Ky Sales Tax

When it comes to understanding sales tax in the state of Kentucky, it's important to delve into the specifics to ensure compliance and accurate financial planning. Kentucky, like many other states, has its own unique set of sales tax regulations, which can impact businesses and consumers alike. This comprehensive guide will explore the intricacies of Kentucky sales tax, providing valuable insights and practical information.

Unraveling Kentucky Sales Tax: A Comprehensive Guide

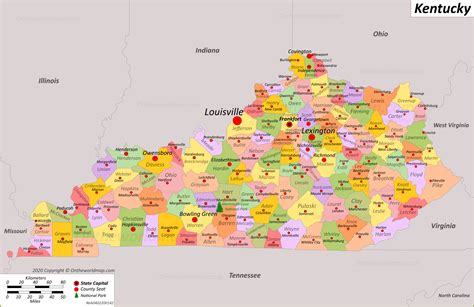

Kentucky’s sales tax structure is a vital aspect of the state’s economy, influencing various industries and consumers’ purchasing decisions. With a general sales and use tax rate of 6%, Kentucky stands out for its straightforward approach to taxation. However, the story doesn’t end there; there are local and special taxes to consider, which can add up and impact businesses significantly.

For instance, Louisville, Kentucky's largest city, imposes a 2.8% sales tax on top of the state rate, bringing the total to 8.8%. This additional tax, known as the "Transit Authority Tax," is allocated towards funding the city's transit system. It's just one example of how local taxes can vary and add complexity to the sales tax landscape.

Navigating Kentucky’s Sales Tax: A Detailed Breakdown

Diving deeper into Kentucky’s sales tax structure reveals a nuanced system that requires careful consideration. While the 6% state sales tax is consistent across Kentucky, local jurisdictions have the authority to impose additional taxes, leading to variations in rates across the state. These local taxes can be as high as 6%, creating a combined rate of 12% in certain areas.

To illustrate, let's examine the city of Lexington, where a 2% local option sales tax is applied, resulting in a total sales tax rate of 8%. This tax, known as the "Lexington-Fayette Urban County Government Tax," funds various municipal projects and services. It serves as a prime example of how local taxes can impact the overall sales tax burden for both businesses and consumers.

| Location | State Sales Tax Rate | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Louisville | 6% | 2.8% | 8.8% |

| Lexington | 6% | 2% | 8% |

| Bowling Green | 6% | 3% | 9% |

| Owensboro | 6% | 2% | 8% |

| Covington | 6% | 2% | 8% |

These variations in local sales tax rates highlight the importance of understanding the specific tax landscape within each Kentucky community. For businesses operating in multiple locations, this can pose a significant challenge in terms of tax compliance and administration.

Exemptions and Special Considerations in Kentucky Sales Tax

Kentucky’s sales tax system is not limited to standard rates; it also encompasses a range of exemptions and special considerations. Understanding these nuances is crucial for businesses and consumers alike to navigate the tax landscape effectively.

One notable exemption in Kentucky is the absence of sales tax on groceries. This exemption is a welcome relief for consumers, as it significantly reduces the tax burden on essential food items. However, it's important to note that this exemption does not extend to all food products; prepared foods and certain luxury items are still subject to sales tax.

Additionally, Kentucky offers tax incentives for specific industries and sectors. For instance, the state provides tax credits for businesses involved in manufacturing and technology-related activities. These incentives aim to foster economic growth and attract businesses to the state. It's an important aspect for businesses to consider when evaluating their tax obligations and potential savings.

The Impact of Kentucky Sales Tax on Businesses and Consumers

The sales tax structure in Kentucky has a profound impact on both businesses and consumers. For businesses, especially those with a physical presence in the state, the varying tax rates and local considerations can pose challenges in terms of pricing, tax compliance, and administrative overhead.

Consider a business operating in multiple Kentucky cities, each with its own unique sales tax rate. This business would need to ensure accurate pricing across all locations, taking into account the different tax rates. Moreover, it would need robust systems in place to manage tax compliance, reporting, and remittance, adding to the operational complexity.

From a consumer perspective, the varying sales tax rates can impact purchasing decisions and budget planning. Consumers in areas with higher sales tax rates may opt to shop online or in neighboring jurisdictions with lower tax rates, leading to potential revenue losses for local businesses. It's a delicate balance that influences consumer behavior and local economies.

Kentucky Sales Tax: A Look into the Future

As Kentucky continues to evolve economically, the sales tax landscape is likely to undergo changes and adaptations. The state’s focus on economic development and the need to generate revenue for essential services may drive future tax reforms and adjustments.

One potential area of reform could be the simplification of the sales tax system. Currently, with varying local tax rates, the system can be complex for businesses and consumers to navigate. Streamlining the tax structure, perhaps by reducing the number of local taxes or implementing a uniform state-wide rate, could enhance transparency and ease compliance.

Additionally, as e-commerce continues to grow, Kentucky may need to address the challenge of collecting sales tax on online transactions. This could involve implementing new regulations or leveraging technology to ensure fair taxation and level the playing field between online and brick-and-mortar businesses.

In conclusion, understanding Kentucky sales tax is crucial for businesses and consumers alike. With its unique structure, exemptions, and local variations, it requires careful consideration and ongoing monitoring. By staying informed and adapting to changes, businesses can ensure compliance and optimize their tax strategies, while consumers can make informed purchasing decisions.

What is the current sales tax rate in Kentucky?

+The current sales tax rate in Kentucky is 6% at the state level. However, local jurisdictions may impose additional taxes, resulting in variations across the state.

Are there any special sales tax rates for specific industries in Kentucky?

+Yes, Kentucky offers tax incentives for certain industries, such as manufacturing and technology-related businesses. These incentives can include tax credits and reduced tax rates.

How often are sales tax rates updated in Kentucky?

+Sales tax rates in Kentucky are subject to change and are typically updated annually or as needed to align with economic and legislative developments.

Are there any sales tax exemptions in Kentucky?

+Yes, Kentucky has various sales tax exemptions, including a notable exemption for groceries. However, certain food items, such as prepared foods, may still be subject to sales tax.