Wyo Sales Tax

Welcome to the comprehensive guide on Wyoming's sales tax, a critical component of the state's revenue generation and economic landscape. In this article, we will delve deep into the intricacies of Wyoming's sales tax system, exploring its history, structure, rates, and impact on businesses and consumers alike. By the end of this piece, you'll have a thorough understanding of this essential aspect of Wyoming's economy, its unique features, and its role in shaping the state's financial environment.

The Evolution of Wyoming’s Sales Tax: A Historical Perspective

The journey of sales tax in Wyoming dates back to the mid-20th century, with its origins rooted in the post-World War II economic boom. Introduced in 1939 as a means to stabilize state revenues and fund essential public services, Wyoming’s sales tax has undergone several transformations over the decades.

The initial sales tax rate was set at 2%, a relatively modest figure compared to other states. However, as Wyoming’s economy expanded and diversified, so too did the sales tax system. The tax rate has fluctuated over time, influenced by various economic factors and the state’s fiscal needs.

A significant milestone in Wyoming’s sales tax history was the introduction of the Destination-Based Sales Tax in 1989. This innovative system, unique to Wyoming, shifted the tax burden from the seller to the buyer, ensuring that sales tax was collected based on the destination of the goods or services, rather than the location of the seller.

This change had a profound impact on Wyoming’s revenue collection, particularly in regions with high tourist activity. It encouraged economic growth and investment in tourism-related industries, while also ensuring a more equitable distribution of tax revenues across the state.

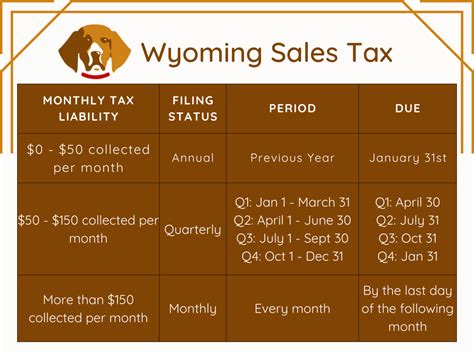

Understanding Wyoming’s Current Sales Tax Structure

As of 2023, Wyoming’s sales tax system is a comprehensive yet straightforward structure, designed to balance revenue generation with the needs of businesses and consumers.

State Sales Tax Rate

Wyoming currently imposes a 4% state sales tax on most goods and services. This rate is applicable statewide and serves as the foundation for the state’s sales tax revenue.

Local Sales Tax Rates

In addition to the state sales tax, Wyoming allows local governments to levy additional sales taxes to fund specific projects or services. These local option taxes can vary significantly across the state, with rates ranging from 0% to 3%.

For instance, the city of Cheyenne, Wyoming’s capital, imposes a local option tax of 2%, bringing the total sales tax rate to 6% within city limits. On the other hand, smaller towns like Jackson may have lower or no local sales tax, making them more attractive to consumers seeking tax-free purchases.

Exemptions and Special Rates

Wyoming’s sales tax system is not without its exemptions and special rates. Certain goods and services are exempt from sales tax, including:

- Prescription drugs

- Medical devices

- Residential rent

- Most food items

- Newspaper subscriptions

Additionally, certain industries enjoy special sales tax rates, such as the 3% sales tax applied to lodging and hotel accommodations.

| Category | Sales Tax Rate |

|---|---|

| General Merchandise | 4% (State) + Local Option Tax |

| Groceries | 0% (State) + Local Option Tax |

| Lodging | 3% (State) + Local Option Tax |

| Vehicle Sales | 4% (State) + Local Option Tax |

The Impact of Wyoming’s Sales Tax on Businesses and Consumers

Wyoming’s sales tax system has a significant influence on both businesses and consumers within the state. For businesses, the sales tax is a critical consideration in their financial planning and operational strategies.

Business Implications

Businesses operating in Wyoming must navigate the complexities of the state’s sales tax system, which can impact their pricing strategies, operational costs, and overall profitability.

The state’s Destination-Based Sales Tax system, for example, requires businesses to collect sales tax based on the destination of the goods or services, not their origin. This can be a challenge for businesses with customers across the state, as they must accurately determine the applicable tax rate for each transaction.

Additionally, businesses must stay updated with the ever-changing sales tax rates and regulations, ensuring compliance with state and local laws. This often requires investment in robust accounting and tax management systems, adding to the operational costs for businesses.

Consumer Behavior and Impact

For consumers, Wyoming’s sales tax system can influence their purchasing decisions and overall spending habits. The varying sales tax rates across the state can encourage consumers to shop in areas with lower tax rates, particularly for high-value items.

