Tax Stamp For A Suppressor

The acquisition and use of a suppressor, commonly known as a silencer, is a unique and often misunderstood aspect of firearms ownership. One of the most critical aspects of owning a suppressor is understanding the tax stamp process, a mandatory requirement by the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) in the United States. This article aims to provide a comprehensive guide to the tax stamp process for a suppressor, offering valuable insights and practical steps to navigate this essential legal procedure.

Understanding the Suppressors and the ATF Regulations

Suppressors, or silencers, are devices attached to firearms that reduce the sound and muzzle flash when a gun is fired. They are designed to mitigate the loud noise associated with discharging a firearm, making it more comfortable for the shooter and those nearby. However, due to their nature and potential for misuse, suppressors are classified as Title II Firearms by the ATF, which means they are subject to more stringent regulations and requirements.

The ATF, a federal law enforcement agency within the United States Department of Justice, is responsible for enforcing federal laws related to firearms, tobacco, and alcohol products. They regulate the manufacture, importation, and distribution of firearms and ammunition. In the context of suppressors, the ATF plays a crucial role in overseeing the tax stamp process, ensuring that all legal requirements are met by individuals seeking to purchase and possess these devices.

The Legal Status of Suppressors

The legal status of suppressors varies across different jurisdictions. In the United States, suppressors are legal in most states, but they are subject to varying degrees of regulation. Some states have stricter laws, requiring additional permits or background checks, while others have more relaxed regulations. It’s essential to be aware of the laws in your specific state and locality to ensure compliance.

Internationally, the legal status of suppressors also varies widely. Some countries, like Sweden and Finland, have more liberal laws, allowing suppressors to be owned and used without extensive restrictions. In contrast, countries like the United Kingdom and Australia have stricter regulations, often requiring special permits or even banning the use of suppressors altogether.

| Country | Suppressor Regulation |

|---|---|

| United States | Legal in most states, subject to ATF regulations |

| Sweden | Liberal laws, easy to obtain and use |

| United Kingdom | Strict regulations, special permits required |

| Australia | Suppressors are banned |

The Tax Stamp Process: A Step-by-Step Guide

The tax stamp process is a critical step for anyone looking to purchase and possess a suppressor. It involves several steps, each requiring careful attention to detail to ensure a smooth and successful outcome. Here’s a detailed breakdown of the process:

Step 1: Research and Select a Suppressor

The first step in the tax stamp process is to research and select a suppressor that suits your needs. There are numerous types and brands of suppressors available in the market, each with its own set of features and specifications. Consider factors such as the type of firearm you intend to use it with, the intended use (hunting, recreational shooting, etc.), and your budget.

Once you've made your selection, it's essential to ensure that the suppressor is legal in your state and that you meet all the necessary requirements to possess it. Some states have specific restrictions on certain types of suppressors, so it's crucial to check local laws before proceeding.

Step 2: Complete the ATF Form 4

After selecting your suppressor, the next step is to complete the ATF Form 4, also known as the Application for Tax Paid Transfer and Registration of Firearm. This form is a critical part of the tax stamp process and requires detailed and accurate information. It includes details such as your personal information, the type of suppressor, and the intended use.

The ATF Form 4 must be filled out completely and correctly to avoid delays or rejections. It's recommended to review the form thoroughly and seek guidance if needed. The ATF website provides detailed instructions and guidelines for completing the form, ensuring that all necessary information is included.

