Wv My Taxes

In the United States, the process of paying taxes is an essential civic duty that every individual and business must fulfill. The Internal Revenue Service (IRS) is the federal agency responsible for collecting taxes and enforcing tax laws. Understanding how to navigate the tax system and comply with tax regulations is crucial for maintaining financial stability and avoiding legal consequences.

This comprehensive guide aims to provide an in-depth exploration of the tax system, offering valuable insights into the why, how, and when of paying taxes. By delving into the intricacies of tax payments, we aim to empower individuals and businesses with the knowledge and tools necessary to navigate this complex yet essential process.

The Importance of Tax Payments

Taxes play a vital role in the functioning of a society and its economy. They are the primary source of revenue for governments, enabling them to fund essential services and infrastructure. Here are some key reasons why tax payments are crucial:

- Funding Public Services: Taxes support the provision of public goods and services such as education, healthcare, national defense, social welfare programs, and transportation infrastructure.

- Economic Stability: Proper tax collection helps maintain economic stability by controlling inflation, stimulating economic growth, and reducing income inequality.

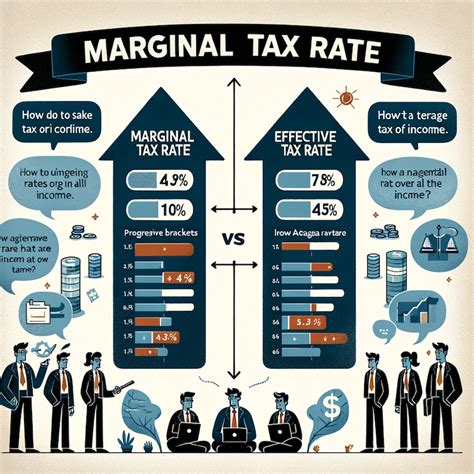

- Social Equity: Progressive tax systems ensure that individuals and entities with higher incomes contribute a larger share of their earnings to the public purse, promoting social justice and fairness.

- Infrastructure Development: Taxes fund the construction and maintenance of roads, bridges, public transportation systems, and other critical infrastructure projects.

- Environmental Initiatives: Taxes can be used to support environmental conservation efforts, promote sustainable practices, and address climate change.

Understanding the importance of taxes not only highlights our civic duty but also emphasizes the role of taxpayers in shaping the future of their communities and the nation as a whole.

Tax Payment Process: A Step-by-Step Guide

Navigating the tax payment process can seem daunting, but breaking it down into simple steps can make it more manageable. Here’s a comprehensive guide to help you through the process:

Step 1: Determine Your Tax Liability

The first step in the tax payment process is understanding your tax liability. This involves calculating the amount of tax you owe based on your income, deductions, and tax credits. Here are some key considerations:

- Income Sources: Identify all sources of income, including wages, salaries, business profits, interest, dividends, and capital gains.

- Deductions and Credits: Research and claim all eligible deductions and tax credits to reduce your taxable income and lower your tax liability. This includes deductions for medical expenses, charitable donations, and certain business expenses.

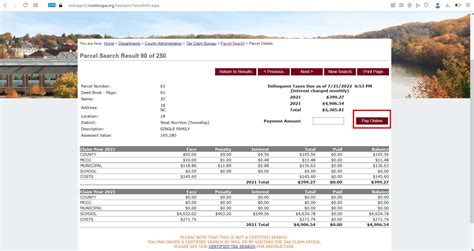

- Tax Rates and Brackets: Familiarize yourself with the applicable tax rates and brackets for your filing status. The IRS provides tax tables and worksheets to help calculate your tax liability.

- Filing Status: Choose the appropriate filing status (single, married filing jointly, married filing separately, head of household, etc.) based on your marital status and household composition.

By accurately determining your tax liability, you can ensure that you are paying the correct amount of taxes and taking advantage of all available deductions and credits.

Step 2: Gather Necessary Documents

To prepare your tax return, you’ll need to gather various documents and records. Here’s a checklist of essential documents to have on hand:

- W-2 Forms: If you’re an employee, you’ll receive a W-2 form from your employer(s) detailing your wages, salaries, and taxes withheld.

- 1099 Forms: If you received income from freelance work, investments, or other sources, you’ll receive 1099 forms detailing these earnings.

- Records of Income: Keep track of all income sources, including bank statements, investment statements, and records of any other income.

- Deduction Documentation: Gather receipts, invoices, and records to support any deductions you plan to claim, such as medical expenses, charitable donations, or business expenses.

- Previous Year’s Tax Return: Review your previous year’s tax return to identify any changes in your financial situation or deductions.

Organizing and maintaining these documents will streamline the tax preparation process and ensure accuracy.

Step 3: Choose Your Filing Method

The IRS offers several methods for filing your tax return. Choose the method that best suits your needs and preferences:

- Paper Filing: If you prefer a traditional approach, you can file your tax return by mailing a completed paper form to the IRS. This method may be more time-consuming and requires careful attention to detail.

