Idaho State Sales Tax Rate

In the state of Idaho, sales tax is an essential component of the revenue stream that funds various public services and infrastructure projects. This tax is levied on the sale of goods and certain services, contributing to the overall economic health of the state. The Idaho State Sales Tax Rate is a critical piece of information for businesses and consumers alike, as it impacts pricing strategies, budgeting, and the overall cost of living.

Understanding the Idaho State Sales Tax Rate

The state of Idaho imposes a sales and use tax on retail sales, leases, or rentals of tangible personal property, as well as the sale of certain services. This tax is applied at multiple levels, with both state and local governments playing a role in setting the rates.

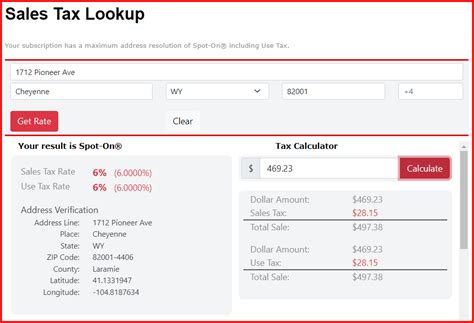

As of my last update in January 2023, the statewide sales tax rate in Idaho is 6%. This rate is applied uniformly across the state and is known as the base rate or state rate. However, it's important to note that local governments, including cities and counties, have the authority to impose additional sales taxes, creating variations in the overall sales tax rate throughout the state.

These local sales tax rates can be as high as 4.5%, bringing the total sales tax rate in certain areas to 10.5%, which is significantly higher than the state's base rate. This variance is due to the different tax jurisdictions within Idaho, each with its own tax structure and needs.

Sales Tax in Idaho: A Comprehensive Breakdown

Idaho’s sales tax structure is intricate, encompassing various components that businesses and consumers should be aware of. Here’s a breakdown of the key elements:

- State Sales Tax Rate: As mentioned, the state imposes a uniform sales tax rate of 6%, applicable across Idaho.

- Local Sales Tax Rate: Local governments can add additional sales tax, resulting in a cumulative rate that varies by location. These local rates can go up to 4.5%, making the total sales tax rate as high as 10.5% in some areas.

- Special Tax Jurisdictions: Certain areas in Idaho, known as special tax jurisdictions, have unique tax structures. For instance, some areas may have different rates for specific types of goods or services, such as restaurant meals or lodging.

- Sales Tax Holidays: Idaho occasionally holds sales tax holidays, during which certain items are exempt from sales tax for a limited time. These holidays are designed to boost economic activity and provide relief to consumers.

- Sales Tax Exemptions: Idaho offers exemptions from sales tax for specific items, such as groceries, prescription drugs, and some manufacturing inputs. These exemptions aim to reduce the tax burden on essential goods and services.

Understanding these nuances is crucial for both businesses and consumers. Businesses must ensure compliance with the applicable sales tax rates and structures to avoid legal and financial repercussions. Meanwhile, consumers can make more informed purchasing decisions by being aware of the sales tax rates in their specific areas, allowing them to budget effectively and compare prices accurately.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax Rate | 6% |

| Maximum Local Sales Tax Rate | 4.5% |

| Total Sales Tax Rate (Maximum) | 10.5% |

How Idaho’s Sales Tax Rate Compares

When compared to other states, Idaho’s sales tax rate is relatively moderate. Some states have much higher rates, while others have no sales tax at all. This diversity in sales tax rates across the United States reflects the varying economic needs and priorities of each state.

For instance, California, with its diverse economy and high cost of living, has a state sales tax rate of 7.25%, which can be combined with local taxes to reach a total rate of up to 10.75% in certain cities. On the other hand, Alaska is one of the few states with no state-level sales tax, allowing local governments to set their own rates.

In Texas, the state sales tax rate is 6.25%, but combined with local taxes, the total rate can reach as high as 8.25% in some areas. Florida, known for its tourism industry, has a state sales tax rate of 6%, which can also be increased by local governments.

