Marion Tax Collector

Welcome to an in-depth exploration of the role of the Marion Tax Collector, an essential figure in the realm of public finance and community governance. This article aims to delve into the intricacies of their responsibilities, impact, and the broader implications of their work on the local economy and society. As an integral part of the administrative machinery, the Tax Collector's office is a pivotal point of interaction between the government and its citizens, often influencing the very fabric of community life.

The Marion Tax Collector: A Pillar of Local Governance

The Marion Tax Collector is a key official in the county of Marion, Florida, tasked with a critical role in the local government’s financial operations. This position, often overlooked by many, plays a pivotal role in the smooth functioning of the community’s economic ecosystem. From property taxes to vehicle registrations, the Tax Collector’s office is a one-stop shop for various financial obligations and services, contributing significantly to the county’s overall fiscal health.

A Day in the Life of a Tax Collector

The typical day of a Marion Tax Collector is filled with a multitude of responsibilities, each crucial to the county’s administrative processes. From overseeing the collection of property taxes, which form a significant portion of the county’s revenue, to managing the registration and titling of vehicles, the Tax Collector’s office is a bustling hub of activity. Here’s a glimpse into some of their daily tasks:

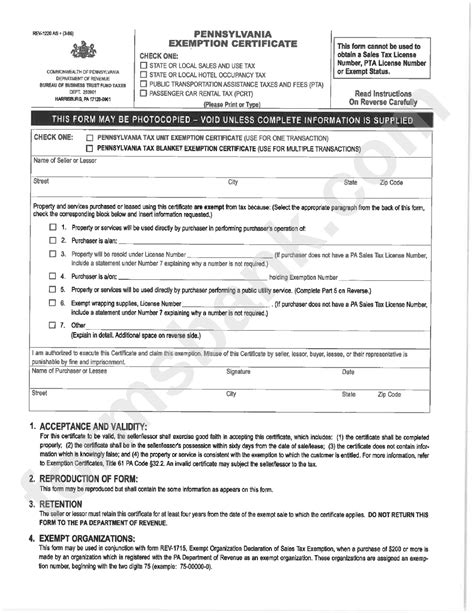

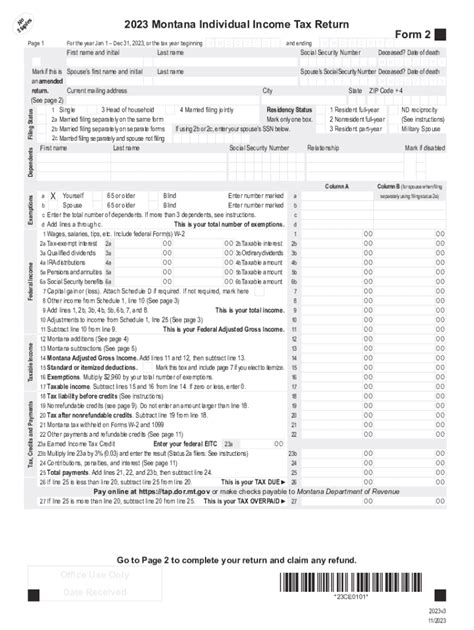

- Tax Assessment and Collection: The primary responsibility involves assessing property values and collecting property taxes. This includes ensuring that the correct tax rates are applied, issuing tax notices, and collecting payments from property owners.

- Vehicle Registration and Titling: Another vital aspect of their job is managing vehicle registrations and titles. This entails processing applications, issuing registration stickers, and maintaining accurate records of vehicle ownership and details.

- Issuing Driver Licenses: The Tax Collector's office often handles driver license issuance, renewal, and replacement. This service is crucial for the community, ensuring that residents can obtain or renew their licenses conveniently.

- Managing Special Taxes and Fees: Depending on local regulations, the Tax Collector may also be responsible for collecting special taxes, such as tourist development taxes or environmental impact fees.

- Providing Public Assistance: Tax Collectors' offices often serve as a source of information and assistance for residents. This can include helping taxpayers understand their bills, providing forms and applications, and offering guidance on payment plans or exemptions.

The work of the Marion Tax Collector extends beyond these tasks, encompassing a wide range of financial and administrative duties. Their office is a vital link between the government and the community, facilitating the smooth flow of financial transactions and ensuring the efficient functioning of the local economy.