- Electronic Filing (e-Filing): The IRS encourages taxpayers to file their returns electronically, as it is faster, more secure, and reduces errors. You can use tax preparation software or file directly through the IRS website.

- Professional Assistance: Consider seeking the help of a tax professional, especially if you have a complex tax situation or prefer personalized guidance. Tax professionals can assist with tax planning, preparation, and filing.

Regardless of the method you choose, ensure that you file your tax return by the deadline to avoid penalties and interest.

Step 4: Prepare and File Your Tax Return

Now it’s time to prepare and file your tax return. Follow these steps:

- Choose the appropriate tax form based on your filing status and income level. The most common forms are the 1040, 1040A, and 1040EZ.

- Complete the form accurately, providing all necessary information and supporting documentation.

- Calculate your tax liability and any tax payments or refunds due.

- Sign and date your tax return, ensuring that all information is correct and complete.

- If you owe taxes, make the necessary payment by the deadline. You can pay online, by mail, or through a tax preparation service.

- If you are expecting a refund, the IRS will process your return and issue the refund accordingly.

It's important to double-check your tax return for accuracy before filing to avoid any potential errors or delays.

Step 5: Stay Informed and Plan Ahead

Tax laws and regulations can change from year to year, so it’s essential to stay informed about any updates that may impact your tax situation. Here are some tips for staying informed and planning ahead:

- Subscribe to IRS updates and notifications to receive important tax-related information and reminders.

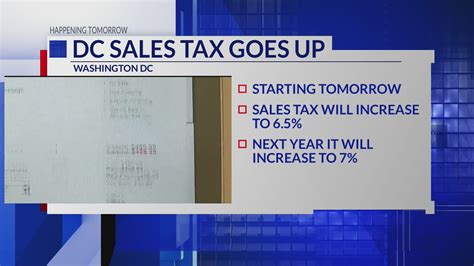

- Research tax changes and new tax laws that may affect your deductions, credits, or tax liability.

- Consider tax planning strategies to optimize your tax situation and minimize your tax burden.

- Keep track of important tax deadlines, including the filing deadline, estimated tax payment deadlines, and any other relevant dates.

- Review your financial situation and make necessary adjustments to ensure you’re on track with your tax obligations.

By staying informed and planning ahead, you can navigate the tax system more effectively and ensure compliance with the latest tax regulations.

Common Tax-Related Questions and Concerns

Navigating the tax system can raise various questions and concerns. Here are some frequently asked questions (FAQs) and their answers to provide clarity and guidance:

What happens if I don't file my taxes on time?

+If you miss the tax filing deadline, you may be subject to penalties and interest. The IRS may charge a late filing penalty of 5% of the unpaid taxes for each month (or part of a month) your return is late, up to a maximum of 25%. Additionally, you may owe interest on any unpaid taxes. It's important to file your tax return as soon as possible to minimize these penalties and interest charges.

Can I claim deductions for personal expenses?

+Generally, personal expenses are not deductible. However, there are certain exceptions, such as medical expenses, charitable donations, and certain business-related expenses. It's important to consult the IRS guidelines or seek professional advice to determine which expenses are eligible for deductions.

What if I disagree with my tax assessment?

+If you disagree with your tax assessment, you have the right to dispute it. You can request a review of your tax return and provide additional information or documentation to support your case. The IRS has a process for resolving disputes, including informal conferences and formal appeals. It's important to act promptly and follow the proper procedures to resolve any disagreements.

How do I handle tax issues related to business ownership?

+As a business owner, you have unique tax obligations and considerations. It's essential to consult with a tax professional who specializes in business taxes. They can guide you through the complex world of business taxes, including filing requirements, deductions, and tax planning strategies specific to your business structure and industry.

Are there any tax breaks or incentives for certain industries or professions?

+Yes, the IRS offers various tax breaks and incentives for specific industries and professions. These can include tax credits for research and development, energy-efficient improvements, and certain business expenses. It's important to stay informed about these incentives and consult with a tax professional to determine which ones may apply to your situation.

Remember, tax laws can be complex, and it's always a good idea to seek professional advice when navigating tax-related matters. The IRS website and tax professionals are valuable resources for obtaining accurate and up-to-date information.

Conclusion

Paying taxes is an essential responsibility for all taxpayers. By understanding the importance of tax payments and following the step-by-step guide outlined above, individuals and businesses can navigate the tax system with confidence. Remember to stay informed about tax laws, plan ahead, and seek professional guidance when needed. With a proactive approach to tax compliance, you can ensure a smooth and stress-free tax experience while contributing to the well-being of your community and the nation.

For further assistance and in-depth information, explore the IRS website and consider consulting with tax professionals who can provide personalized advice tailored to your specific circumstances.