Pa Estimated Tax Payments

In the realm of financial planning and tax management, understanding the concept of estimated tax payments is crucial, especially for individuals with varied income streams or those whose tax liabilities are not adequately covered by regular withholdings. This guide will delve into the intricacies of estimated tax payments, offering a comprehensive understanding of what they are, when they are required, and how to navigate the process effectively. We'll also explore the consequences of non-compliance and provide strategies for optimizing your estimated tax payments to ensure a smooth and stress-free financial journey.

Understanding Estimated Tax Payments

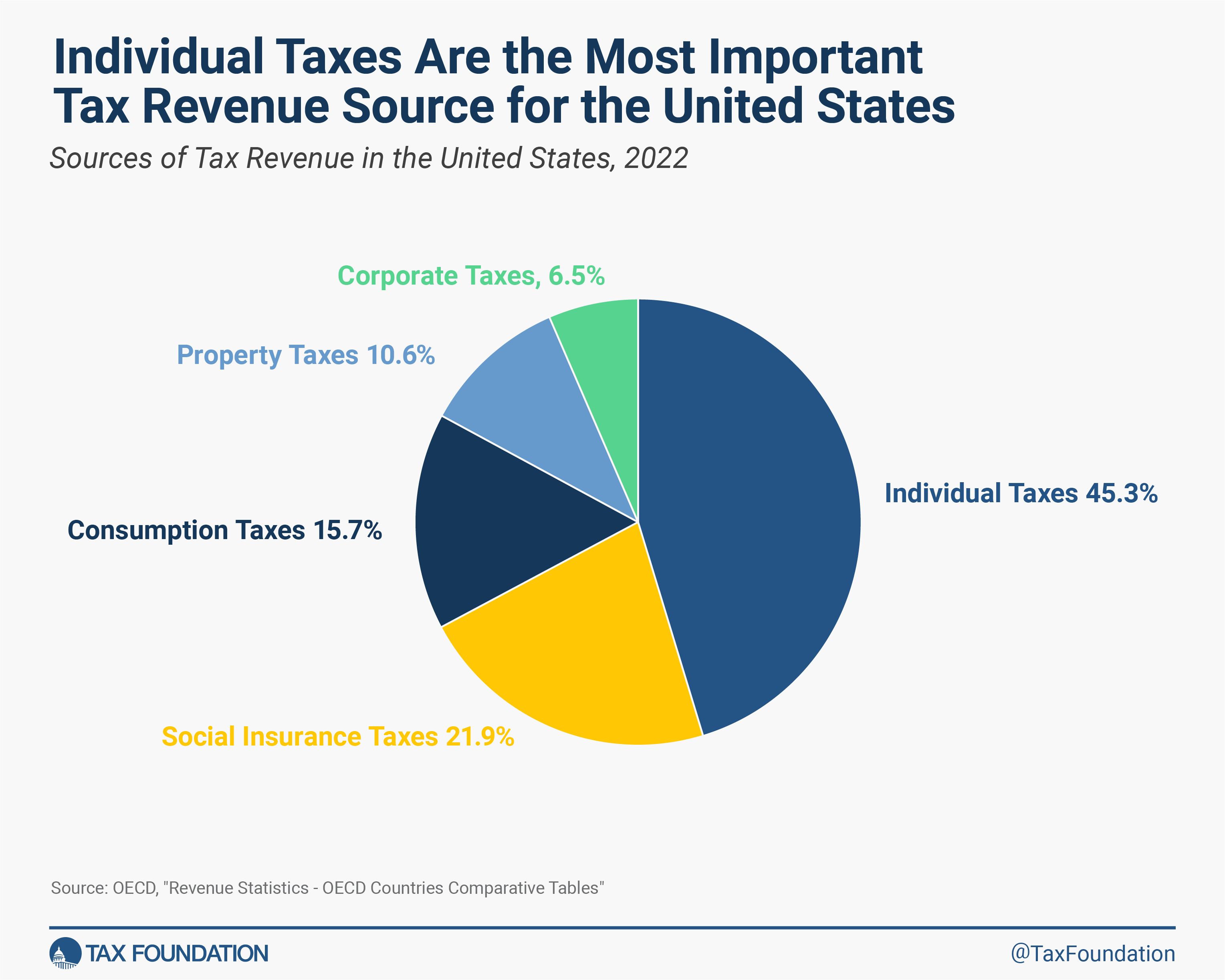

Estimated tax payments are periodic payments made by individuals and businesses to the Internal Revenue Service (IRS) to cover their anticipated tax liability for the current year. These payments are particularly relevant for individuals whose income is not subject to regular withholding, such as self-employed individuals, freelancers, independent contractors, and small business owners.

The primary purpose of estimated tax payments is to ensure that taxpayers meet their tax obligations in a timely manner, even if they do not have traditional employment where taxes are withheld from their paychecks. By making these payments throughout the year, taxpayers avoid the accumulation of a large tax liability at the end of the year, which could result in penalties and interest.

Who Needs to Make Estimated Tax Payments?

