Annuities And Taxes

The topic of annuities and taxes can be a complex and often confusing one, especially for those new to financial planning and investments. Annuities are financial products that offer a steady stream of income, typically during retirement, and understanding their tax implications is crucial for effective financial management. This article aims to provide a comprehensive guide to annuities and their tax landscape, covering everything from the basics to advanced strategies.

Understanding Annuities and Their Purpose

Annuities are long-term contracts offered by insurance companies, designed to provide regular payments to the annuitant, either for a specified period or for the rest of their life. These payments can be a valuable source of income, particularly in retirement when other sources of income may diminish. Annuities come in various forms, including immediate annuities, which start payments right away, and deferred annuities, which begin payments at a later date.

One of the key benefits of annuities is their ability to provide a guaranteed income stream, which can be especially valuable in an uncertain market. Annuities can also offer tax advantages, depending on the type and how they are structured. However, it's important to understand that annuities also come with certain risks and limitations, and their tax treatment can be complex.

Types of Annuities and Their Characteristics

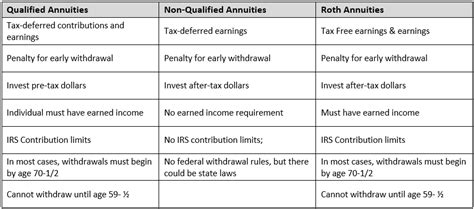

There are several types of annuities, each with its own features and tax implications. Let’s explore some of the most common ones:

- Fixed Annuities: These annuities offer a guaranteed interest rate and a fixed payment amount. They are often used for conservative investors seeking a steady income stream. Fixed annuities are typically taxed as ordinary income when payments are received.

- Variable Annuities: Unlike fixed annuities, variable annuities allow the investor to allocate funds among various investment options, such as stocks, bonds, or money market funds. The value and payments can fluctuate based on the performance of these investments. The tax treatment for variable annuities is more complex, as gains and losses are taxed differently depending on when the annuity is cashed out.

- Indexed Annuities: These annuities offer a return linked to a specific market index, such as the S&P 500, while also providing a minimum guaranteed return. The tax treatment is similar to variable annuities, with gains and losses impacting the tax liability.

- Immediate Annuities: As mentioned earlier, immediate annuities start making payments right after the initial investment. They are often used to provide a regular income stream for retirees. The tax treatment for immediate annuities is straightforward, with each payment typically consisting of a mix of taxable earnings and a return of the initial investment, which is tax-free.

- Deferred Annuities: Deferred annuities allow the investor to postpone payments until a future date, often when they reach retirement age. During the deferral period, the annuity can grow tax-deferred, similar to a traditional IRA. When payments begin, the annuity's earnings are taxed as ordinary income.

| Annuity Type | Key Characteristics |

|---|---|

| Fixed Annuities | Guaranteed interest rate, fixed payments, taxed as ordinary income |

| Variable Annuities | Investment options, value fluctuates, complex tax treatment |

| Indexed Annuities | Linked to market indexes, minimum guaranteed return, taxed like variable annuities |

| Immediate Annuities | Start payments immediately, mix of taxable and tax-free returns |

| Deferred Annuities | Postponed payments, tax-deferred growth during deferral, taxed as ordinary income upon payment |

Tax Treatment of Annuities: A Comprehensive Overview

The tax treatment of annuities can be intricate, and it’s essential to understand how they are taxed at each stage to make informed financial decisions.

Taxation During the Accumulation Phase

During the accumulation phase, which is the period before the annuity starts making payments, the tax treatment varies depending on the type of annuity.

- Tax-Deferred Annuities: In the case of tax-deferred annuities, such as deferred annuities and some types of variable annuities, the earnings grow tax-free during the accumulation phase. This means that any gains from investment performance are not taxed until the annuity is cashed out or payments begin.

- Taxable Annuities: On the other hand, immediate annuities and fixed annuities are generally taxable during the accumulation phase. Any interest or gains earned are subject to taxation each year, even if the annuity is not yet making payments.

Taxation During the Payout Phase

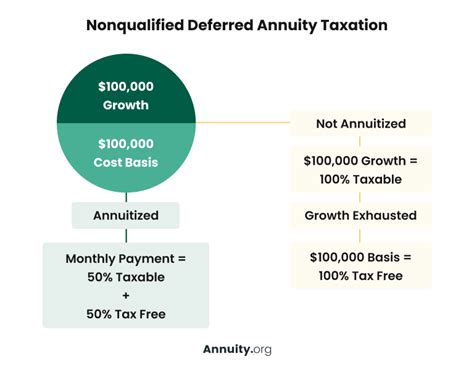

When the annuity enters the payout phase, which is when payments begin, the tax treatment depends on the type of annuity and how it was funded.

- Tax-Deferred Annuities: For tax-deferred annuities, the payout phase is when taxes become due. Each payment is considered a combination of a return of the initial investment and taxable earnings. The portion representing the return of investment is tax-free, while the portion representing earnings is taxed as ordinary income.

- Taxable Annuities: In the case of taxable annuities, the entire payment is considered taxable income. This includes both the return of investment and any earnings, which are taxed at the individual's ordinary income tax rate.

Advanced Tax Strategies with Annuities

Annuities can be powerful tools in an investor’s financial arsenal, and understanding advanced tax strategies can help maximize their benefits.