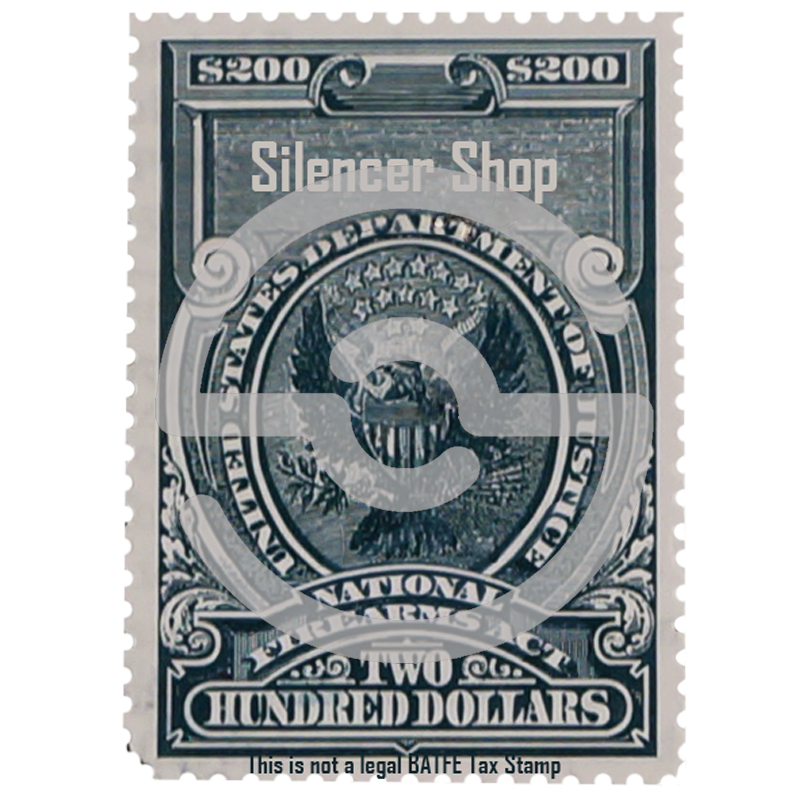

Step 3: Submit the Form and Fees

Once you’ve completed the ATF Form 4, the next step is to submit it, along with the required fees, to the ATF. The fee for a tax stamp is typically $200, which covers the processing and approval of your application. This fee is non-refundable, even if your application is denied or withdrawn.

You can submit the form and fees online through the ATF's eForm system or by mail. Ensure that you follow the instructions carefully and include all the required documents and payments. Any missing or incorrect information can lead to delays or even rejection of your application.

Step 4: Wait for ATF Approval

After submitting your application and fees, the next step is to wait for ATF approval. The processing time can vary, typically ranging from several weeks to a few months. During this time, it’s essential to be patient and ensure that you have provided all the necessary information.

The ATF will review your application and conduct a thorough background check. If there are any issues or discrepancies, they may contact you for further information or clarification. It's crucial to respond promptly to any requests from the ATF to avoid delays in the approval process.

Step 5: Receive Your Tax Stamp and Take Possession

Once your application is approved, the ATF will issue a tax stamp, which is a physical document confirming your registration and approval to possess the suppressor. This tax stamp is a critical piece of documentation and must be kept securely with your suppressor at all times.

After receiving the tax stamp, you can take possession of your suppressor from the dealer or manufacturer. Ensure that you follow all the necessary procedures for taking possession, including any state or local requirements. It's essential to keep your tax stamp and suppressor in a secure location, as they are valuable items and subject to legal regulations.

Frequently Asked Questions

What is the purpose of a tax stamp for a suppressor?

+

A tax stamp for a suppressor is a legal requirement imposed by the ATF to regulate the ownership and possession of these devices. It ensures that individuals who acquire suppressors have met all the necessary legal requirements and have paid the required tax.

How long does the tax stamp process typically take?

+

The tax stamp process can take several weeks to a few months, depending on various factors such as the ATF’s workload and the completeness of your application. It’s important to plan accordingly and allow sufficient time for the process to be completed.

Can I use my suppressor while waiting for the tax stamp to be approved?

+

No, it is illegal to use a suppressor without the approved tax stamp. The tax stamp is a crucial part of the legal process and must be obtained before you can possess or use the suppressor. Using a suppressor without the tax stamp can result in severe legal consequences.

What happens if my tax stamp application is denied?

+

If your tax stamp application is denied, the ATF will provide a reason for the denial. You have the right to appeal the decision and request a review. It’s important to carefully review the denial reason and take the necessary steps to address any issues or discrepancies.

Are there any alternatives to the tax stamp process for suppressors?

+

No, there are no legal alternatives to the tax stamp process for suppressors in the United States. The tax stamp is a mandatory requirement imposed by the ATF, and failure to comply can result in severe legal consequences. It’s crucial to follow the process to ensure legal compliance.

The tax stamp process for a suppressor is a critical legal procedure that requires careful attention and compliance with ATF regulations. By following the steps outlined in this guide and staying informed about the latest laws and regulations, you can navigate the process successfully and legally possess your suppressor. Remember, it’s essential to prioritize safety and legality when dealing with firearms and their accessories.