Illinois Income Tax 1040Sr

For Illinois residents, understanding the intricacies of the state's income tax system is essential for accurate filing and optimizing returns. The Illinois Income Tax Form 1040Sr is a critical component of this process, offering specific benefits and considerations for certain taxpayers. This article aims to provide a comprehensive guide to the 1040Sr, exploring its purpose, eligibility criteria, and the impact it can have on your financial planning.

Unveiling the Illinois Income Tax Form 1040Sr

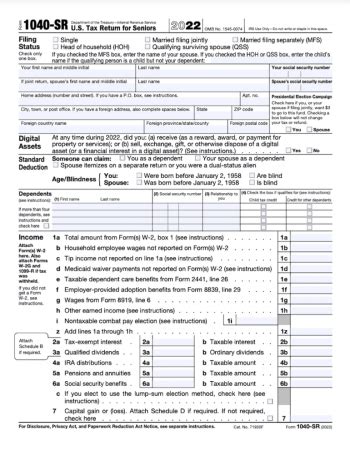

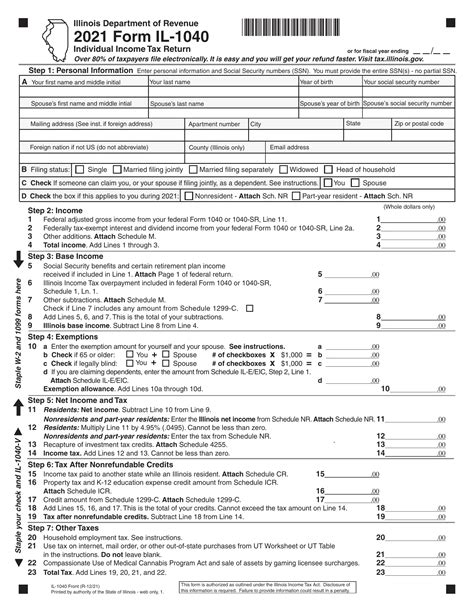

The 1040Sr is a unique tax form designed specifically for senior residents of Illinois, providing a simplified and tailored approach to filing income taxes. It offers a more straightforward process for individuals aged 65 and above, catering to their specific financial circumstances and needs. This form is a testament to the state’s recognition of the diverse financial landscapes that exist among its taxpayers.

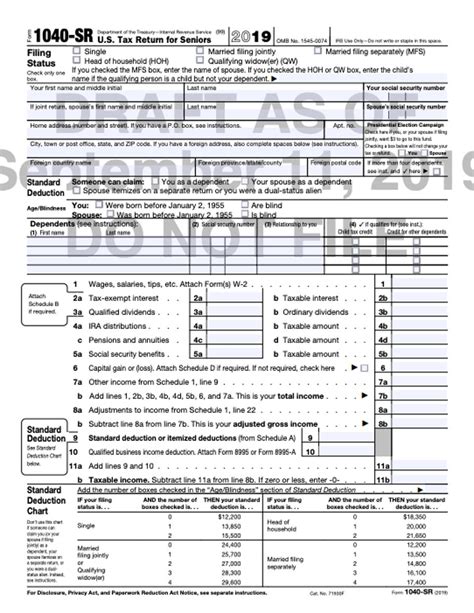

The 1040Sr stands out as a specialized tax form, differing significantly from the standard 1040. While the latter is a comprehensive form suitable for all taxpayers, the 1040Sr is a focused, streamlined version designed to ease the tax filing process for seniors. This form considers the unique financial aspects of retirement, such as pension income, Social Security benefits, and retirement savings, making it a valuable tool for seniors to navigate their tax obligations effectively.

Eligibility Criteria and Key Benefits

To be eligible for the 1040Sr, taxpayers must meet certain criteria. Firstly, they must be residents of Illinois, as the form is state-specific. Additionally, taxpayers must be aged 65 or older as of the end of the tax year for which they are filing. This age criterion is a critical factor in determining eligibility for the simplified form.

One of the key benefits of the 1040Sr is its simplicity. The form is designed with clear and concise instructions, making it user-friendly for seniors who may not be as familiar with complex tax regulations. It streamlines the filing process, reducing the potential for errors and confusion. Moreover, the 1040Sr often results in a lower tax liability for eligible seniors due to the specific deductions and credits it allows, such as the Senior Citizens Real Estate Tax Credit and the Property Tax Credit.

| Eligibility Criterion | Description |

|---|---|

| Age | 65 years or older as of the tax year end. |

| Residency | Must be a resident of Illinois. |

| Filing Status | Singles, married filing jointly, or head of household. |

Deductions and Credits Unique to the 1040Sr

The 1040Sr offers several deductions and credits that are exclusive to this form. For instance, eligible taxpayers can claim a deduction for up to 10,000 in pension or annuity income, which is a significant benefit for seniors relying on these sources of income. Additionally, the Senior Citizens Real Estate Tax Credit provides a credit of up to 500 for real estate taxes paid, further reducing the tax burden for homeowners aged 65 and above.