Impact and Significance of the Tax Collector’s Role

The influence of the Marion Tax Collector extends far beyond the confines of their office. Their work has a profound impact on the local community, shaping the economic landscape and influencing the overall well-being of residents. Here’s a deeper look at the significance of their role:

Economic Development and Fiscal Health

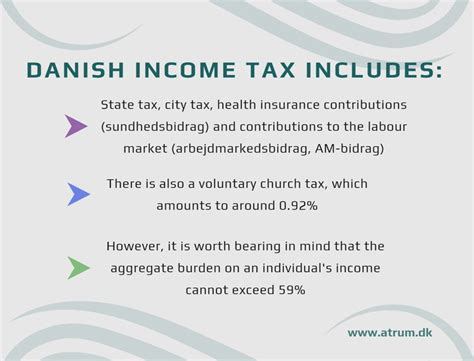

The Tax Collector’s office plays a pivotal role in the county’s economic development and fiscal stability. By efficiently collecting property taxes, vehicle registration fees, and other levies, they ensure a steady stream of revenue for the local government. This revenue is crucial for funding essential services like education, healthcare, infrastructure development, and public safety. The effective management of these financial obligations contributes significantly to the county’s fiscal health, enabling it to invest in community growth and improvement.

| Tax Type | Revenue Generated |

|---|---|

| Property Taxes | $[X] million annually |

| Vehicle Registration Fees | $[Y] million annually |

| Special Taxes and Fees | $[Z] million annually |

Community Engagement and Outreach

The Tax Collector’s office serves as a vital point of contact between the government and the community. They provide a range of services that are integral to residents’ daily lives, from driver license issuance to property tax payment assistance. This direct interaction fosters a sense of community engagement and trust in local governance. The office’s proactive outreach initiatives, such as tax relief programs or educational campaigns, further strengthen the bond between the government and its citizens.

Equitable Tax Administration

A critical aspect of the Tax Collector’s role is ensuring equitable tax administration. They are responsible for implementing fair and transparent tax policies, ensuring that all taxpayers are treated equally and that the tax burden is distributed fairly. This involves regular reviews of tax assessment processes, ensuring compliance with legal requirements, and offering support to taxpayers facing financial difficulties.

Challenges and Future Prospects

While the Marion Tax Collector’s role is critical, it is not without its challenges. From navigating complex tax laws to keeping up with technological advancements, the job demands a high level of expertise and adaptability. As the county’s population grows and the economic landscape evolves, the Tax Collector’s office faces new challenges and opportunities.

Technological Advancements and Digital Transformation

The Tax Collector’s office is increasingly adopting digital technologies to enhance efficiency and improve taxpayer services. Online platforms for tax payments, vehicle registration renewals, and driver license applications are becoming more prevalent. These digital tools not only streamline processes but also offer greater convenience and accessibility to taxpayers.

However, the digital transformation also presents challenges, particularly in ensuring that all segments of the community have equal access to these services. The Tax Collector's office must work towards digital inclusion, providing alternative methods of service delivery for those without internet access or digital literacy skills.

Community Engagement and Transparency

Building and maintaining trust with the community is a continuous challenge for the Tax Collector’s office. They must actively engage with residents, listen to their concerns, and provide clear and transparent communication about tax policies and procedures. Regular community outreach programs, town hall meetings, and educational workshops can help bridge the gap between the government and taxpayers.

Future Opportunities and Innovations

Looking ahead, the Marion Tax Collector’s office has the potential to leverage emerging technologies and innovative practices to enhance its services. Artificial intelligence (AI) and machine learning can be utilized for more accurate tax assessments and efficient data management. Blockchain technology could be explored for secure and transparent record-keeping, particularly for land and property transactions.

Additionally, the Tax Collector's office can explore partnerships with local businesses and organizations to promote economic development and community initiatives. By collaborating with local chambers of commerce, educational institutions, and community groups, they can contribute to the overall well-being and prosperity of the county.

Conclusion: The Marion Tax Collector’s Vital Role

The Marion Tax Collector stands as a critical pillar of local governance, playing a pivotal role in the economic and social well-being of the community. Their work extends beyond financial transactions, influencing the very fabric of community life. From ensuring the county’s fiscal health to fostering community engagement and equitable tax administration, the Tax Collector’s office is an indispensable part of the administrative machinery.

As the county of Marion continues to grow and evolve, the role of the Tax Collector will remain essential, adapting to new challenges and opportunities. By embracing technological advancements, prioritizing community engagement, and striving for equitable tax administration, the Tax Collector's office will continue to serve as a trusted partner in the community's development and prosperity.

What is the primary function of the Marion Tax Collector’s office?

+The primary function of the Marion Tax Collector’s office is to collect various taxes and fees, including property taxes and vehicle registration fees, which contribute significantly to the county’s revenue. They also provide essential services like issuing driver licenses and offering public assistance to taxpayers.

How does the Tax Collector’s office impact the local community?

+The Tax Collector’s office has a profound impact on the local community by ensuring the county’s fiscal health, which in turn funds essential services like education and public safety. They also serve as a vital point of contact between the government and residents, fostering community engagement and trust.

What are some of the challenges faced by the Tax Collector’s office?

+The Tax Collector’s office faces challenges such as keeping up with complex tax laws, adapting to technological advancements, and ensuring equitable tax administration. They must also work towards digital inclusion and maintain open communication with the community to build trust.