Parcel Tax

Parcel tax, also known as a special tax or benefit assessment, is a unique and often controversial form of taxation implemented in certain jurisdictions, primarily in the United States. It is a type of ad valorem tax levied on the owners of real property within a defined area, usually to fund specific services or improvements that benefit the community.

This form of taxation has gained attention and sparked debates among policymakers, taxpayers, and economists due to its distinct nature and potential impact on property owners. As we delve into the world of parcel taxes, we will explore its intricacies, understand its mechanisms, and analyze its implications on communities and the economy.

Understanding Parcel Tax

Parcel tax is a type of property-based levy that targets the ownership of land or buildings within a specific geographic boundary, often a municipality or a special district. Unlike general property taxes, which are typically calculated based on the value of the entire property, parcel taxes focus solely on the value of the land. This means that the tax is not influenced by the improvements made to the property, such as the construction of buildings or infrastructure.

The primary purpose of a parcel tax is to generate funds for specific public services or infrastructure projects that directly benefit the taxed community. These services can range from maintaining and improving local schools, parks, and libraries to funding emergency services, transportation infrastructure, or even cultural amenities. By targeting a defined geographic area, parcel taxes ensure that the tax revenue is directly invested in the community's well-being and development.

The Mechanism of Parcel Taxation

The implementation of parcel taxes follows a systematic process, often requiring public support and legislative approval. Here’s a simplified breakdown of how parcel taxes typically come into effect:

- Proposal and Petition: The idea for a parcel tax is usually initiated by a community group, a local government agency, or a special district. They propose the tax to address a specific need or improve a particular service. To move forward with the proposal, a petition is often required, gathering signatures from a significant portion of the affected property owners.

- Public Hearing: Once the petition gains enough support, a public hearing is scheduled. This provides an opportunity for community members to voice their opinions, concerns, and suggestions regarding the proposed tax. It is a crucial step in ensuring transparency and accountability in the decision-making process.

- Ballot Measure: After the public hearing, the proposal is put to a vote, often as a ballot measure during a local election. Property owners within the defined area are given the chance to cast their votes, indicating whether they support or oppose the parcel tax. A majority vote is typically required for the tax to be approved and implemented.

- Implementation and Collection: If the parcel tax is approved, the taxing authority, such as a city or county government, is responsible for implementing the tax. This involves setting the tax rate, determining the assessment methodology, and collecting the tax from property owners. The collected funds are then allocated to the specified services or projects as outlined in the original proposal.

Key Characteristics of Parcel Taxes

Parcel taxes possess several distinctive features that set them apart from other forms of taxation:

- Community-Driven: Parcel taxes are often initiated and supported by the very communities they aim to benefit. This bottom-up approach empowers residents to actively participate in shaping their local services and infrastructure.

- Specific Purpose: Unlike general taxes that contribute to a broad range of governmental activities, parcel taxes are specifically earmarked for a particular service or project. This targeted approach ensures that the tax revenue is directly utilized for the intended purpose.

- Fairness and Equity: Parcel taxes are designed to be fair and equitable. The tax is typically based on the value of the land, which is a more stable and less volatile measure compared to the value of the entire property. This approach aims to distribute the tax burden proportionally among property owners.

- Opt-Out Options: In some jurisdictions, property owners have the option to "opt-out" of a parcel tax if they do not directly benefit from the funded services or improvements. This provision ensures that taxpayers have some control over their financial obligations and can choose to exempt themselves if they feel the tax is not in their best interest.

Real-World Examples of Parcel Taxation

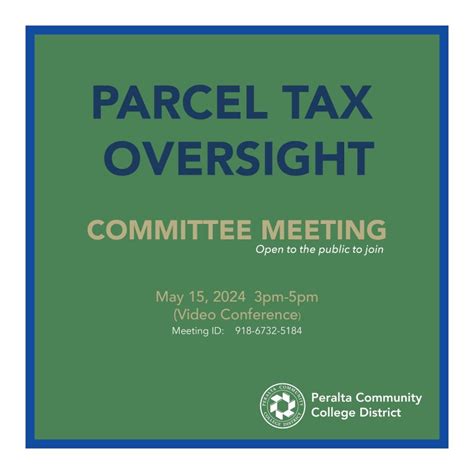

Parcel taxes are implemented in various regions across the United States, each with its unique context and purpose. Here are a few notable examples:

School District Parcel Taxes

Many school districts in California, for instance, rely on parcel taxes to supplement their funding. These taxes are often proposed to enhance educational programs, reduce class sizes, or maintain and upgrade school facilities. One such example is the Berkeley Unified School District’s Measure A, which was approved by voters in 2016 to generate funds for school maintenance, technology upgrades, and staff retention.

