Ny Income Tax Calculator

Welcome to the comprehensive guide to understanding and navigating the New York State Income Tax system. Filing taxes can be a complex process, especially when it comes to one of the most populous and economically diverse states in the United States. This expert-led article will provide an in-depth analysis of the New York Income Tax Calculator, offering valuable insights and practical guidance to ensure a smoother tax-filing experience.

Introduction to the New York Income Tax Calculator

The New York Income Tax Calculator is an essential tool for individuals and businesses residing in the state of New York. It serves as a digital assistant, simplifying the often daunting task of calculating and filing income taxes. With its user-friendly interface and precise calculations, this calculator has become a trusted resource for taxpayers seeking clarity and accuracy in their tax obligations.

The calculator takes into account various factors such as income sources, deductions, credits, and tax rates applicable in New York. By inputting relevant financial information, users can obtain an estimate of their tax liability or refund, empowering them to make informed financial decisions.

Key Features of the New York Income Tax Calculator

The New York Income Tax Calculator offers a range of features designed to cater to the diverse needs of taxpayers:

- Accurate Tax Calculations: The calculator employs advanced algorithms to provide precise tax computations based on the latest tax laws and regulations in New York.

- User-Friendly Interface: With a clean and intuitive design, the calculator ensures a seamless experience, making it accessible to users with varying levels of tax knowledge.

- Deduction and Credit Support: It guides users through the process of claiming eligible deductions and credits, maximizing their tax benefits.

- Income Source Categorization: The calculator allows users to input income from various sources, including wages, business profits, investments, and more, ensuring a comprehensive tax assessment.

- Real-Time Updates: Regular updates ensure that the calculator remains aligned with any changes in tax laws, providing taxpayers with the most current information.

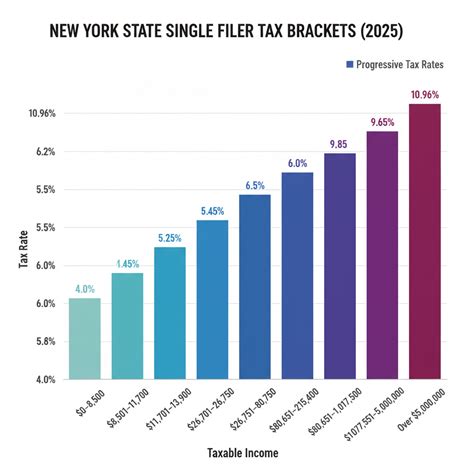

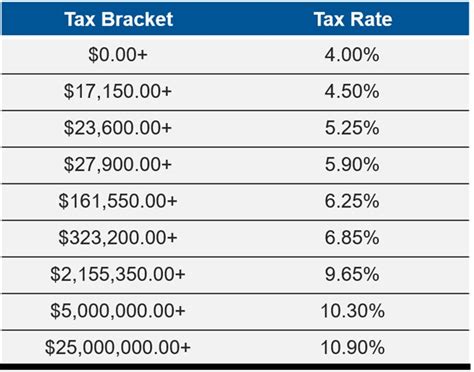

Understanding New York Income Tax Brackets

New York operates on a progressive tax system, meaning that income tax rates vary depending on an individual’s or entity’s taxable income. The state has established different tax brackets, each with its own tax rate. Understanding these brackets is crucial for accurate tax planning.

| Tax Bracket | Tax Rate |

|---|---|

| Up to $8,600 | 4% |

| $8,601 - $11,950 | 4.5% |

| $11,951 - $14,200 | 5.25% |

| $14,201 - $16,450 | 5.9% |

| $16,451 - $21,100 | 6.45% |

| $21,101 and above | 6.85% |

It's important to note that these tax brackets and rates are subject to change, and taxpayers should refer to the official New York State Department of Taxation and Finance website for the most current information.

Applying the Tax Calculator for Optimal Results

When utilizing the New York Income Tax Calculator, taxpayers can follow these steps to ensure accurate results:

- Gather Income Information: Collect all necessary financial documents, including pay stubs, investment statements, and any other records related to your income.

- Access the Calculator: Visit the official New York State Department of Taxation and Finance website or use a trusted third-party tax calculator.