Furthermore, the 1040Sr allows for a deduction of up to $6,000 for Social Security benefits received. This is particularly advantageous for seniors who rely heavily on Social Security as their primary source of income during retirement. By taking advantage of these deductions and credits, eligible taxpayers can significantly reduce their taxable income, resulting in a more favorable tax outcome.

Filing Process and Tips

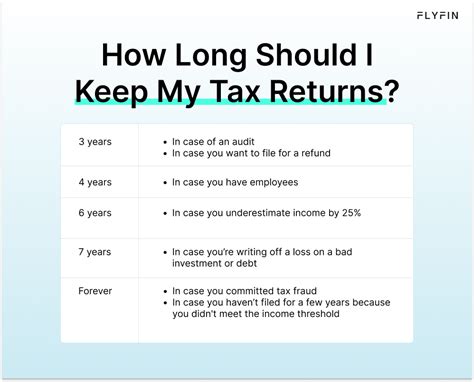

The filing process for the 1040Sr is straightforward but requires attention to detail. Taxpayers should gather all relevant financial documents, including pension statements, Social Security benefit letters, and real estate tax bills. It’s advisable to keep these documents organized to streamline the filing process.

When completing the 1040Sr, taxpayers should carefully review the instructions provided with the form. While the form is designed for simplicity, there may be nuances that require attention, such as calculating the correct amount for deductions and credits. It's beneficial to seek guidance from a tax professional or utilize tax preparation software that is familiar with the specific requirements of the 1040Sr.

Potential Challenges and Considerations

Despite its benefits, the 1040Sr does come with a few considerations. One of the primary challenges is understanding the eligibility criteria. While the age criterion is straightforward, the residency requirement can be more complex, especially for seniors who may have moved or have multiple residences. It’s essential to clarify residency status to ensure eligibility for the form.

Another consideration is the potential for over-simplification. While the 1040Sr is designed to be user-friendly, it may not capture all the financial complexities that some seniors may face. For instance, seniors with complex investment portfolios or business income may find that the 1040Sr does not adequately address their specific tax needs. In such cases, consulting a tax professional is advisable to ensure all relevant income and deductions are considered.

Strategic Financial Planning for Optimal Tax Outcomes

Maximizing the benefits of the 1040Sr often involves strategic financial planning. Taxpayers can work with financial advisors to structure their income and investments in a way that optimizes their tax position. This may involve timing the receipt of certain types of income, such as capital gains or pension distributions, to align with the most beneficial tax year.

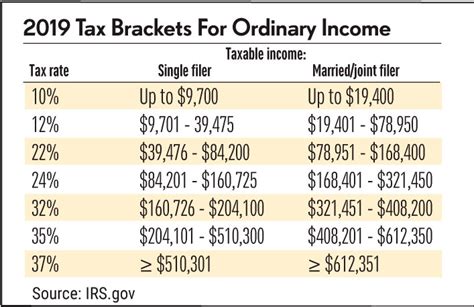

Additionally, understanding the interplay between federal and state tax laws is crucial. While the 1040Sr provides specific benefits at the state level, taxpayers must also consider their federal tax obligations. For instance, pension income may be subject to federal tax, so coordinating federal and state tax planning is essential to avoid surprises at filing time.

Conclusion: The 1040Sr as a Financial Tool for Seniors

The Illinois Income Tax Form 1040Sr is a powerful tool for seniors to manage their tax obligations effectively. By understanding the eligibility criteria, unique deductions, and strategic planning opportunities, seniors can navigate the tax landscape with confidence. While the form simplifies the filing process, it also requires a nuanced understanding of financial circumstances to maximize its benefits.

For seniors looking to optimize their tax position, the 1040Sr offers a tailored solution. Combined with expert financial advice, it can be a cornerstone of a comprehensive financial plan, ensuring seniors can make the most of their retirement years.

What are the income limits for eligibility for the 1040Sr form?

+

There are no specific income limits for eligibility. The key criterion is the taxpayer’s age (65 or older) and residency in Illinois.

Can I file jointly with my spouse if I’m eligible for the 1040Sr, and they’re not eligible?

+

Yes, you can file jointly with your spouse, even if they are not eligible for the 1040Sr. In such cases, you would use the standard 1040 form.

Are there any disadvantages to using the 1040Sr form?

+

While the 1040Sr offers benefits for eligible taxpayers, it may not capture all potential deductions or credits available on the standard 1040 form. It’s essential to consider your unique financial circumstances to determine if the 1040Sr is the best option.

Can I e-file my 1040Sr return?

+

Yes, the 1040Sr can be e-filed through various tax preparation software or services. However, ensure the software you choose is compatible with the form and can accurately calculate your deductions and credits.