Collin County Propery Tax

Welcome to this comprehensive guide on Collin County property taxes. Understanding property taxes is crucial for homeowners and prospective buyers alike. In this article, we will delve into the intricacies of property taxation in Collin County, Texas, providing you with valuable insights and information to navigate this complex process.

Unraveling the Complexity of Collin County Property Taxes

Collin County, known for its vibrant communities and thriving economy, boasts a unique property tax system. This system, while essential for funding local services, can be a daunting aspect of homeownership. Let’s explore the key components and factors that influence property taxes in this vibrant county.

The Property Tax Process: A Step-by-Step Guide

The journey of a property owner in Collin County begins with an annual assessment, a critical step in the property tax process. The Collin Central Appraisal District (CCAD), an independent entity, is responsible for appraising all taxable properties within the county. This appraisal determines the property’s value, which serves as the basis for tax calculations.

Once the appraisal is complete, the CCAD provides property owners with a Notice of Appraised Value. This notice outlines the appraised value and offers an opportunity for property owners to review and potentially challenge the assessment. It is essential to scrutinize this notice carefully, as it sets the stage for the subsequent tax billing process.

Following the appraisal and potential challenges, the Collin County Tax Assessor-Collector's Office steps in. This office calculates the actual property taxes based on the appraised value and the tax rate set by the various taxing entities within the county. These entities include school districts, cities, special districts, and the county itself.

| Taxing Entity | Tax Rate |

|---|---|

| Collin County | 0.2876 per $100 valuation |

| City of Plano | 0.5433 per $100 valuation |

| Plano ISD | 1.5309 per $100 valuation |

| Special Districts (e.g., MUDs) | Varies by district |

The calculated tax amount is then communicated to property owners through a Tax Statement. This statement details the tax amount, payment due dates, and instructions for remittance. Property owners have the option to pay their taxes in installments or in full, with specific deadlines to avoid penalties.

Understanding Property Tax Rates and Values

The tax rate in Collin County is a critical factor influencing the final tax amount. This rate is expressed as a percentage of the property’s appraised value. For instance, if a property has an appraised value of 300,000 and the tax rate is 0.30%, the annual tax liability would be 900. It’s essential to note that tax rates can vary significantly depending on the location and the services provided by the taxing entities.

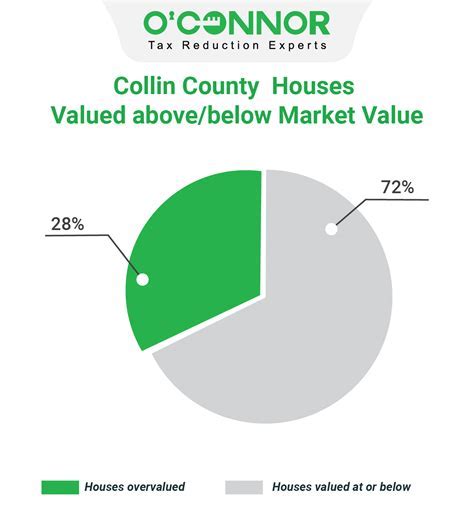

Additionally, property values in Collin County are subject to fluctuations. The CCAD conducts annual appraisals, considering factors such as market trends, recent sales, and property improvements. These appraisals can result in increases or decreases in property values, subsequently impacting the tax liability. It is wise for property owners to stay informed about these appraisals and their potential impact.

Exemptions and Special Considerations

Collin County offers various exemptions and special considerations to eligible property owners. These exemptions can significantly reduce the taxable value of a property, resulting in lower tax liabilities. Some common exemptions include:

- Homestead Exemption: Available to homeowners who use their property as their primary residence. This exemption reduces the taxable value of the property by a specified amount.

- Over-65 Exemption: Senior citizens aged 65 and above can qualify for this exemption, which provides additional relief on their taxable value.

- Disability Exemption: Individuals with disabilities may be eligible for a partial or total exemption, depending on their specific circumstances.

- Veteran's Exemption: Collin County extends special considerations to honorably discharged veterans, offering exemptions based on disability status and length of service.