The destination-based sales tax also means that online shoppers may face different tax rates depending on the shipping destination. This can add an element of uncertainty to online purchases, as consumers must factor in the applicable sales tax rate at the time of checkout.

However, Wyoming’s relatively low sales tax rates, particularly in rural areas with no local option tax, can make the state an attractive destination for shoppers seeking tax-free or low-tax purchases.

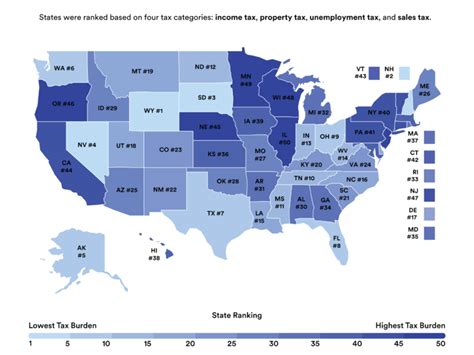

Wyoming’s Sales Tax: A Comparative Analysis

When compared to other states, Wyoming’s sales tax system stands out for its simplicity and flexibility. The state’s 4% state sales tax, one of the lowest in the nation, is a significant draw for businesses and consumers alike.

However, it’s important to note that Wyoming’s sales tax system is not without its complexities. The addition of local option taxes can result in a wide range of sales tax rates across the state, making it challenging for businesses and consumers to keep track of the applicable rates.

In comparison to its neighboring states, Wyoming’s sales tax system offers a unique balance. While states like Colorado and Utah have higher state sales tax rates, they do not allow for local option taxes, resulting in a more uniform tax structure. On the other hand, states like Idaho and Montana have similar state sales tax rates to Wyoming but also allow for local option taxes, creating a similar landscape of varying tax rates.

| State | State Sales Tax Rate | Local Option Tax |

|---|---|---|

| Wyoming | 4% | Varies by Location |

| Colorado | 2.9% | No Local Option Tax |

| Utah | 4.75% | No Local Option Tax |

| Idaho | 6% | Varies by Location |

| Montana | 0% | Varies by Location |

Future Outlook: Wyoming’s Sales Tax Evolution

As Wyoming’s economy continues to evolve, so too will its sales tax system. The state’s commitment to economic growth and stability suggests that the sales tax will remain a key revenue generator for the foreseeable future.

Looking ahead, several trends and factors could shape the future of Wyoming’s sales tax system.

Economic Growth and Diversification

As Wyoming’s economy diversifies beyond its traditional industries of energy and tourism, the sales tax base is likely to expand. This could lead to a more robust and stable revenue stream for the state, reducing the need for frequent rate adjustments.

Technological Advances

The rise of e-commerce and digital sales presents both challenges and opportunities for Wyoming’s sales tax system. The state will need to adapt its regulations and enforcement mechanisms to ensure compliance in the digital realm, particularly with the increasing popularity of online marketplaces.

Tax Reform and Simplification

There may be growing calls for tax reform and simplification in Wyoming, particularly with the increasing complexity of the sales tax system due to local option taxes. Simplifying the tax structure could make it more accessible and understandable for businesses and consumers, while also reducing administrative burdens.

Regional Economic Cooperation

Wyoming’s unique sales tax system, with its destination-based approach, could serve as a model for regional economic cooperation. The state’s experience in managing a complex sales tax system could be leveraged to foster collaboration and uniformity across the Mountain West region, benefiting businesses and consumers throughout the area.

Conclusion: Wyoming’s Sales Tax - A Balancing Act

Wyoming’s sales tax system is a dynamic and evolving component of the state’s economic landscape. Its low state sales tax rate, combined with the flexibility of local option taxes, provides a unique and competitive advantage for businesses and consumers.

However, the system’s complexity, particularly with varying local rates, underscores the importance of staying informed and adapting to changing regulations. As Wyoming’s economy continues to grow and diversify, its sales tax system will play a crucial role in shaping the state’s financial future, requiring careful management and strategic planning.

What is the current sales tax rate in Wyoming for general merchandise?

+The current sales tax rate for general merchandise in Wyoming is 4%, which is the state sales tax rate. However, local governments can impose additional local option taxes, which can increase the total sales tax rate.

Are there any sales tax holidays in Wyoming?

+No, Wyoming does not currently have any sales tax holidays. However, certain items like groceries and prescription drugs are exempt from sales tax year-round.

How does Wyoming’s sales tax system compare to other states in the region?

+Wyoming’s sales tax system, with its low state rate and local option taxes, offers a competitive advantage compared to some neighboring states. However, the varying local rates can make it more complex than states with uniform sales tax structures.