Tax Rebate Mn

The tax landscape in the United States is complex and varies across states, and Minnesota, often referred to as the "Land of 10,000 Lakes," is no exception. Understanding the tax rebate system in Minnesota is crucial for individuals and businesses alike to optimize their financial strategies and ensure compliance with state regulations.

Unraveling the Tax Rebate System in Minnesota

Minnesota, like many other states, offers a range of tax rebate programs aimed at providing relief to taxpayers and stimulating economic growth. These rebates can significantly impact individuals’ and businesses’ financial plans, making it essential to delve into the specifics of the state’s tax rebate system.

The Minnesota Department of Revenue plays a pivotal role in administering these rebate programs, ensuring that eligible taxpayers receive the benefits they are entitled to. From income tax refunds to specialized rebates for specific industries, the state's tax rebate system is designed to provide financial incentives and support.

Income Tax Rebates: A Closer Look

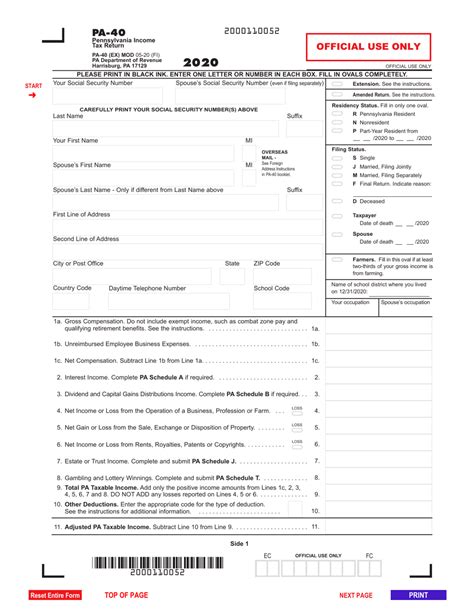

One of the most common forms of tax rebates in Minnesota is the income tax refund. This rebate is a return of a portion of the income tax paid by individuals or businesses, typically based on the tax rate, income level, and various deductions and credits available.

The income tax rebate process in Minnesota involves a thorough review of the taxpayer's annual income, deductions, and applicable credits. This process is designed to ensure fairness and accuracy, providing taxpayers with the correct refund amount. The state's progressive tax system means that higher-income earners often pay a larger proportion of their income in taxes, making income tax rebates a significant financial consideration for many Minnesotans.

| Income Bracket | Tax Rate | Estimated Rebate |

|---|---|---|

| Up to $12,500 | 5.35% | $662.50 |

| $12,501 - $29,000 | 7.05% | $2,050.50 |

| $29,001 and above | 9.85% | $2,864.50 |

The above table provides a simplified estimate of potential income tax rebates for different income brackets. However, it's important to note that actual rebate amounts can vary significantly based on individual circumstances and the utilization of tax credits and deductions.

Industry-Specific Tax Rebates: Supporting Economic Growth

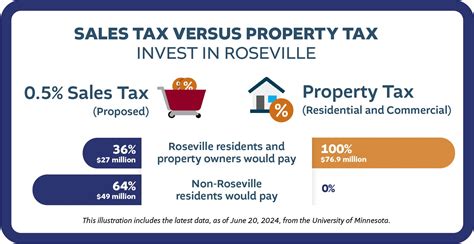

In addition to income tax rebates, Minnesota offers a range of industry-specific tax rebates designed to stimulate economic growth and support specific sectors. These rebates are often tailored to encourage investment, job creation, and innovation within targeted industries.

For instance, the state provides tax incentives for businesses operating in the manufacturing sector, aiming to boost employment opportunities and enhance the state's economic competitiveness. These incentives can include rebates on property taxes, sales taxes, or specific industry-related expenses, making Minnesota an attractive location for businesses in these sectors.

| Industry | Tax Rebate Type | Rebate Amount |

|---|---|---|

| Manufacturing | Property Tax Rebate | Up to 75% of eligible expenses |

| Clean Technology | Sales Tax Exemption | $5,000 per project |

| Agriculture | Equipment Investment Credit | 10% of eligible equipment costs |

The table above showcases some of the industry-specific tax rebates available in Minnesota. These incentives can provide significant financial relief to businesses, helping them allocate resources more effectively and invest in growth and development.

The Impact of Tax Rebates on Minnesota’s Economy

Tax rebates play a crucial role in shaping Minnesota’s economic landscape. By offering financial incentives, the state encourages investment, job creation, and economic diversification. This, in turn, leads to increased tax revenue, a more robust job market, and a higher quality of life for Minnesotans.

Moreover, tax rebates can help attract businesses and talent to the state, contributing to a thriving business ecosystem. This positive cycle of economic growth and investment is a key benefit of an effective tax rebate system.

However, it's essential to balance these incentives with the state's financial stability and long-term goals. A well-designed tax rebate system should not only stimulate growth but also ensure the sustainability of public services and infrastructure.

Conclusion: Navigating Minnesota’s Tax Rebate Landscape

Understanding and utilizing Minnesota’s tax rebate system is a strategic financial move for both individuals and businesses. From income tax refunds to industry-specific incentives, the state offers a range of opportunities to optimize tax liabilities and support economic growth.

However, navigating the complexities of tax regulations requires expertise and careful planning. It's crucial to stay informed about the latest tax laws, seek professional advice when needed, and utilize reliable resources to ensure compliance and maximize the benefits of the state's tax rebate system.

How often are tax rebates offered in Minnesota?

+

Tax rebates in Minnesota are typically offered on an annual basis, with deadlines for claiming rebates aligned with the state’s tax filing season. However, certain rebates may have specific eligibility criteria or be offered on a more flexible timeline. It’s essential to stay updated with the latest information from the Minnesota Department of Revenue to ensure you don’t miss out on any available rebates.

Are there any eligibility requirements for claiming tax rebates in Minnesota?

+

Yes, eligibility requirements vary depending on the type of tax rebate. For income tax refunds, individuals must meet certain income thresholds and file their taxes accurately. Industry-specific rebates often have additional criteria, such as business size, location, or specific investments made. It’s crucial to review the eligibility criteria for each rebate program to ensure you qualify.

How can I maximize my tax rebates in Minnesota?

+

Maximizing your tax rebates in Minnesota requires a strategic approach. First, ensure you understand all the available rebate programs and their eligibility criteria. Then, take advantage of tax-saving opportunities throughout the year, such as maximizing deductions and credits. Consider seeking professional tax advice or using reputable tax preparation software to ensure you’re claiming all the rebates you’re entitled to.