Understanding the Tax in Alabama Rate to Maximize Your Savings

Taxation forms the backbone of state revenue systems across the United States, funding essential public services like education, infrastructure, healthcare, and emergency services. Alabama, with its unique economic landscape and fiscal policies, presents an interesting case for residents and businesses aiming to optimize their tax strategies. Understanding Alabama's tax rates, including income, sales, property, and other miscellaneous taxes, is crucial for maximizing savings and making informed financial decisions. This article explores the multifaceted tax environment of Alabama, analyzing competing viewpoints and providing a comprehensive synthesis to guide residents toward economic efficiency.

The Landscape of Alabama Tax Rates: An Overview

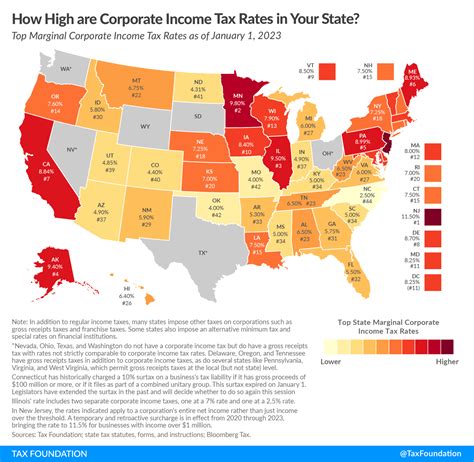

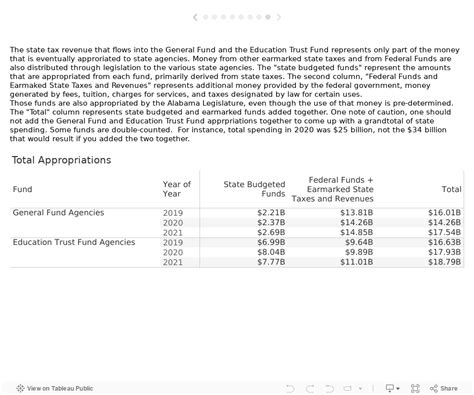

Alabama’s tax code encompasses several key categories: individual income tax, sales and use tax, property tax, and corporate taxes. Each component influences the overall financial obligation of residents and businesses differently. The state’s revenue structure is designed to balance budget needs with competitiveness to attract and retain residents and economic activity. As of the latest data, Alabama’s income tax system features rates ranging from 2% to 5%, with progressive brackets that aim to tax higher earners proportionally more—yet critics argue that the rate structure offers room for reduction to enhance disposable income. Meanwhile, the sales tax rate stands at a combined average of 8.9%, composed of state, county, and local levies, which can significantly impact consumer purchasing power. Property taxes are relatively moderate compared to national standards, averaging below 1% of assessed value, but vary across counties. This complex tax mosaic prompts a debate about the optimal configuration for growth, fairness, and fiscal health.

Arguments Supporting Tax Reductions to Maximize Savings

Proponents of lowering Alabama’s tax rates emphasize that a more favorable tax environment can invigorate local economies, attract high-income residents, and stimulate consumer spending. Economists such as those advocating for supply-side policies argue that decreased income and sales taxes enhance disposable income, thereby encouraging increased consumption and investment. Empirical evidence from states like Texas and Florida— which maintain no state income tax—suggests that lower rates can lead to economic expansion and job creation. Furthermore, advocates claim that high tax burdens might dissuade remote workers or entrepreneurs from establishing businesses within Alabama, ultimately lowering the state’s competitive edge.

For example, reducing the top personal income tax rate from 5% to 3% could potentially leave residents with an additional 2% of their earnings, which, over significant income levels, translates into thousands of dollars annually. These increased savings could then be reinvested into local businesses, real estate markets, or personal development. Similarly, advocates propose streamlining sales taxes and reducing local levies to boost retail activity, especially in rural and underdeveloped areas. The rationale is rooted in the fiscal principle that lower taxes can produce a larger tax base over time—a phenomenon sometimes called the “Laffer Curve” effect—where the total revenue might initially decline but ultimately increase as economic activity blooms.

| Relevant Category | Substantive Data |

|---|---|

| Top Personal Income Tax Rate | 5% (current) |

| Proposed Reduction | to 3% could increase disposable income by up to 2%, benefiting high earners |

| State Sales Tax | 4%; combined rate averages 8.9% |

| Impact of Sales Tax Reduction | potentially increases consumer spending by reducing purchase costs |

Critiques and Cautions Against Excessive Tax Cuts

On the other hand, opponents and fiscal conservatives warn that significant tax reductions could undermine Alabama’s ability to finance critical infrastructure, education, and healthcare. They emphasize that Alabama’s current tax rates, while moderate, have historically provided a stable revenue flow necessary for the state’s development programs. Critics also cite research indicating that reducing taxes, especially on high earners and corporations, might lead to increased income inequality and decreased public investment, ultimately harming economic mobility.

