Ct Tax Return Status

Welcome to a comprehensive guide on the Connecticut Tax Return Status! In this expert-driven article, we will delve into the intricacies of tracking and understanding the status of your Connecticut tax returns. Whether you're a resident or a business owner in Connecticut, staying informed about the progress of your tax filings is crucial. Join us as we explore the various aspects of the CT Tax Return Status, providing you with valuable insights and practical guidance.

Unraveling the CT Tax Return Status

Connecticut, known as the Constitution State, takes a systematic approach to tax administration. Understanding the status of your tax returns is essential for individuals and businesses alike. Let’s break down the process and provide you with the knowledge you need to navigate this critical aspect of financial management.

The Importance of Tax Return Status

Knowing the status of your tax returns is more than just a formality; it’s a vital aspect of financial planning and compliance. For individuals, it ensures timely processing of refunds and accurate filing of taxes. Businesses, on the other hand, rely on tax return status to manage cash flow, plan investments, and stay on top of their financial obligations.

In the context of Connecticut, where the Department of Revenue Services (CT DRS) oversees tax administration, being well-informed about the status of your returns is even more crucial. It allows you to address any potential issues promptly and ensures a smooth tax journey.

How to Check Your CT Tax Return Status

Connecticut offers several convenient methods for taxpayers to check the status of their returns. Here’s a step-by-step guide to accessing your tax return status:

- Online Portal: The CT DRS provides an online My Account portal, accessible through their official website. This portal allows registered users to view the status of their returns, refunds, and any pending actions. It's a quick and secure way to stay informed.

- Phone Call: For those who prefer a more direct approach, the CT DRS has a dedicated taxpayer assistance line. By calling the specified number, you can speak to a representative who can provide real-time status updates and answer any queries you may have.

- Email or Mail: In certain cases, the CT DRS may communicate the status of your return via email or traditional mail. Keep an eye on your inbox and physical mailbox for any updates, especially if you've opted for these communication methods during your tax filing process.

It's worth noting that the method you choose to check your tax return status may depend on the type of return you've filed. For instance, individual income tax returns might have different status inquiries compared to business tax returns.

Interpreting Your CT Tax Return Status

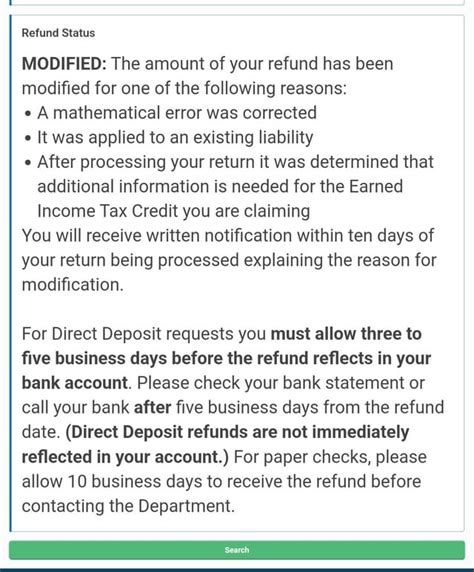

Understanding the language of tax return status can be a bit cryptic for the uninitiated. Here’s a breakdown of some common terms you might encounter when checking your CT tax return status:

- Accepted: This is the green light you've been waiting for! Your tax return has been successfully processed and accepted by the CT DRS. If applicable, your refund will be processed shortly.

- Pending: Your tax return is in the processing stage. It could be awaiting additional documentation, verification, or simply going through the standard review process. Check back regularly for updates.

- Rejected: Unfortunately, your tax return has been rejected. This could be due to various reasons, such as missing information, errors in calculations, or issues with your taxpayer identification. Reach out to the CT DRS for guidance on how to rectify the situation.

- Under Review: Your tax return is currently undergoing a more detailed examination by the CT DRS. This could be due to discrepancies, potential errors, or further clarification required. Patience is key during this stage.

Remember, the CT DRS provides detailed guidelines and resources on their website to help taxpayers navigate these status terms and take appropriate actions.

