Tax Topic 152 Refund Information

Tax refunds are a crucial aspect of the financial landscape, offering individuals and businesses a much-needed financial boost. In this comprehensive guide, we delve into the intricacies of Tax Topic 152, exploring its significance, the process involved, and the impact it can have on taxpayers. As we navigate the complexities of the tax system, we'll uncover valuable insights and strategies to ensure a seamless and beneficial refund experience.

Understanding Tax Topic 152: A Comprehensive Overview

Tax Topic 152 refers to the specific guidelines and regulations surrounding tax refunds. It encompasses a wide range of scenarios, from personal income tax returns to business tax adjustments. This topic is of paramount importance as it provides taxpayers with the opportunity to reclaim overpaid taxes, rectify errors, and optimize their financial standing.

The process of claiming a tax refund under Tax Topic 152 involves a systematic approach. Taxpayers must first identify the reasons for the refund, whether it be excess withholding, eligible deductions, or tax credits. Once identified, the appropriate forms and documentation must be completed and submitted to the relevant tax authority.

Key Considerations for a Successful Refund

To maximize the benefits of Tax Topic 152, taxpayers should consider the following:

- Accurate Record-Keeping: Maintaining detailed records of income, expenses, and deductions is essential. This ensures a smooth refund process and helps identify any potential errors or discrepancies.

- Eligible Deductions and Credits: Understanding the various deductions and credits available can significantly impact the refund amount. Taxpayers should explore options such as mortgage interest, charitable contributions, and education expenses.

- Timely Submission: Meeting the deadline for tax return submission is crucial. Late filings can result in penalties and delays, impacting the overall refund process.

By being proactive and informed, taxpayers can navigate Tax Topic 152 with confidence, ensuring a positive outcome.

Maximizing Your Refund: Strategies and Tips

Maximizing the refund under Tax Topic 152 requires a strategic approach. Here are some expert insights to consider:

1. Reviewing Tax Withholdings

Taxpayers should regularly review their tax withholdings throughout the year. Adjusting withholdings can help avoid overpaying taxes and maximize the refund. Utilizing tax calculators and consulting with tax professionals can provide valuable guidance.

2. Exploring Tax Credits

Tax credits are a powerful tool for maximizing refunds. Credits such as the Child Tax Credit, Earned Income Tax Credit, and Education Credits can significantly reduce tax liabilities. Understanding eligibility criteria and claiming these credits can lead to substantial refunds.

3. Optimizing Deductions

Maximizing deductions is another strategy to consider. Taxpayers should explore options such as medical expenses, state and local taxes, and retirement contributions. By carefully documenting and claiming eligible deductions, taxpayers can reduce their taxable income and increase their refund.

4. Utilizing Tax Software

Tax software has revolutionized the refund process. These tools guide taxpayers through the refund journey, ensuring accuracy and efficiency. By leveraging tax software, individuals can navigate complex tax scenarios and identify potential refund opportunities.

| Tax Software Features | Benefits |

|---|---|

| Intuitive Interface | Simplifies the tax filing process |

| Deduction and Credit Analysis | Maximizes refund potential |

| Error Checking | Reduces the risk of mistakes |

| Electronic Filing | Ensures timely submission |

Case Study: A Successful Tax Refund Journey

Let’s explore a real-life scenario to illustrate the impact of Tax Topic 152 and the strategies employed.

Meet Sarah, a Small Business Owner

Sarah, a successful entrepreneur, faced a challenging tax season. With a growing business, she had complex tax obligations. By leveraging Tax Topic 152 and the strategies outlined above, Sarah achieved a significant refund.

Sarah's journey involved the following steps:

- Reviewing Withholdings: Sarah adjusted her tax withholdings to align with her business income, ensuring she wasn't overpaying.

- Exploring Credits: She claimed the Research and Development Tax Credit, which incentivized innovation in her industry.

- Optimizing Deductions: Sarah carefully documented and claimed deductions for business expenses, including office rent and equipment.

- Utilizing Tax Software: She used specialized tax software to ensure accuracy and maximize her refund potential.

As a result, Sarah received a substantial refund, which she reinvested into her business, contributing to its growth and success.

The Impact of Tax Refunds: A Broader Perspective

Tax refunds under Tax Topic 152 have a significant impact on both individuals and the economy as a whole. For individuals, refunds provide a financial boost, allowing for debt repayment, savings, or investments. This, in turn, stimulates economic activity and contributes to overall growth.