- Input Income Data: Accurately enter your income details, ensuring that all sources of income are accounted for.

- Claim Deductions and Credits: The calculator will guide you through the process of claiming eligible deductions and credits, reducing your taxable income.

- Review and Verify: Carefully review the calculated tax liability or refund. Verify the accuracy of the information by comparing it with your records.

- Make Adjustments: If needed, make adjustments to your income or deductions based on the calculator's recommendations.

Exploring Deductions and Credits in New York

New York offers a range of deductions and credits that can significantly reduce an individual’s or business’s tax liability. Understanding these deductions and credits is essential for maximizing tax benefits.

Common Deductions in New York

- Standard Deduction: New York allows taxpayers to claim a standard deduction based on their filing status, reducing their taxable income.

- Itemized Deductions: Taxpayers can opt for itemized deductions, which include expenses such as medical costs, charitable contributions, and certain taxes paid.

- Personal Exemptions: New York allows exemptions for each taxpayer, dependent, and spouse, reducing taxable income.

Notable Tax Credits in New York

- Child and Dependent Care Credit: This credit helps offset the cost of childcare, providing relief for working families.

- Education Credits: New York offers credits for qualified education expenses, encouraging investment in education.

- Energy Credits: Taxpayers can claim credits for installing energy-efficient systems, promoting sustainability.

- Business Credits: Various business-related credits are available, supporting entrepreneurship and economic growth.

Tax Planning Strategies for New York Residents

Effective tax planning can help New York residents optimize their financial situation and minimize tax liabilities. Here are some strategies to consider:

Maximize Deductions and Credits

Review all eligible deductions and credits and ensure that you are taking full advantage of them. Consider consulting a tax professional to identify additional opportunities for tax savings.

Optimize Retirement Contributions

Contributing to retirement accounts, such as 401(k)s or IRAs, can provide tax benefits. These contributions reduce taxable income and offer long-term financial security.

Consider Business Ownership

Starting a business in New York can offer tax advantages, including the ability to claim business-related deductions and credits. Consult a tax advisor to explore the potential benefits.

Strategic Financial Planning

Work with a financial planner to develop a comprehensive financial strategy that considers tax implications. This can involve asset allocation, investment choices, and estate planning.

The Future of New York’s Tax System

As the economic landscape evolves, so does the tax system. New York has implemented various initiatives to enhance its tax structure and promote economic growth. Here’s a glimpse into the future of New York’s tax system:

Tax Reform Initiatives

The state has proposed reforms aimed at simplifying the tax code, reducing complexities, and improving compliance. These initiatives aim to make the tax system more efficient and accessible.

Digital Transformation

The New York State Department of Taxation and Finance is investing in digital technologies to enhance taxpayer services. This includes improved online filing systems and the development of advanced tax calculators.

Economic Incentives

New York continues to offer incentives to attract and retain businesses, including tax credits and deductions. These incentives promote economic development and job creation.

FAQs

How often are the tax brackets and rates updated in New York?

+The tax brackets and rates in New York are typically updated annually to align with economic changes. It’s essential to refer to the official New York State Department of Taxation and Finance website for the most current information.

Are there any income tax exemptions for specific professions in New York?

+New York offers certain tax exemptions for specific professions, such as active-duty military personnel and retired firefighters. These exemptions vary based on eligibility criteria and should be verified through official sources.

Can I use the New York Income Tax Calculator for estimating my tax refund?

+Absolutely! The New York Income Tax Calculator can provide an estimate of your potential tax refund by taking into account your deductions, credits, and tax liabilities. It’s a valuable tool for planning your finances.

Are there any tax filing deadlines I should be aware of in New York?

+Yes, it’s crucial to meet the tax filing deadlines to avoid penalties and interest. The standard deadline for filing New York State income tax returns is typically aligned with the federal deadline, which is usually April 15th. However, it’s advisable to check the official website for any updates.

The New York Income Tax Calculator serves as a valuable resource for taxpayers seeking clarity and accuracy in their tax obligations. By understanding the tax system, utilizing the calculator effectively, and implementing strategic tax planning, individuals and businesses can navigate the complex world of New York State taxes with confidence.