Understanding Missouri Tax Status: A Guide to Your Obligations and Benefits

Missouri, a state renowned for its diverse economic landscape and complex fiscal policies, has long challenged residents and business owners with its intricate tax code and evolving regulations. As we peer into a future where digital transformation, administrative modernization, and policy shifts continue to reshape tax obligations across the United States, Missouri’s tax status remains a quintessential case study in balancing fiscal responsibility with equitable taxation. Understanding Missouri tax status—covering the nuances of state income, corporate, sales, and property taxes—becomes not only a matter of compliance but also a strategic tool for optimizing financial decisions. With projections indicating increased automation and data integration in state tax systems by 2030, grasping current obligations and benefits positions taxpayers advantageously in this emerging landscape.

Futuristic Dimensions of Missouri Tax Structure: Navigating Complexity with Innovation

Over the next decade, technological advances in data analytics, blockchain, and artificial intelligence will radically transform how Missouri administers and enforces its taxation policies. Contemporary challenges—such as tax evasion, compliance costs, and administrative inefficiency—are anticipated to diminish as dynamic, real-time reporting becomes standard. For instance, integrating blockchain ledgers for sales and income transactions could enable instantaneous audits, reducing the need for manual filings and increasing transparency. Simultaneously, evolving federal guidance and interstate compacts may influence Missouri’s tax obligations, especially regarding digital commerce, remote work, and cross-state business operations.

Adapting to Digital Taxation and Automation

As digital economies expand, Missouri’s future tax system may leverage automated processes using AI-driven compliance platforms. These systems could proactively flag discrepancies, recommend strategic tax planning, and even predict fiscal health based on real-time data streams. For residents and enterprises, this means navigating a more dynamic tax environment, where today’s compliance involves continuous engagement with AI assistive tools, predictive analytics, and blockchain-backed records. As the state moves toward these innovations, understanding the foundational tax obligations—such as income, sales, and property taxes—becomes critical in leveraging available benefits and avoiding penalties.

| Relevant Category | Projected Future Metric |

|---|---|

| Tax Filing Efficiency | 99% automation expected by 2030 |

| Audit Transparency | Blockchain-enabled real-time audits |

| Taxpayer Compliance Rate | Projected increase to 95% |

Deciphering Missouri Income Tax in a Futuristic Context

The Missouri income tax system has historically balanced progressive rates with deductions, credits, and exemptions designed to support both individual and corporate taxpayers. As automation and data-sharing mature, future filings will likely be less about manual data entry and more about verifying AI-generated summaries. This transition hinges on a comprehensive understanding of existing obligations, including federal compliance requirements, state-specific deductions such as the Missouri Working Family Credit, and emerging credits linked to sustainable initiatives or digital economy engagement.

The Role of Advanced Data Analytics in Income Tax Management

Integrating predictive analytics will enable Missouri to tailor tax incentives dynamically, encouraging behaviors aligned with state policy goals—such as green energy investments or tech innovation. For example, real-time monitoring of income streams from remote work, digital platforms, or gig economy ventures could influence tax credits or rate adjustments on an ongoing basis. For taxpayers, staying informed about these technological shifts involves embracing data sovereignty and understanding how blockchain and AI influence their reporting obligations, warranties, and benefits.

| Aspect | Future Outlook |

|---|---|

| Tax Collection Method | Automated, blockchain-verified submissions |

| Compliance Monitoring | Real-time AI risk assessments |

| Tax Credits & Incentives | Predictively allocated via data-driven models |

Corporate Tax in Missouri: Innovations and Strategic Opportunities

Business entities operating within Missouri today are increasingly confronting a landscape shaped by automation, digital taxation policies, and strategic incentives. The corporate tax framework—comprising corporate income taxes, franchise taxes, and sales taxes—will likely evolve to harness big data analytics, facilitating more precise tax assessments while incentivizing innovation. For example, blockchain-based smart contracts could automatically trigger tax liabilities, reduce fraud, and optimize compliance workflows.