Estimated tax payments are generally required for individuals whose tax liability for the current year is expected to be $1,000 or more and for whom the amount of tax being withheld from their income is not sufficient to meet their tax obligations. This includes taxpayers with income from sources such as:

- Self-employment or freelance work

- Rental properties

- Interest and dividends

- Gains from the sale of stocks, bonds, or other investments

- Certain retirement plan distributions

- Alimony payments

It's important to note that even if you have multiple income sources, as long as the total amount of tax withheld from your wages, salaries, and pensions is expected to be at least equal to your total tax liability for the year, you may not need to make estimated tax payments.

When Are Estimated Tax Payments Due?

Estimated tax payments are due on specific dates throughout the year. The payment deadlines are set as follows:

| Payment Period | Due Date |

|---|---|

| First Payment Period | April 15th |

| Second Payment Period | June 15th |

| Third Payment Period | September 15th |

| Fourth Payment Period | January 15th of the following year |

It's crucial to note that these payment deadlines are not flexible, and late payments may result in penalties and interest charges. To avoid these consequences, it's advisable to set up a payment schedule and ensure that you have the necessary funds available to make your estimated tax payments on time.

Calculating Your Estimated Tax Payments

Calculating your estimated tax payments involves a series of steps to determine your expected tax liability for the year. This process can be complex, but with careful planning and the use of the right tools, it can be managed effectively. Here's a step-by-step guide to help you calculate your estimated tax payments:

Step 1: Estimate Your Annual Income

Start by estimating your total income for the year. This should include all sources of income, such as wages, salaries, self-employment income, rental income, interest, dividends, and any other taxable income. If your income is variable, use a reasonable estimate based on your past earnings and current projections.

Step 2: Calculate Your Deductions and Credits

Next, estimate your deductions and credits for the year. This includes both above-the-line deductions (such as IRA contributions and student loan interest) and itemized deductions (such as medical expenses, state and local taxes, and charitable contributions). You can also claim tax credits, such as the Child Tax Credit or the Earned Income Tax Credit, which can reduce your tax liability.

Step 3: Determine Your Tax Liability

With your estimated income and deductions in hand, you can now calculate your expected tax liability for the year. This involves applying the appropriate tax rates and brackets to your taxable income. You can use tax calculators or consult with a tax professional to ensure accuracy.

Step 4: Compare to Withholdings

Compare your estimated tax liability to the amount of tax that has been withheld from your income. If the amount withheld is less than your estimated tax liability, you will likely need to make estimated tax payments to cover the difference.

Step 5: Calculate Your Estimated Tax Payments

To calculate your estimated tax payments, divide your estimated annual tax liability by four. This will give you the amount you need to pay for each of the four payment periods. However, it's important to note that you can adjust your payments based on your income and deductions for each payment period. For example, if you expect higher income or deductions in one quarter, you can increase your payment for that period.

Alternatively, you can use the IRS' Estimated Tax Worksheet to determine your required payments. This worksheet takes into account your previous year's tax liability, current year's payments, and expected income and deductions to provide a more accurate estimate of your required payments.

Making Your Estimated Tax Payments

Once you have calculated your estimated tax payments, it's time to make the actual payments to the IRS. Here's a guide to help you through the process:

Step 1: Choose Your Payment Method

The IRS offers several options for making estimated tax payments. You can choose the method that best suits your preferences and financial situation. The available methods include:

- Electronic Funds Withdrawal: You can authorize the IRS to withdraw the payment directly from your bank account. This method is secure and ensures timely payment.

- Credit or Debit Card: You can use a credit or debit card to make your payment. However, there may be fees associated with this method, so check with your card issuer.

- Electronic Federal Tax Payment System (EFTPS): EFTPS allows you to make payments online or by phone. It's a secure and convenient method, and you can schedule payments in advance.

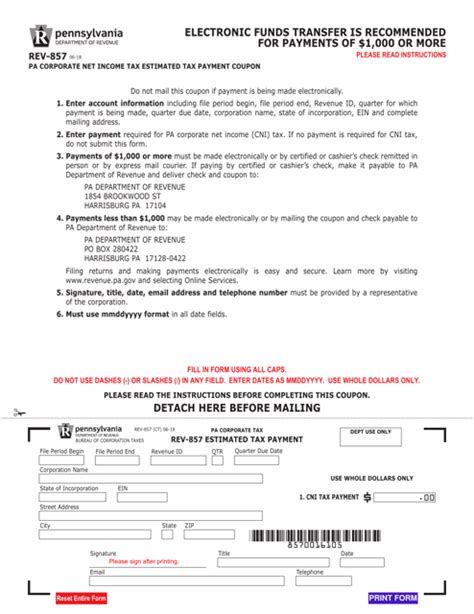

- Check or Money Order: You can mail a check or money order to the IRS. Be sure to include the appropriate voucher form and write your Social Security Number or Employer Identification Number on the check.

