Sales Tax In Delaware

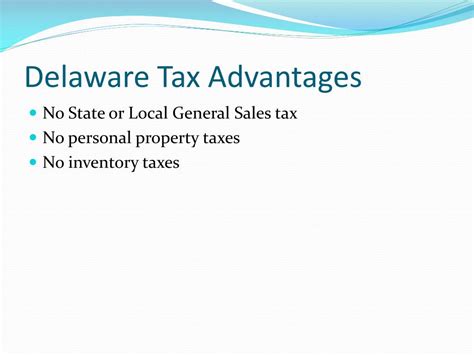

Delaware, a mid-Atlantic state in the United States, has gained attention for its unique approach to sales tax, particularly for online retailers. Unlike most states, Delaware does not impose a statewide sales tax on retail transactions. This has led to a distinct set of tax implications and opportunities, especially for businesses operating in the e-commerce space.

Understanding Delaware’s Sales Tax Landscape

Delaware’s sales tax system is notably straightforward. While there is no statewide sales tax, certain localities within the state have the authority to impose their own sales taxes. As of my last update in January 2023, only one city, Wilmington, has implemented a sales tax of 2%. This local tax applies to all retail sales within the city limits, including online purchases delivered to Wilmington addresses.

However, it's important to note that this tax structure can vary over time. The absence of a statewide sales tax has made Delaware an attractive destination for online retailers, particularly those looking to minimize their tax liabilities. This unique arrangement has spurred economic growth and has led to a thriving e-commerce industry within the state.

Sales Tax Implications for Online Retailers

For online retailers, Delaware’s sales tax exemption presents a significant advantage. Without a statewide sales tax, online sellers are not required to collect and remit sales tax on orders shipped to Delaware residents. This means that customers in Delaware can enjoy lower prices compared to other states where sales tax is added at checkout.

However, the situation is more complex for businesses with physical presence in Delaware. If an online retailer has a physical store, warehouse, or distribution center within the state, they may be subject to sales tax collection and remittance for in-store sales and deliveries within the state. This is because Delaware follows the physical presence rule, which requires businesses with a physical presence to collect and remit sales tax.

Nexus and Sales Tax Collection

Delaware’s definition of nexus, the legal term for a business’s connection to a state that triggers tax obligations, is worth exploring. The state considers a business to have nexus if it has any of the following:

- A physical store or office in Delaware.

- Employees or agents working in the state.

- Ownership or lease of real property in Delaware.

- A significant economic presence, such as a substantial number of sales or transactions within the state.

If a business meets any of these criteria, it is considered to have nexus and must collect and remit sales tax for transactions within Delaware. This includes online sales delivered to Delaware addresses, especially if the business has a physical presence in the state.

Sales Tax Compliance and Reporting

For online retailers with nexus in Delaware, sales tax compliance involves a few key steps. First, businesses must register with the Delaware Division of Revenue to obtain a sales tax permit. This permit allows them to collect and remit sales tax for transactions subject to Delaware’s sales tax laws.

Next, retailers must calculate the sales tax due for each transaction. This calculation considers the sales tax rate applicable to the customer's shipping address. For example, if an online purchase is delivered to a Wilmington address, the 2% city sales tax applies. Retailers should have systems in place to accurately calculate and apply the correct sales tax rate for each order.

Sales Tax Remittance

After collecting sales tax from customers, online retailers must remit the tax to the Delaware Division of Revenue. The frequency of remittance depends on the business’s sales volume and the number of transactions. Generally, businesses with higher sales volumes are required to remit sales tax more frequently, such as monthly or quarterly. Businesses with lower sales may be allowed to remit sales tax annually.

The sales tax remittance process involves submitting the collected sales tax to the state, along with a sales tax return that details the sales and tax amounts. The sales tax return typically includes information such as the total sales, taxable sales, and the calculated sales tax. This information helps the state monitor and enforce sales tax compliance.

Delaware’s Economic Impact and Future Outlook

Delaware’s sales tax exemption has had a notable impact on the state’s economy, particularly in the e-commerce sector. The absence of a statewide sales tax has attracted numerous online retailers, resulting in increased economic activity and job opportunities within the state. This has led to a thriving business climate, with Delaware becoming a hub for e-commerce operations.

Looking ahead, the future of sales tax in Delaware is uncertain. While the state currently benefits from its unique tax structure, there are ongoing discussions and proposals to introduce a statewide sales tax. These proposals aim to address budget concerns and ensure a more balanced tax system. However, any changes to Delaware's sales tax laws would have significant implications for businesses, especially those in the e-commerce industry.

The potential introduction of a statewide sales tax would likely impact online retailers operating in Delaware. They would need to adapt their systems and processes to collect and remit sales tax, potentially increasing operational costs and complexity. However, a statewide sales tax could also provide a more stable revenue stream for the state, benefiting public services and infrastructure.

Preparing for Potential Changes

In anticipation of potential sales tax changes, online retailers operating in Delaware should consider the following steps:

- Stay informed about any proposed sales tax legislation and its potential impact on their business.

- Evaluate their systems and processes to ensure they can adapt to new sales tax requirements efficiently.

- Consider the potential financial impact of a statewide sales tax on their pricing strategies and customer experience.

- Explore options for tax automation tools or services to streamline sales tax collection and remittance.

By staying proactive and prepared, online retailers can navigate any changes to Delaware's sales tax landscape with confidence and ensure continued compliance.

Frequently Asked Questions

Does Delaware have a statewide sales tax?

+No, Delaware does not impose a statewide sales tax. However, certain localities, such as the city of Wilmington, have their own sales taxes.

Are online retailers required to collect sales tax in Delaware?

+Online retailers are generally not required to collect sales tax for transactions delivered to Delaware addresses. However, if the business has a physical presence in Delaware, it may need to collect and remit sales tax for in-state sales.

What is the sales tax rate in Wilmington, Delaware?

+As of my last update, Wilmington has a sales tax rate of 2%. This rate applies to all retail sales within the city limits.

How does Delaware define nexus for sales tax purposes?

+Delaware considers a business to have nexus if it has a physical store, employees, real property, or a significant economic presence within the state.

What are the sales tax compliance requirements for online retailers in Delaware?

+Online retailers with nexus in Delaware must register with the Delaware Division of Revenue, collect sales tax based on the customer’s shipping address, and remit the collected tax to the state. The frequency of remittance depends on the business’s sales volume.