Troubleshooting Common Issues

Despite your best efforts, you might encounter challenges along the way. Here are some common issues and potential solutions to help you navigate the CT tax return status process smoothly:

- Missing Refund: If your tax return status shows as Accepted, but you haven't received your refund, don't panic. Refunds can take up to 60 days to process. However, if it's been over 60 days, consider reaching out to the CT DRS to inquire about the delay.

- Return Rejection: If your tax return is rejected, carefully review the rejection notice for specific reasons. Common issues include incorrect taxpayer ID, math errors, or missing signatures. Address these issues promptly to resubmit your return.

- Pending for Long Periods: If your tax return status remains Pending for an extended period, consider contacting the CT DRS for an update. Sometimes, additional documentation or information might be required to complete the processing.

Real-World Examples and Case Studies

To bring these concepts to life, let’s explore a few real-world scenarios that illustrate the importance of understanding and managing your CT tax return status.

Scenario 1: Individual Taxpayer

Meet Sarah, a Connecticut resident who filed her individual income tax return on time. She eagerly checks her CT tax return status a few weeks later and discovers that her return is pending. Concerned, she contacts the CT DRS, only to find out that her return was flagged for a potential error in her calculations. With their guidance, she corrects the error and successfully processes her return.

Scenario 2: Business Taxpayer

Imagine a small business owner, John, who recently filed his business tax return. A few days later, he logs into his My Account portal and finds that his return is under review. Worried, he reaches out to the CT DRS, who assures him that it’s a standard review process for certain business tax returns. John patiently awaits the outcome and receives a confirmation of acceptance a few weeks later.

Scenario 3: Complex Tax Situation

Emily, a Connecticut resident with a complex tax situation, files her return but encounters a rejected status. Confused, she reviews the rejection notice and discovers that her taxpayer ID was incorrect. With the help of the CT DRS, she rectifies the issue and successfully submits her return, ensuring her taxes are processed accurately.

Future Implications and Recommendations

As we look ahead, staying informed about tax return status becomes even more critical in an evolving financial landscape. Here are some key takeaways and recommendations for Connecticut taxpayers:

- Stay Up-to-Date: Regularly check your CT tax return status, especially during the tax filing season. Being proactive can help you address any potential issues promptly.

- Utilize Online Resources: Take advantage of the CT DRS's online My Account portal and other digital tools to access real-time status updates and essential resources.

- Keep Records: Maintain a well-organized record of your tax documents, receipts, and correspondence with the CT DRS. This can simplify the process of addressing any status-related queries or issues.

- Seek Professional Guidance: For complex tax situations or if you encounter persistent challenges with your tax return status, consider seeking the expertise of a tax professional or accountant.

By staying informed, leveraging digital tools, and seeking expert guidance when needed, Connecticut taxpayers can navigate the CT tax return status process with confidence and ease.

FAQs

How long does it typically take for the CT DRS to process tax returns?

+

The processing time can vary depending on the type of return and the volume of filings. Generally, individual income tax returns are processed within 60 days, while business tax returns may take longer. However, factors like errors or additional documentation can extend the processing time.

What should I do if my tax return status shows as pending for an extended period?

+

If your tax return status remains pending for an unusually long time, it’s advisable to contact the CT DRS for an update. They can provide specific reasons for the delay and guide you on the next steps.

Can I check the status of my tax return online if I haven’t registered for the My Account portal?

+

Yes, you can check the status of your tax return online even if you haven’t registered for the My Account portal. The CT DRS provides a guest access feature that allows you to check your return status using your taxpayer ID and other relevant details.

What happens if my tax return is rejected due to a minor error?

+

If your tax return is rejected due to a minor error, you can address the issue and resubmit your return. The CT DRS provides guidance on how to correct the error and ensures a smooth resubmission process.

Are there any penalties for late tax return submissions in Connecticut?

+

Connecticut imposes penalties for late tax return submissions. The specific penalties vary depending on the type of return and the extent of the delay. It’s crucial to file your returns on time to avoid unnecessary penalties.