It is crucial for property owners to research and understand the specific exemptions they may qualify for. These exemptions can provide significant savings and should not be overlooked.

Payment Options and Deadlines

Collin County offers a range of payment options to accommodate different preferences and financial situations. Property owners can choose to pay their taxes in full or opt for installment payments. The payment due dates are typically set for November and January, with specific deadlines to avoid late fees and penalties.

For those who prefer online transactions, the Collin County Tax Assessor-Collector's Office provides an online payment portal. This portal offers a convenient and secure way to remit tax payments, ensuring timely processing. Additionally, property owners can choose to pay via mail, in person at the tax office, or through authorized payment locations.

Navigating the Future: Trends and Considerations

As we look ahead, several trends and considerations emerge that will shape the property tax landscape in Collin County. These insights are crucial for homeowners and prospective buyers to make informed decisions.

Population Growth and Development

Collin County has experienced significant population growth in recent years, driven by its thriving job market and high quality of life. This growth has led to increased demand for housing and commercial spaces. As a result, property values have been on an upward trajectory, impacting tax liabilities.

While this growth brings economic benefits, it also presents challenges. The increasing population puts pressure on local infrastructure and services, prompting taxing entities to consider tax rate adjustments to meet the growing demand. Property owners and buyers must stay vigilant about these potential changes and their implications.

Tax Rate Stability and Budgeting

In recent years, Collin County has made efforts to maintain stable tax rates. This stability provides predictability for property owners, allowing them to budget effectively for their tax liabilities. However, it is essential to recognize that tax rates can be subject to change, especially in response to economic fluctuations or shifts in local governance.

Property owners should remain engaged with local government initiatives and proposals that may impact tax rates. Staying informed about budget discussions and proposed changes can empower homeowners to advocate for their interests and ensure transparency in the taxation process.

Exemption Awareness and Planning

As mentioned earlier, exemptions play a significant role in reducing property tax liabilities. However, many property owners may not be fully aware of the exemptions they qualify for. It is crucial to stay informed about the various exemptions available and take proactive steps to apply for them.

For example, the Homestead Exemption is a valuable tool for homeowners, but it requires annual renewal. Failing to renew this exemption could result in higher taxable values and increased tax liabilities. Property owners should mark their calendars for exemption renewal deadlines and ensure they meet the eligibility criteria to maximize their savings.

Conclusion: Empowering Property Owners

Understanding and managing property taxes is an essential aspect of homeownership in Collin County. By unraveling the complexities of the tax process, exploring exemptions, and staying informed about trends and considerations, property owners can navigate this landscape with confidence.

This guide aims to provide a comprehensive resource for homeowners and prospective buyers, offering insights and strategies to make informed decisions. Remember, staying engaged with local tax authorities, understanding your rights, and seeking professional advice when needed are key to successfully managing your property tax obligations.

What is the average property tax rate in Collin County?

+The average property tax rate in Collin County varies depending on the location and taxing entities. However, as of the latest data, the average effective tax rate is approximately 2.20%, which is slightly higher than the national average.

How can I challenge my property’s appraised value?

+If you believe your property’s appraised value is incorrect, you have the right to protest. You can file a protest with the Collin Central Appraisal District within a specified timeframe. It is advisable to gather supporting evidence, such as recent sales of similar properties, to strengthen your case.

Are there any tax breaks or incentives for renewable energy installations?

+Yes, Collin County offers a renewable energy exemption for qualifying renewable energy systems. This exemption can reduce the taxable value of your property. To be eligible, your system must meet specific criteria, and you need to apply with the Collin Central Appraisal District.

Can I pay my property taxes online?

+Absolutely! The Collin County Tax Assessor-Collector’s Office provides an online payment portal. You can access this portal through their official website and make secure payments using various methods, including credit cards and electronic checks.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline can result in penalties and interest charges. It is essential to stay informed about the payment deadlines and make timely payments to avoid additional costs. If you encounter financial difficulties, it is advisable to contact the Tax Assessor-Collector’s Office to explore potential payment arrangements.