Infrastructure and Community Development

In other areas, parcel taxes are used to finance specific infrastructure projects. For example, the City of San Francisco implemented a parcel tax to fund the development of a new central subway line, connecting various neighborhoods and improving public transportation options.

Environmental and Conservation Efforts

Parcel taxes have also been employed to support environmental conservation and open space preservation. In the case of Marin County, California, a parcel tax was approved to fund the acquisition and maintenance of open spaces, ensuring the preservation of natural habitats and recreational areas for the community.

| Case Study | Purpose | Tax Rate |

|---|---|---|

| Berkeley School District (Measure A) | School Maintenance & Technology | $120 per parcel |

| San Francisco Central Subway | Public Transportation Infrastructure | $24 per parcel |

| Marin County Open Spaces | Environmental Conservation | $90 per parcel |

The Impact and Considerations of Parcel Taxes

While parcel taxes can provide much-needed funding for essential services and infrastructure, they also present certain challenges and considerations:

Economic Impact on Property Owners

Parcel taxes add an additional financial burden to property owners, especially those with multiple parcels or larger land holdings. This can lead to concerns about the affordability of ownership and potential impacts on property values. However, supporters argue that the benefits of improved services and infrastructure can outweigh the costs, enhancing the overall desirability and value of the community.

Equity and Progressivity

The fairness of parcel taxes has been a subject of debate. While the tax is based on land value, which is generally more stable than property value, there are still variations in land values within a community. This can result in a disproportionate tax burden on certain property owners. Efforts to ensure progressivity, such as income-based exemptions or sliding-scale tax rates, have been proposed to address this issue.

Community Engagement and Transparency

The success of parcel taxes relies heavily on community engagement and trust. Transparent and inclusive decision-making processes are essential to gain public support and avoid potential controversies. Regular communication and outreach can help educate residents about the proposed tax, its benefits, and how the funds will be utilized.

Alternative Funding Sources

Parcel taxes are not the only means to fund community services and projects. Alternative sources, such as general fund allocations, grants, or bond measures, should also be explored and considered. A balanced approach that combines multiple funding streams can provide stability and reduce the reliance on any single source.

Future Implications and Trends

As communities continue to grapple with the challenges of funding essential services and infrastructure, parcel taxes are likely to remain a relevant and debated topic. Here are some potential future implications and trends:

- Increased Community Involvement: With the rise of digital engagement tools and social media, communities may become even more active in proposing and supporting parcel taxes. This could lead to a greater sense of ownership and investment in local services.

- Expanding Use Cases: Parcel taxes may be explored for a wider range of purposes, such as funding affordable housing initiatives, supporting local businesses, or addressing social equity issues.

- Innovative Funding Models: Communities may experiment with innovative funding models, combining parcel taxes with other sources or creating public-private partnerships to maximize the impact of tax revenue.

- Regional Collaboration: There could be a shift towards regional collaboration, where multiple jurisdictions work together to implement parcel taxes and share the benefits across a broader geographic area.

Conclusion

Parcel taxes represent a unique and powerful tool for communities to take control of their future and fund specific initiatives that enhance their well-being. While they present certain challenges and considerations, the potential benefits of improved services and infrastructure cannot be overlooked. As communities continue to evolve and face new challenges, the role of parcel taxes will undoubtedly remain a topic of discussion and exploration.

How are parcel taxes different from regular property taxes?

+Parcel taxes differ from regular property taxes in their scope and purpose. Regular property taxes are typically broader in nature, funding a range of governmental activities and services. In contrast, parcel taxes are targeted and specific, designed to fund particular services or projects that directly benefit the taxed community.

Can property owners opt-out of parcel taxes if they don’t benefit from the funded services?

+In some jurisdictions, property owners have the option to “opt-out” of a parcel tax if they can demonstrate that they do not directly benefit from the funded services or improvements. However, the opt-out provisions vary across different regions, and some areas may not offer this option at all.

How are parcel taxes assessed and collected?

+Parcel taxes are assessed based on the value of the land, not the entire property. The taxing authority sets the tax rate, determines the assessment methodology, and collects the tax from property owners. The collected funds are then allocated to the specified services or projects as outlined in the original proposal.