For instance, reducing the top income tax bracket could deprive the state of substantial revenue, forcing cuts to public services or the need to increase other taxes, such as sales or property taxes, which tend to be more regressive. Furthermore, some argue that Alabama’s economic growth has been more heavily influenced by infrastructure investments, workforce development, and business incentives than by tax rates alone. Therefore, a nuanced approach balancing tax relief with revenue adequacy is essential to maintain fiscal health while fostering growth. Data from fiscal reports indicates that Alabama relies on sales and property taxes for a significant portion of its revenue, implying that shifting the tax burden too heavily onto these sources could disproportionately affect lower-income residents.

| Relevant Category | Substantive Data |

|---|---|

| Revenue Impact of Tax Cuts | Estimated loss of $1.2 billion over five years if top income tax rate drops to 3% |

| Public Service Funding | Public education consumes approximately 30% of state budget revenue |

| Potential Regressive Shift | Increased reliance on sales/property taxes may burden lower-income households |

Balancing Tax Policy: A Strategic Synthesis

The debate over Alabama’s tax rates epitomizes the classic tension between promoting economic growth and ensuring equitable public financing. While lower tax rates—if carefully implemented—can stimulate disposable income, employment, and regional competitiveness, they must be balanced against the risk of revenue deficits that could impair service delivery. Strategic reforms could include phased reductions paired with measures to broaden the tax base, such as closing loopholes, broadening sales tax coverage, or introducing targeted incentives for sectors with high growth potential.

For example, a tiered approach might gradually lower income tax rates for middle-income brackets while protecting or slightly increasing taxes on luxury goods or non-residential property. Meanwhile, investing in infrastructure, education, and workforce development can enhance long-term economic resilience. This approach aligns with best practices favored by policymakers who prioritize fiscal responsibility alongside economic dynamism. Data shows that Alabama’s economic gains in recent years have been driven partly by investment in higher education and transportation networks, underscoring that tax policy must work in concert with broader economic strategies.

Key Points

- Careful calibration of Alabama’s tax rates can unlock economic growth without compromising fiscal stability.

- Targeted reforms, rather than sweeping cuts, may yield more sustainable public revenue increases.

- Progressive policies that support workforce development enhance long-term savings and community well-being.

- Balancing tax relief with revenue security is essential to avoid underfunded services that could hinder social mobility.

- Data indicates that infrastructure investment combined with selective tax reforms drives robust economic development.

Concluding Perspectives: Towards an Informed Tax Strategy

The core challenge for Alabama’s policymakers is to craft a tax environment that fosters economic vitality while safeguarding the fiscal health necessary for public investment. Both viewpoints—favoring tax cuts and advocating for cautious reform—hold valid insights rooted in empirical data and economic theory. An evidence-based, phased approach appears most prudent: gradually reducing rates where feasible, broadening the tax base to offset revenue losses, and investing in strategic sectors that propel growth. This integrated perspective aims not only to maximize individual and business savings but also to strengthen the social fabric so vital for Alabama’s sustained prosperity. Ultimately, informed, nuanced policy decisions—grounded in robust data analysis and community needs—will shape Alabama’s fiscal future in a way that balances growth with fairness.

What are the current Alabama income tax rates?

+Alabama’s personal income tax rates are progressive, ranging from 2% to 5% across four brackets, with the top rate applying to higher income levels. The structure aims to balance fairness with revenue generation.

How do sales tax rates in Alabama compare nationally?

+The combined average sales tax rate in Alabama is approximately 8.9%, making it moderately high compared to other states, especially given local additives. This can significantly influence consumer spending and cost of living.

Can lowering taxes actually increase state revenue?

+Some economic models suggest that carefully implemented tax cuts can stimulate economic activity enough to expand the tax base, potentially increasing total revenue—a concept associated with the Laffer Curve. However, outcomes depend on the specifics of the reforms and economic conditions.

What risks are associated with significant tax reductions?

+Major tax cuts may lead to revenue shortfalls, forcing cuts in vital services like education and health or resulting in increased regressivity when other taxes are restructured. Balancing rates to support both growth and revenue is therefore necessary.

What strategies can Alabama adopt to optimize its tax policy?

+Strategies include phased tax rate reforms, broadening the tax base through closing loopholes, investing in infrastructure and workforce development, and implementing targeted incentives. These allow growth stimulation while maintaining fiscal balance.