Iowa Income Tax

Iowa's income tax system is an essential component of the state's financial framework, playing a crucial role in funding public services and infrastructure. This comprehensive guide delves into the intricacies of Iowa's income tax, offering a detailed understanding of its structure, rates, and implications for individuals and businesses.

Understanding Iowa’s Income Tax System

Iowa operates a progressive income tax system, which means that higher incomes are taxed at a proportionally higher rate. This approach aims to ensure fairness and contribute to a balanced distribution of tax burdens. The state’s tax system is governed by the Iowa Department of Revenue, which sets the tax rates and administers the collection process.

The income tax in Iowa is calculated based on a series of tax brackets, each with its own tax rate. This system ensures that as income increases, the taxpayer moves into higher tax brackets, leading to a corresponding increase in the tax rate applied to that income.

| Tax Bracket (Single Filers) | Tax Rate |

|---|---|

| $0 - $2,187 | 0.36% |

| $2,188 - $5,570 | 0.96% |

| $5,571 - $10,194 | 2.53% |

| $10,195 - $21,777 | 4.56% |

| $21,778 - $36,295 | 6.13% |

| $36,296 - $59,689 | 7.97% |

| $59,690 - $95,517 | 8.53% |

| $95,518 - $238,792 | 8.98% |

| $238,793 and above | 8.53% |

For married couples filing jointly, the tax brackets are doubled, ensuring that their tax liability is calculated fairly based on their combined income.

Exemptions and Deductions

Iowa offers several exemptions and deductions to help reduce the tax burden on individuals and families. These include exemptions for dependents, such as children and elderly relatives, as well as deductions for various expenses, such as medical costs, charitable contributions, and certain business-related expenses.

One notable exemption is the standard deduction, which allows taxpayers to reduce their taxable income by a certain amount. For the 2023 tax year, the standard deduction for single filers is $2,300, while it's $4,600 for married couples filing jointly. Taxpayers can choose between claiming the standard deduction or itemizing their deductions, whichever provides a more significant reduction in their taxable income.

Iowa’s Tax Credits

In addition to exemptions and deductions, Iowa provides a range of tax credits designed to encourage specific behaviors or support certain groups. For instance, the state offers a Credit for Contributions to School Infrastructure, which provides a tax credit for contributions made to public school foundations.

Another notable credit is the Earned Income Tax Credit (EITC), which benefits low- to moderate-income working individuals and families. This credit can significantly reduce the amount of tax owed or even result in a refund, providing a financial boost to those who need it most.

Special Considerations for Businesses

Businesses operating in Iowa are subject to a corporate income tax, which is calculated based on their taxable income. The tax rate for C corporations is 6.5%, while S corporations and personal service corporations are taxed at 8.98%.

Iowa also offers various incentives and tax credits to encourage business investment and growth. These include tax credits for research and development, job creation, and investment in renewable energy projects. These incentives can significantly reduce a business's tax liability and promote economic development in the state.

The Impact of Iowa’s Income Tax

Iowa’s income tax system has a significant impact on the state’s economy and its residents. By funding essential public services and infrastructure, the income tax contributes to the overall well-being and prosperity of Iowans.

For individuals and families, the income tax can be a significant financial burden, especially for those with higher incomes. However, the progressive nature of the tax system ensures that those with greater means contribute proportionally more, helping to maintain a level of economic equality.

Businesses, too, bear a significant portion of the tax burden through corporate income taxes. While this may seem like a disadvantage, Iowa's competitive tax rates and incentives make it an attractive location for businesses, fostering economic growth and job creation.

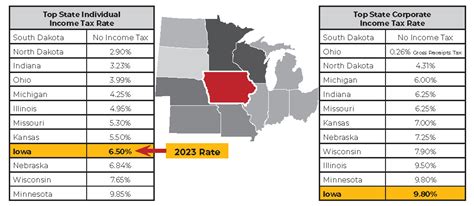

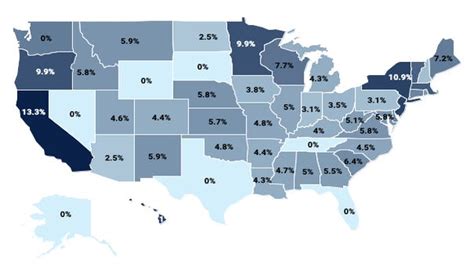

How Iowa’s Income Tax Compares

When compared to other states, Iowa’s income tax system is relatively moderate. While it does not have the lowest tax rates, it also avoids the highest rates, striking a balance that aims to be fair and competitive.

For instance, compared to neighboring states like Illinois and Nebraska, Iowa's top income tax rate is lower, making it a more attractive option for high-income earners. However, when compared to states like Texas or Florida, which have no income tax, Iowa may seem less appealing.

However, it's essential to consider the overall tax landscape when making such comparisons. Iowa offers a range of tax credits and incentives that can significantly reduce the overall tax burden, making it a competitive choice for individuals and businesses alike.

The Future of Iowa’s Income Tax

Like all tax systems, Iowa’s income tax is subject to ongoing review and potential changes. As economic conditions and political landscapes shift, the state may consider adjustments to its tax rates, brackets, or exemptions to ensure the system remains fair and sustainable.

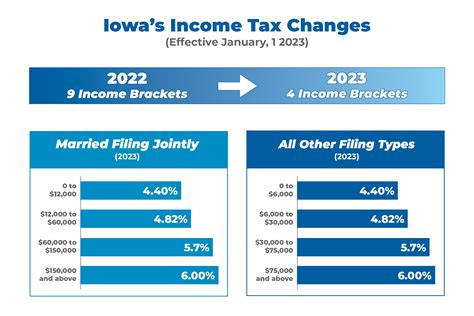

In recent years, there has been a growing emphasis on tax reform in Iowa, with proposals to simplify the tax system, reduce rates, and broaden the tax base. These reforms aim to make the system more efficient and reduce the administrative burden on taxpayers and businesses.

One potential reform is the introduction of a flat tax, which would replace the current progressive system with a single tax rate applied to all income levels. While this could simplify the tax code, it may also lead to a shift in the tax burden, affecting different income groups differently.

Conclusion

Iowa’s income tax system is a complex but crucial component of the state’s financial framework. By understanding its structure, rates, and implications, individuals and businesses can navigate the tax landscape more effectively and make informed decisions about their financial strategies.

As Iowa continues to evolve and adapt to changing economic conditions, its income tax system will remain a vital tool for funding public services and promoting economic growth. By staying informed and engaged with these tax matters, Iowans can ensure their voices are heard in shaping the future of the state's tax policy.

What is the current income tax rate in Iowa for 2023?

+For 2023, Iowa has a progressive income tax system with tax rates ranging from 0.36% to 8.98%, depending on the taxpayer’s income level.

Are there any tax breaks or incentives for businesses in Iowa?

+Yes, Iowa offers a range of tax incentives and credits to encourage business investment and growth, including tax credits for research and development, job creation, and renewable energy projects.

How does Iowa’s income tax system compare to other states?

+Iowa’s income tax rates are relatively moderate compared to other states. While it has lower rates than some neighboring states, it also lacks the extreme rates seen in certain states with no income tax.

Are there any plans for tax reform in Iowa?

+Yes, there have been discussions and proposals for tax reform in Iowa, with a focus on simplifying the tax system, reducing rates, and broadening the tax base. One potential reform is the introduction of a flat tax.