Kansas Tax Calculator

The Kansas Tax Calculator is a valuable tool for individuals and businesses operating within the state of Kansas, offering a comprehensive means of assessing tax obligations accurately. This online resource plays a crucial role in ensuring compliance with state tax regulations and helping users navigate the complexities of the Kansas tax system.

Understanding the Kansas Tax System

Kansas, like many other states, has a unique tax structure, encompassing a range of taxes from income tax to sales tax and property tax. Understanding this system is essential for anyone with financial interests in the state, as it directly impacts their bottom line and overall financial planning.

Income Tax in Kansas

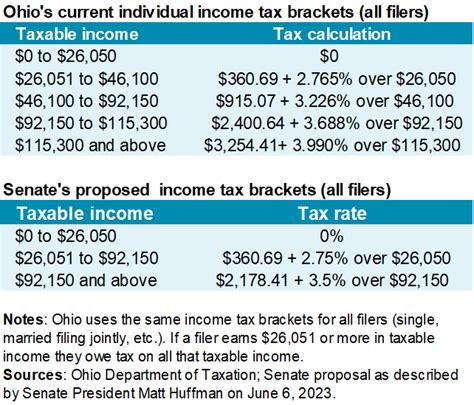

The income tax in Kansas is structured on a marginal rate system, with tax rates varying based on income brackets. For the tax year 2023, there are four tax brackets, with rates ranging from 2.9% to 5.7%. Here’s a simplified breakdown of the income tax rates for Kansas residents:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | Up to $15,000 | 2.9% |

| 2 | $15,001 to $30,000 | 3.1% |

| 3 | $30,001 to $60,000 | 4.6% |

| 4 | Over $60,000 | 5.7% |

These rates are applicable for both single and joint filers. It's important to note that Kansas has a non-resident income tax rate of 6.45%, which applies to income earned in Kansas by non-residents.

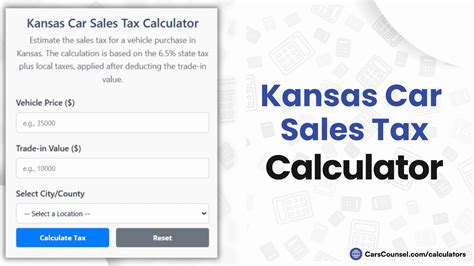

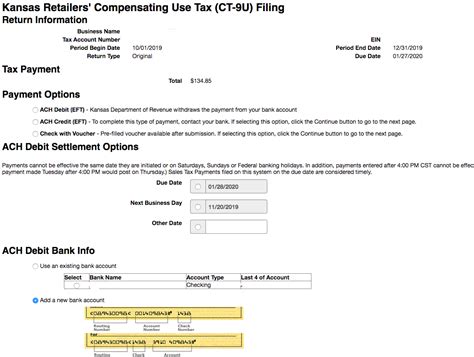

Sales and Use Tax

Kansas imposes a 6.5% state sales tax on most tangible personal property and certain services. However, local jurisdictions can also levy additional sales taxes, resulting in a combined rate that can vary across the state. For instance, the city of Wichita has a 1.5% local sales tax, bringing the total sales tax rate to 8% within the city limits.

Property Tax

Property taxes in Kansas are assessed at the local level, primarily by counties and school districts. The state’s average effective property tax rate is 1.33%, which is slightly lower than the national average. However, actual rates can vary significantly depending on the specific location within the state.

Introduction to the Kansas Tax Calculator

Given the intricate nature of the Kansas tax system, having a reliable tool to calculate taxes accurately is invaluable. This is where the Kansas Tax Calculator comes into play, providing a user-friendly interface to estimate tax liabilities based on various scenarios.

Key Features of the Calculator

- Income Tax Estimation: Users can input their annual income to estimate their Kansas income tax liability, taking into account the state’s progressive tax rates.

- Sales Tax Calculator: This feature allows users to determine the sales tax on a particular purchase, which is especially useful for businesses and individuals planning large purchases.

- Property Tax Assessment: While property taxes are primarily assessed at the local level, the calculator provides a rough estimate based on the user’s location and property value.

- Withholding Tax Calculator: This tool assists employers in calculating the appropriate amount of income tax to withhold from their employees’ paychecks, ensuring compliance with state regulations.

Benefits of Using the Kansas Tax Calculator

The Kansas Tax Calculator offers several advantages, making it an indispensable tool for both individuals and businesses operating within the state.

- Accuracy: By utilizing the calculator, users can ensure they are calculating their tax obligations accurately, avoiding potential penalties due to underpayment or overpayment.

- Time Efficiency: The calculator saves time by providing quick estimates, allowing users to focus on other aspects of their financial planning.

- Compliance: It helps users stay compliant with Kansas tax laws, reducing the risk of audits and legal complications.

- Financial Planning: For businesses and individuals, the calculator aids in financial planning by providing a clear picture of tax obligations, which can be factored into budgeting and investment strategies.

Real-World Application

Let’s consider a real-life scenario to understand how the Kansas Tax Calculator can be beneficial.

Imagine a small business owner, Jane, who recently relocated her business to Wichita, Kansas. With the help of the Kansas Tax Calculator, Jane can quickly estimate her business's tax obligations. By inputting her annual income, she can determine her income tax liability, which is crucial for financial planning and budgeting.

Furthermore, the calculator's sales tax feature allows Jane to estimate the sales tax on large equipment purchases, ensuring she budgets accordingly. For instance, if she's planning to purchase a new delivery truck, she can use the calculator to determine the sales tax component, which is an important consideration for her overall business expenses.

Future Implications

As Kansas continues to evolve its tax policies, the Kansas Tax Calculator will play a vital role in keeping taxpayers informed and compliant. With potential changes in tax brackets and rates, the calculator will need to be updated regularly to reflect these modifications.

Moreover, as the state explores initiatives like tax incentives for businesses or environmental tax reforms, the calculator will need to adapt to incorporate these new elements. This ensures that taxpayers have an accurate tool to navigate the ever-changing tax landscape in Kansas.

How often is the Kansas Tax Calculator updated to reflect changes in tax laws and rates?

+

The Kansas Tax Calculator is updated annually to account for changes in tax laws and rates. Major updates are typically released before the start of each new tax year, ensuring users have the most accurate information for their tax planning.

Can the calculator provide estimates for multiple years, or is it limited to the current tax year?

+

Yes, the calculator can provide estimates for multiple years. This feature is particularly useful for businesses and individuals engaged in long-term financial planning, as they can project their tax obligations over several years.

Are there any limitations or assumptions made by the calculator that users should be aware of?

+

While the Kansas Tax Calculator is designed to be accurate and comprehensive, it does make certain assumptions. For instance, it assumes a standard deduction for income tax calculations, and it may not account for all possible tax credits or deductions. Users should always consult with a tax professional for a more detailed analysis.

Can the calculator handle complex tax scenarios, such as multiple streams of income or business ownership?

+

The Kansas Tax Calculator is designed to handle a wide range of tax scenarios, including multiple streams of income and business ownership. However, for extremely complex situations, it may be advisable to seek professional tax advice to ensure all aspects are considered.

Is there a mobile app version of the Kansas Tax Calculator for on-the-go tax estimation?

+

Yes, there is a mobile app version of the Kansas Tax Calculator available for both iOS and Android devices. The app provides the same functionality as the web-based calculator, making it convenient for users to estimate their tax obligations while on the move.