Athens Clarke County Tax Office

Welcome to a comprehensive guide on the Athens-Clarke County Tax Office, a vital institution within the vibrant community of Athens, Georgia. This article aims to delve into the intricate workings of this tax office, shedding light on its services, operations, and the impact it has on the local economy and residents.

Athens-Clarke County Tax Office: A Pillar of Local Governance

The Athens-Clarke County Tax Office is a critical component of the county’s administrative landscape, responsible for a wide array of functions that directly affect the daily lives of its residents. From property assessments to tax collection, this office plays a pivotal role in maintaining the financial health of the community.

Services and Operations

The Tax Office offers a range of services to ensure the smooth functioning of Athens-Clarke County’s financial affairs. These include:

- Property Tax Assessments: The office conducts thorough assessments of properties within the county to determine their fair market value. This data is crucial for establishing property tax rates and ensuring equitable taxation.

- Tax Collection: It is responsible for collecting various taxes, including property taxes, vehicle taxes, and other relevant levies. Efficient tax collection ensures the county’s ability to fund essential services and infrastructure projects.

- Taxpayer Assistance: The office provides assistance to taxpayers, offering guidance on tax payment methods, tax exemptions, and resolving any queries or concerns related to taxation.

- Online Services: Recognizing the digital age, the Athens-Clarke County Tax Office has embraced technology, offering online platforms for taxpayers to access information, make payments, and manage their tax accounts.

The Tax Office operates with a team of dedicated professionals, including assessors, tax collectors, and support staff, who work tirelessly to ensure the accuracy and efficiency of their operations.

Impact on the Community

The influence of the Athens-Clarke County Tax Office extends far beyond its administrative functions. Here are some key ways it impacts the local community:

- Funding Public Services: The taxes collected by the office are a primary source of revenue for the county. This funding supports a wide range of public services, including education, healthcare, public safety, and infrastructure development.

- Economic Stability: By ensuring a fair and efficient tax system, the Tax Office contributes to the overall economic stability of the region. This stability attracts businesses and fosters economic growth, benefiting residents through job opportunities and improved living standards.

- Community Engagement: The office often hosts community events and workshops to educate residents about taxation, provide updates on tax policies, and address concerns. These initiatives foster a sense of community involvement and transparency.

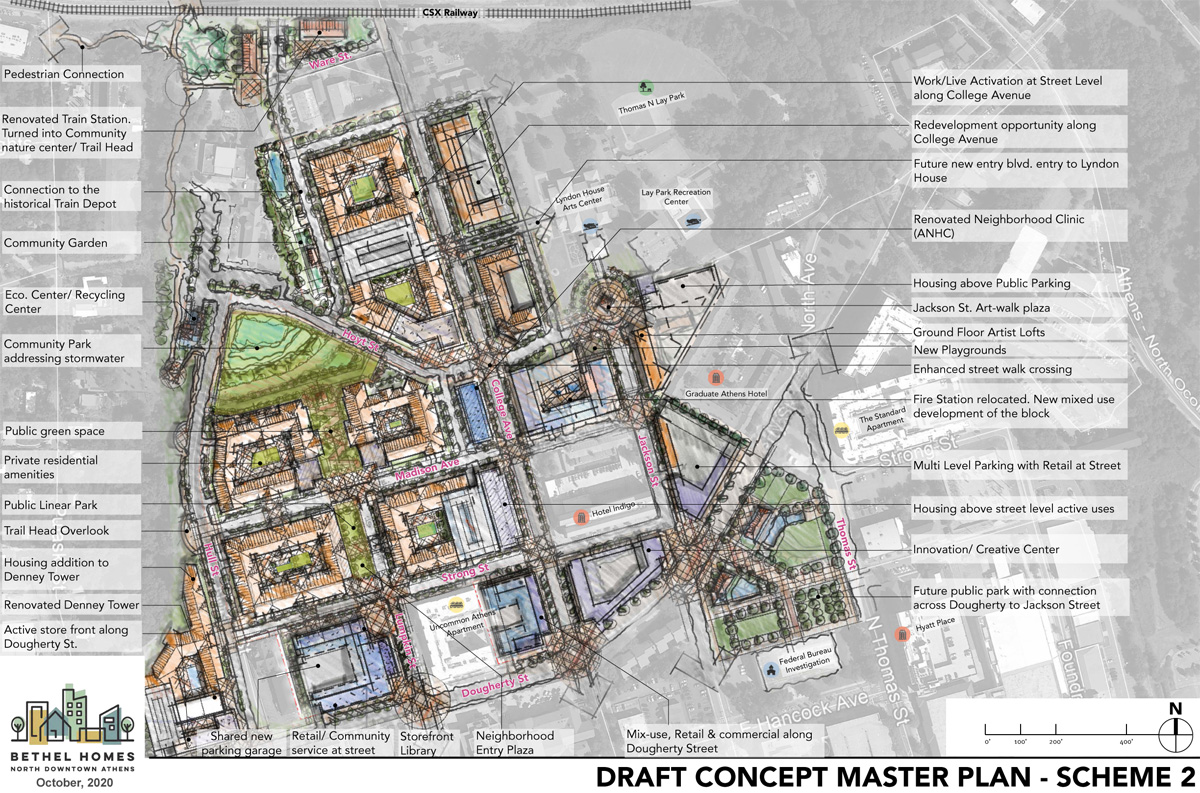

- Property Development: Accurate property assessments by the Tax Office encourage property development and renovation. This, in turn, leads to increased property values, improved aesthetics, and a boost in the local real estate market.

A Look at Key Metrics

To provide a deeper understanding of the Athens-Clarke County Tax Office’s operations, let’s examine some key metrics:

| Metric | Value |

|---|---|

| Total Property Tax Collection | $245 million (as of FY 2022) |

| Number of Taxpayer Accounts | Over 45,000 |

| Average Property Tax Rate | 10.25 mills |

| Online Payment Transactions | 25,000+ per year |

| Community Outreach Events | 4-6 annually |

Future Prospects and Innovations

As Athens-Clarke County continues to evolve, the Tax Office is poised to embrace new technologies and initiatives to enhance its services. Here’s a glimpse into the future:

- AI Integration: The office is exploring the use of Artificial Intelligence to further automate processes, enhance data accuracy, and improve overall operational efficiency.

- Mobile Apps: Developing user-friendly mobile applications to provide taxpayers with convenient access to their tax information and services is a priority.

- Property Tax Incentives: The Tax Office is considering implementing incentives to encourage property development and renewable energy adoption, fostering a greener and more sustainable community.

Conclusion

The Athens-Clarke County Tax Office stands as a testament to effective local governance, ensuring the financial stability and prosperity of the community. Through its dedicated services and commitment to innovation, it continues to shape the future of Athens-Clarke County, one tax assessment at a time.

How can I pay my property taxes in Athens-Clarke County?

+You can pay your property taxes through the Athens-Clarke County Tax Office’s online portal, by mail, or in person at their office. The office accepts various payment methods, including credit cards, e-checks, and cash.

What happens if I miss the property tax deadline?

+Late payment of property taxes may incur penalties and interest. It’s important to note that the Tax Office offers payment plans for eligible taxpayers to help manage their tax obligations.

Can I appeal my property tax assessment?

+Yes, Athens-Clarke County taxpayers have the right to appeal their property tax assessments. The Tax Office provides guidance on the appeal process and the necessary steps to follow.

How often are property tax assessments conducted?

+Property tax assessments are typically conducted every three years in Athens-Clarke County. However, certain circumstances, such as property renovations or sales, may trigger a reassessment.