From a broader perspective, tax refunds can impact government spending and fiscal policies. The distribution of refunds can influence consumer spending patterns, impacting industries and the overall economy. Additionally, refunds can influence tax policies and future budgetary decisions.

The Future of Tax Refunds

As technology advances, the tax refund process is expected to become even more efficient and accessible. The integration of artificial intelligence and machine learning can enhance tax software, providing personalized refund strategies. Additionally, the concept of real-time refunds, where taxpayers receive refunds shortly after filing, is gaining traction.

Furthermore, the rise of digital currencies and blockchain technology may revolutionize the refund process, offering secure and transparent transactions.

Conclusion

Tax Topic 152 offers taxpayers a valuable opportunity to optimize their financial standing. By understanding the process, employing strategic approaches, and staying informed, individuals and businesses can navigate the tax landscape successfully. The impact of tax refunds extends beyond individual benefits, influencing economic growth and government policies.

As we continue to explore the complexities of the tax system, staying updated with the latest regulations and advancements is crucial. By embracing technology and adopting proactive strategies, taxpayers can maximize their refund potential and contribute to a thriving economy.

What is the average processing time for tax refunds under Tax Topic 152?

+

The processing time can vary depending on the complexity of the return and the tax authority’s workload. On average, taxpayers can expect a refund within 21 days of filing. However, it’s essential to note that this timeframe may vary, and taxpayers should monitor their refund status regularly.

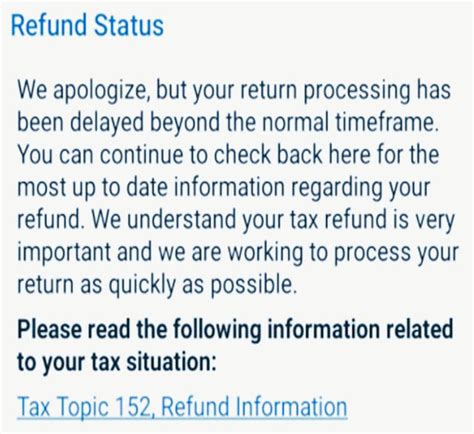

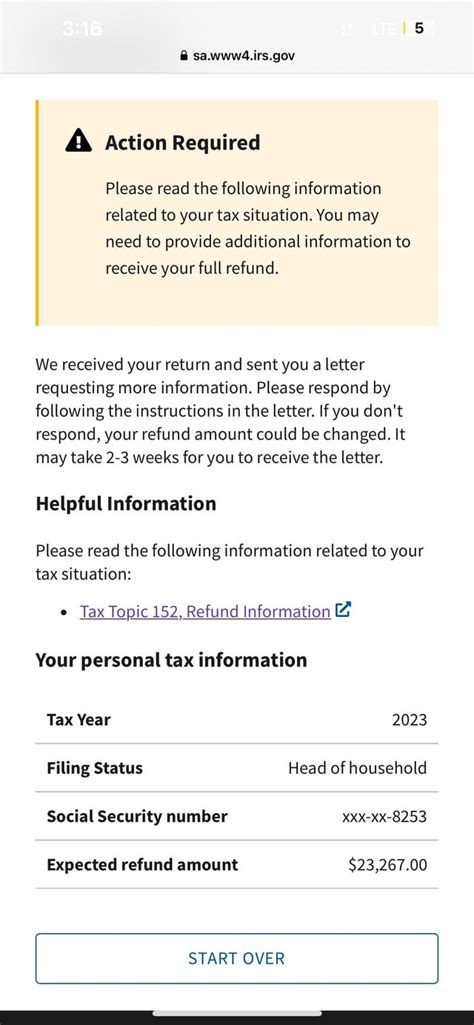

Can I track the status of my tax refund online?

+

Absolutely! Most tax authorities provide online portals or apps where taxpayers can check the status of their refund. By accessing these platforms, individuals can stay informed and receive updates on their refund journey.

Are there any penalties for claiming ineligible deductions or credits under Tax Topic 152?

+

Yes, claiming ineligible deductions or credits can result in penalties and interest charges. It’s crucial to accurately assess eligibility and consult with tax professionals if needed. Honesty and transparency are key to avoiding penalties.