Tax-Efficient Withdrawal Strategies

When it comes to withdrawing funds from an annuity, there are several strategies to consider to minimize tax liability.

- Partial Withdrawals: Instead of taking a full surrender, which may trigger higher taxes and penalties, partial withdrawals can be made to reduce the tax burden. This strategy is particularly useful for those who need income but want to maintain their annuity's growth potential.

- Strategic Withdrawal Order: Investors can choose the order in which they withdraw funds from different annuities to optimize their tax situation. For example, withdrawing from a tax-deferred annuity first may be more advantageous if the investor is in a lower tax bracket, while withdrawals from taxable annuities can be postponed until later years when they expect to be in a higher tax bracket.

- Using Multiple Annuities: By spreading investments across multiple annuities, investors can manage their tax liability more effectively. For instance, an investor may choose to withdraw from a taxable annuity first to reduce its value and lower the tax burden, while keeping a tax-deferred annuity intact for future years when they expect to be in a higher tax bracket.

Tax-Free Exchanges and Rollovers

Tax-free exchanges, also known as 1035 exchanges, allow investors to transfer funds from one annuity to another without triggering immediate taxes. This strategy can be useful for those who want to change their investment strategy or consolidate multiple annuities.

Annuities as Estate Planning Tools

Annuities can also play a role in estate planning, particularly in providing a steady income stream to beneficiaries. By structuring an annuity to continue payments to beneficiaries after the annuitant’s death, the annuity can serve as a legacy for future generations. The tax treatment for these payments can vary, and it’s essential to consult with an estate planning expert to understand the implications.

Real-World Examples and Case Studies

To illustrate the concepts discussed, let’s look at a few real-world examples and case studies:

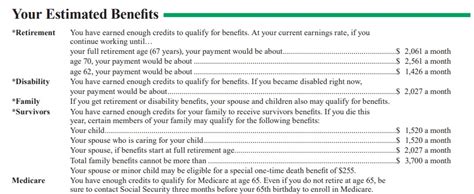

Case Study 1: Retirement Planning with Annuities

Mr. Johnson, a 65-year-old retiree, has been relying on his pension and social security benefits for income. To supplement his retirement income, he decides to purchase an immediate annuity with a lump sum of 100,000. The annuity promises to pay him 800 per month for the rest of his life. During the payout phase, Mr. Johnson’s payments will be a mix of taxable earnings and a return of his initial investment. Each payment will be partially tax-free, allowing him to maintain a steady income stream without a significant tax burden.

Case Study 2: Tax-Efficient Withdrawal Strategy

Ms. Smith, a 55-year-old investor, has a deferred annuity with a substantial balance. She is considering taking a full surrender to access the funds, but she wants to minimize her tax liability. Instead, she decides to implement a strategic withdrawal strategy. She withdraws a small portion of the annuity each year, keeping her income below the threshold for higher tax brackets. By doing so, she can maintain her annuity’s growth potential and reduce her overall tax burden.

Case Study 3: Annuities in Estate Planning

Mr. and Mrs. Wilson, a retired couple, have a deferred annuity as part of their estate plan. They structure the annuity to continue payments to their children after their deaths. By doing so, they ensure a steady income stream for their children, providing financial security and peace of mind. The tax treatment for these payments is favorable, as the payments are considered a return of investment and are tax-free.

Conclusion and Future Implications

Annuities can be a valuable component of a well-diversified investment portfolio, offering a guaranteed income stream and potential tax advantages. However, the tax treatment of annuities is complex and requires careful consideration. By understanding the different types of annuities, their tax implications, and advanced tax strategies, investors can make informed decisions to maximize their financial goals.

As the financial landscape evolves, annuities are likely to remain a popular option for retirement planning. With the right strategies and guidance, investors can leverage the benefits of annuities while managing their tax obligations effectively. It's essential to stay informed about tax laws and regulations and consult with financial and tax professionals to navigate the complexities of annuities and taxes.

How do I choose the right type of annuity for my financial goals?

+The choice of annuity depends on various factors, including your financial goals, risk tolerance, and tax situation. Fixed annuities offer a guaranteed income stream but may provide lower returns. Variable annuities offer investment flexibility but come with market risk. Indexed annuities provide a balance between guaranteed returns and market-linked growth. It’s essential to assess your needs and consult with a financial advisor to determine the best fit.

Are there any tax benefits to consider when purchasing an annuity?

+Yes, annuities can offer tax advantages. During the accumulation phase, tax-deferred annuities allow your investment to grow tax-free, which can lead to higher returns. Additionally, when you start receiving payments, a portion of each payment may be tax-free, representing a return of your initial investment. This can help reduce your overall tax burden.

What are the potential tax drawbacks of annuities?

+While annuities can offer tax benefits, they also come with potential drawbacks. If you withdraw funds from an annuity before the age of 59½, you may incur a 10% early withdrawal penalty, in addition to regular income taxes. Additionally, annuities may have surrender charges if you withdraw funds during the early years, which can reduce your investment returns.

Can I use multiple annuities to manage my tax liability?

+Yes, by spreading your investments across multiple annuities, you can manage your tax liability more effectively. For example, you can withdraw from a taxable annuity first to reduce its value and lower your tax burden, while keeping a tax-deferred annuity intact for future years when you expect to be in a higher tax bracket.