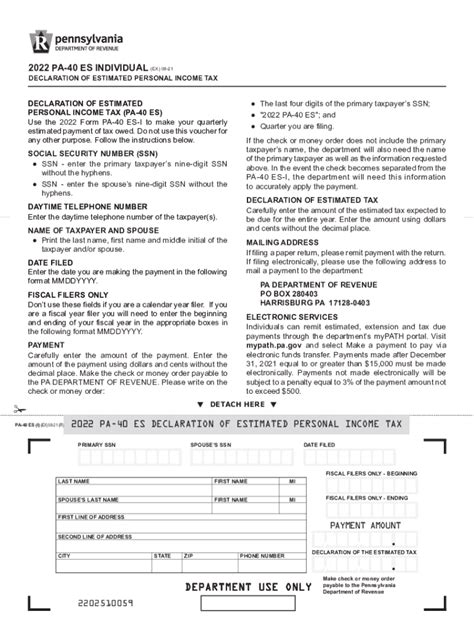

Step 2: Complete the Required Forms

Depending on your payment method, you may need to complete specific forms. For example, if you're mailing a check, you'll need to include Form 1040-ES voucher with your payment. If you're using EFTPS, you'll need to register and set up your account before making your first payment.

Step 3: Make Your Payments on Time

Remember to make your payments by the due dates to avoid penalties and interest. If you have multiple income sources or variable income, consider setting up a payment schedule to ensure you have the necessary funds available when payments are due.

Step 4: Keep Records

It's essential to keep records of your estimated tax payments. This includes saving your payment confirmations, vouchers, and any other documentation related to your payments. These records will be valuable when you prepare your tax return at the end of the year.

Consequences of Non-Compliance

Failing to make estimated tax payments when required can result in penalties and interest charges. The IRS imposes a penalty for underpayment of estimated tax, which is generally calculated as 0.5% of the unpaid tax liability for each month or part of a month that the payment is late, up to a maximum of 25%.

Additionally, if your estimated tax payments are significantly less than your actual tax liability at the end of the year, you may also face penalties for underpayment of tax. These penalties can add up quickly and can be costly, so it's important to make accurate estimates and timely payments to avoid these consequences.

Optimizing Your Estimated Tax Payments

Optimizing your estimated tax payments involves making informed decisions to minimize your tax liability while ensuring you meet your obligations to the IRS. Here are some strategies to consider:

1. Adjust Your Withholdings

If you have a traditional job where taxes are withheld from your paycheck, you can adjust your withholdings to ensure that enough tax is being withheld to cover your expected tax liability. This can reduce or eliminate the need for estimated tax payments.

2. Take Advantage of Deductions and Credits

Explore all available deductions and credits to reduce your taxable income and, consequently, your tax liability. This includes claiming deductions for business expenses, medical expenses, and charitable contributions, as well as taking advantage of tax credits like the Child Tax Credit or the Earned Income Tax Credit.

3. Consider a Tax Professional

If you have a complex financial situation or are unsure about your tax obligations, consider consulting with a tax professional. A tax advisor or accountant can help you navigate the intricacies of estimated tax payments, ensure you're meeting your obligations, and identify strategies to minimize your tax liability.

4. Stay Informed

Keep up-to-date with tax law changes and IRS guidelines. Tax laws can evolve, and understanding these changes can help you make more informed decisions about your estimated tax payments. Stay informed through reputable sources, such as the IRS website or tax publications.

5. Plan for Variability

If your income is variable, plan for potential ups and downs. Adjust your estimated tax payments accordingly, and consider setting aside funds in a separate account to cover your tax obligations. This can help you avoid surprises and ensure you have the necessary funds available when payments are due.

Frequently Asked Questions

How do I know if I need to make estimated tax payments?

+

You need to make estimated tax payments if you expect your tax liability for the year to be $1,000 or more and the amount withheld from your income is insufficient to cover this liability. This applies to individuals with income from self-employment, freelance work, rental properties, and other sources not subject to regular withholding.

What happens if I don’t make estimated tax payments when required?

+

Failing to make estimated tax payments when required can result in penalties and interest charges. The IRS imposes a penalty for underpayment of estimated tax, which can be up to 0.5% of the unpaid tax liability for each month or part of a month that the payment is late, up to a maximum of 25%. Additionally, you may face penalties for underpayment of tax if your estimated payments are significantly less than your actual tax liability.

Can I adjust my estimated tax payments throughout the year?

+

Yes, you can adjust your estimated tax payments based on your income and deductions for each payment period. If you expect higher income or deductions in one quarter, you can increase your payment for that period. This flexibility allows you to optimize your payments and ensure you’re meeting your tax obligations.

How do I calculate my estimated tax payments accurately?

+

To calculate your estimated tax payments accurately, estimate your annual income, calculate your deductions and credits, determine your tax liability, and compare it to your withholdings. Divide your estimated tax liability by four to get the amount for each payment period. Alternatively, use the IRS’ Estimated Tax Worksheet for a more precise calculation.

What are the payment options for estimated taxes?

+

The IRS offers several payment options for estimated taxes, including Electronic Funds Withdrawal, credit or debit card payments, the Electronic Federal Tax Payment System (EFTPS), and mailing checks or money orders. Choose the method that best suits your preferences and financial situation, and ensure you complete the required forms and make payments on time.