These variations in sales tax rates can significantly impact businesses and consumers. For businesses, understanding these rates is crucial for pricing strategies and compliance with tax laws. Consumers, on the other hand, need to be aware of these rates to make informed purchasing decisions and manage their budgets effectively.

| State | State Sales Tax Rate | Total Sales Tax Rate (Maximum) |

|---|---|---|

| Idaho | 6% | 10.5% |

| California | 7.25% | 10.75% |

| Texas | 6.25% | 8.25% |

| Florida | 6% | 7% |

The Impact of Sales Tax on Idaho’s Economy

Sales tax plays a pivotal role in Idaho’s economy, contributing significantly to the state’s revenue stream. This tax is a key source of funding for various public services and infrastructure projects, making it an essential component of the state’s economic health.

The revenue generated from sales tax is used to support critical areas such as education, healthcare, transportation, and public safety. It also helps fund local projects and initiatives, ensuring that communities across Idaho have access to essential services and resources.

However, the impact of sales tax goes beyond revenue generation. It also influences consumer behavior and purchasing decisions. A higher sales tax rate can discourage certain purchases, especially for high-value items, leading to a potential decrease in sales and revenue for businesses. Conversely, a lower sales tax rate can stimulate economic activity and boost sales, benefiting both businesses and the state's economy as a whole.

Additionally, the sales tax structure in Idaho, with its local variations, allows for a certain degree of customization to meet the unique needs of different communities. This flexibility ensures that the tax burden is distributed fairly and that the revenue generated is allocated efficiently to address local priorities.

Future Outlook and Potential Changes

As with any tax structure, Idaho’s sales tax rates are subject to change and evolution. While the state’s current sales tax rate remains at 6%, there is always the potential for adjustments in the future, driven by economic conditions, political priorities, or shifts in consumer behavior.

The state's decision-makers closely monitor economic trends and tax revenue to ensure that the sales tax structure remains fair and effective. This includes evaluating the impact of the sales tax on businesses and consumers, as well as its contribution to the overall economic health of Idaho.

In recent years, there has been a growing discussion around the potential for sales tax reform in Idaho. Some stakeholders advocate for a simplified tax structure, suggesting the removal of local sales tax variations to create a more uniform rate across the state. Others propose the introduction of new tax categories or the adjustment of existing rates to address specific economic or social needs.

Regardless of the specific proposals, any changes to Idaho's sales tax structure would have far-reaching implications for businesses, consumers, and the state's economy as a whole. It is therefore essential for all stakeholders to stay informed and engage in the dialogue around potential tax reforms, ensuring that any changes are well-considered and aligned with the state's long-term economic goals.

Conclusion

Idaho’s sales tax rate is a critical piece of information for businesses and consumers, influencing pricing strategies, budgeting, and the overall cost of living. With a statewide rate of 6% and the potential for local additions up to 4.5%, the total sales tax rate can vary significantly across the state.

Understanding these variations is essential for both businesses and consumers. Businesses need to ensure compliance with the applicable rates to avoid legal and financial repercussions, while consumers can make more informed purchasing decisions by being aware of the sales tax rates in their specific areas.

As Idaho's economy continues to evolve, so too will its sales tax structure. Staying informed about potential changes and engaging in the discussion around tax reforms is crucial for all stakeholders, ensuring that any adjustments are well-considered and aligned with the state's economic goals and the needs of its residents.

What is the current state sales tax rate in Idaho?

+As of my last update, the state sales tax rate in Idaho is 6%.

Can local governments in Idaho impose additional sales taxes?

+Yes, local governments in Idaho have the authority to impose additional sales taxes, which can result in a higher total sales tax rate in certain areas.

What are some of the key components of Idaho’s sales tax structure?

+Idaho’s sales tax structure includes the state sales tax rate, local sales tax rates, special tax jurisdictions, sales tax holidays, and sales tax exemptions.