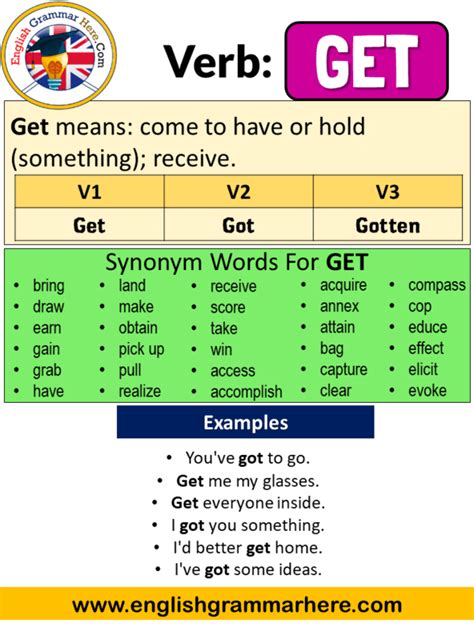

Understanding how to obtain a copy of your tax return is an essential aspect of financial literacy and tax compliance. By following the steps and considerations outlined in this guide, you can confidently navigate the process of retrieving tax return copies, whether for personal, business, or legal purposes.

Remember that tax authorities are committed to providing accessible and transparent services, and they are there to assist taxpayers in maintaining their financial records. With the right approach and attention to detail, you can ensure that your tax return information is readily available when needed.

Stay informed, stay organized, and continue to empower yourself with knowledge about your financial obligations and rights as a taxpayer.

How long does it take to receive a tax return copy?

+The processing time for tax return requests can vary. Online retrieval methods are often the fastest, with copies available within a few minutes or hours. Mail requests may take several days to weeks, depending on the tax authority’s processing capacity and the complexity of the request.

Are there any fees associated with requesting a tax return copy?

+Some tax authorities may charge a small fee for providing tax return copies, especially for older records or if the request involves extensive research. However, many jurisdictions offer free access to recent tax returns through online portals. Check the tax authority’s website for specific fee structures and payment methods.

Can I access my tax return if I filed jointly with my spouse?

+Yes, both spouses can access their joint tax return information. However, they may need to provide additional identification and tax details, such as their Social Security Numbers, to verify their identities.

What if I need to amend my tax return after receiving the copy?

+If you identify errors or omissions in your tax return, you can file an amendment using the appropriate forms provided by the tax authority. Follow their guidelines for filing amended returns, which may involve additional documentation and explanations.

How can I securely store my tax return copies?

+To ensure the security of your tax return copies, consider using password-protected digital storage solutions, such as encrypted cloud storage or external hard drives. Alternatively, you can keep physical copies in a locked filing cabinet or safe. Regularly review and update your storage methods to maintain data integrity.