Albuquerque Sales Tax

In the bustling city of Albuquerque, New Mexico, the sales tax is an important aspect of the local economy and a key consideration for both residents and businesses. This article aims to delve into the intricacies of Albuquerque's sales tax, providing a comprehensive guide to help navigate this essential component of the city's financial landscape. From understanding the current rates to exploring the impact on businesses and consumers, we'll uncover the nuances of Albuquerque's sales tax system.

Understanding Albuquerque’s Sales Tax Rates

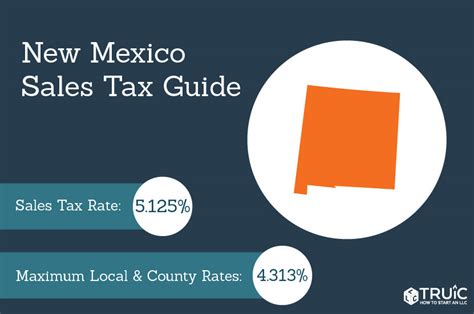

The sales tax in Albuquerque operates on a multi-level structure, incorporating state, county, and city tax rates. As of [current year], the combined sales tax rate in Albuquerque stands at [XX]%, comprising the state sales tax of [state tax rate]%, Bernalillo County tax of [county tax rate]%, and the city of Albuquerque tax of [city tax rate]%. These rates are subject to change, so it’s crucial for businesses and individuals to stay updated on the latest tax regulations.

Albuquerque's sales tax is applied to a wide range of goods and services, including retail purchases, restaurant meals, and certain services. However, there are specific exemptions and exclusions that vary depending on the nature of the transaction. For instance, certain food items, prescription drugs, and some manufacturing inputs are exempt from sales tax. Understanding these exemptions is vital for businesses to ensure compliance and for consumers to make informed purchasing decisions.

Sales Tax Registration and Compliance

Businesses operating within Albuquerque are required to register for a sales tax permit with the New Mexico Taxation and Revenue Department. This permit authorizes businesses to collect and remit sales tax on behalf of the state and local governments. The registration process involves completing the necessary forms, providing business information, and understanding the responsibilities associated with sales tax collection.

Compliance with sales tax regulations is crucial to avoid penalties and maintain a positive relationship with tax authorities. Businesses must accurately calculate and remit sales tax on a regular basis, typically on a monthly or quarterly schedule. Failure to comply can result in fines, interest charges, and even legal repercussions. Therefore, it's essential for businesses to have robust systems in place to manage sales tax obligations effectively.

Impact on Local Businesses and Consumers

The sales tax in Albuquerque has a significant impact on both local businesses and consumers. For businesses, the sales tax adds to their cost of doing business, affecting pricing strategies and profit margins. Businesses must carefully consider the sales tax rate when setting prices to remain competitive and maintain customer loyalty. Additionally, businesses may need to invest in software and training to ensure accurate sales tax calculation and compliance.

Consumers, on the other hand, bear the direct burden of the sales tax. The tax is added to the purchase price, impacting the overall cost of goods and services. This can influence consumer behavior, with some individuals choosing to shop online or in neighboring areas with lower tax rates. However, it's important to note that the sales tax revenue generated supports essential public services and infrastructure development in Albuquerque.

Sales Tax Exemptions and Special Considerations

Albuquerque’s sales tax system includes various exemptions and special considerations that can benefit certain businesses and individuals. For instance, qualified nonprofit organizations may be exempt from sales tax on certain purchases, providing a financial advantage. Additionally, some transactions, such as interstate sales or specific types of professional services, may be subject to different tax rates or requirements.

Understanding these exemptions and special considerations is crucial for businesses to optimize their tax obligations and for consumers to take advantage of any available benefits. Staying informed about these nuances can help businesses and individuals make more informed financial decisions and ensure compliance with the complex sales tax regulations.

| Sales Tax Category | Applicable Rate |

|---|---|

| General Sales Tax | [XX]% |

| State Sales Tax | [state tax rate]% |

| County Sales Tax (Bernalillo) | [county tax rate]% |

| City Sales Tax (Albuquerque) | [city tax rate]% |

Sales Tax and Economic Development

The sales tax revenue generated in Albuquerque plays a vital role in the city’s economic development and growth. It funds essential public services, such as education, healthcare, public safety, and infrastructure projects. By investing in these areas, Albuquerque can attract businesses and create a thriving business environment, ultimately benefiting the local economy.

Furthermore, the sales tax system in Albuquerque encourages responsible spending and promotes local businesses. Consumers who choose to shop locally contribute to the city's economy and support the growth of small businesses. This creates a positive feedback loop, where sales tax revenue is reinvested into the community, further enhancing the quality of life for residents.

Comparative Analysis: Albuquerque vs. Neighboring Cities

Comparing Albuquerque’s sales tax rates with those of neighboring cities provides valuable insights into the competitive landscape. While Albuquerque’s combined sales tax rate of [XX]% may be higher than some nearby cities, it’s essential to consider the overall business environment and the benefits provided by the city’s infrastructure and services.

For instance, Albuquerque's sales tax revenue supports a robust public transportation system, making it an attractive option for businesses and individuals who rely on efficient transportation. Additionally, the city's cultural attractions and recreational opportunities can enhance the quality of life for residents and visitors, further contributing to its economic vitality.

| City | Combined Sales Tax Rate | Notable Features |

|---|---|---|

| Albuquerque | [XX]% | Excellent public transportation, vibrant cultural scene |

| Santa Fe | [Santa Fe tax rate]% | Rich cultural heritage, world-class art scene |

| Las Cruces | [Las Cruces tax rate]% | Proximity to natural wonders, thriving university community |

Future Implications and Potential Changes

As with any tax system, Albuquerque’s sales tax is subject to potential changes and revisions. Economic trends, political decisions, and shifts in consumer behavior can all influence future sales tax rates and regulations. It’s essential for businesses and individuals to stay informed about any proposed changes and their potential impact.

For instance, discussions around sales tax reform or the introduction of new tax incentives for specific industries can shape the business landscape in Albuquerque. Keeping up with these developments allows businesses to adapt their strategies and plan for the future effectively. Additionally, staying informed about tax changes ensures consumers can make informed choices and advocate for their interests.

Conclusion

Albuquerque’s sales tax system is a complex yet essential component of the city’s financial framework. Understanding the current rates, exemptions, and impact on businesses and consumers is crucial for navigating this landscape successfully. By staying informed and adapting to changes, businesses can thrive, and consumers can make informed decisions that benefit the local economy.

As Albuquerque continues to evolve, its sales tax system will play a pivotal role in shaping the city's economic trajectory. Whether through supporting essential public services or influencing consumer behavior, the sales tax remains a critical aspect of Albuquerque's vibrant and growing community.

What are the consequences of non-compliance with sales tax regulations in Albuquerque?

+

Non-compliance with sales tax regulations can result in significant penalties, including fines, interest charges, and even legal action. It’s crucial for businesses to understand their sales tax obligations and seek professional guidance to ensure compliance.

How often do sales tax rates change in Albuquerque?

+

Sales tax rates can change periodically, often as a result of legislative decisions or economic factors. It’s essential to stay updated on any changes to ensure accurate tax calculation and compliance.

Are there any sales tax holidays in Albuquerque?

+

New Mexico, including Albuquerque, does not observe sales tax holidays. However, there may be specific tax incentives or exemptions for certain industries or transactions.