Future Corporate Tax Incentives and Digital Compliance

Future policies might provide targeted credits for investments in digital infrastructure, renewable energy within the state, or other forward-looking sectors. Blockchain-based recordkeeping and AI-driven compliance platforms will allow corporations to monitor their obligations seamlessly, minimizing audits and penalties. These developments necessitate a paradigm shift: corporate leaders will need to understand not only traditional tax code but also how emerging technologies influence their obligations and opportunities for strategic tax planning.

| Corporation | Projected Benefit |

|---|---|

| Tax Optimization | AI-powered scenario modeling |

| Compliance | Blockchain-verified transaction records |

| Incentives | Dynamic, data-informed credit allocations |

Sales and Use Tax: The Digital Economics Challenge

One of Missouri’s most complex and evolving areas involves sales and use tax, especially given the rapid growth of e-commerce and digital services. The state’s fiscal future hinges on adapting to this digital economy by implementing sophisticated nexus rules, real-time transaction tracking, and automated tax collection systems. Forward-looking strategies encompass integrating third-party data sources, such as payment processors and digital marketplaces, into central tax collection frameworks.

Envisioning Automated, Real-Time Sales Tax Systems

In the coming decades, Missouri’s sales tax system will likely operate with minimal human intervention. For remote entities and digital services, blockchain and AI will determine nexus status instantaneously, calculating owed taxes based on transaction location, buyer profile, and supply chain data. This dynamic approach reduces evasion, simplifies compliance, and enhances revenue stability—vital for funding infrastructure and public services amidst demographic and economic shifts.

| Key Development | Implication |

|---|---|

| Real-time Nexus Detection | Enhanced compliance for remote sellers |

| Automated Collection | Reduced administrative burdens |

| Market Data Integration | Accurate, dynamic tax rate application |

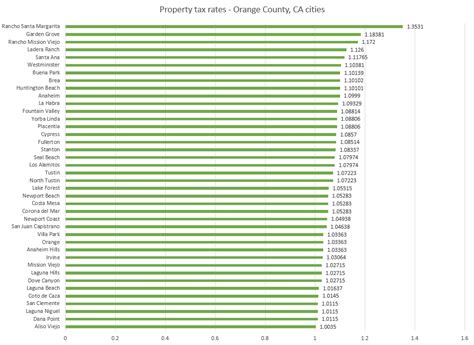

Property Tax: Future Management in a Changing Landscape

Property tax remains a vital source of local revenue in Missouri. However, the future promises significant shifts driven by smart cities, IoT-enabled property assessments, and data-driven valuation models. Blockchain-based property registries could streamline ownership verification, reduce fraud, and facilitate transparent property transfer records.

Emergent Technologies in Property Valuation

Automated valuation models harnessing AI and IoT sensors may provide real-time data on property conditions and market trends, enabling dynamic assessment adjustments. For homeowners and investors, understanding these innovations offers opportunities for strategic asset management and tax planning—especially as base assessments become more precise, reducing disputes and fostering equitable taxation.

| Technology | Impact |

|---|---|

| Blockchain Property Records | Enhanced transparency and security |

| IoT Sensors | Real-time property condition data |

| AI Valuation Models | Dynamic tax assessment accuracy |

Implications for Tax Policy and Citizen Benefits

Anticipating widespread technological integration, Missouri’s future tax policies could evolve beyond mere revenue collection to become active levers for social and economic policy. For instance, real-time tax incentives for sustainable practices or digital literacy initiatives could transform taxation into a tool for societal advancement. Citizens and businesses that engage early with these systems will gain access to personalized benefits—such as tailored incentives, simplified filings, and enhanced transparency.

Potential Risks and Ethical Considerations

Nevertheless, the march toward an automated, data-driven tax system introduces challenges such as data privacy concerns, digital divides, and algorithmic biases. Future policymakers must address these issues by fostering inclusive digital literacy programs, ensuring robust data security measures, and maintaining human oversight over automated assessments.

| Consideration | Future Outlook |

|---|---|

| Data Privacy | Enhanced encryption and user control |

| Equity | Bridging digital divides through outreach |

| Transparency | Open algorithms and auditability |

How will technological advances change Missouri’s tax filing process?

+Automated, AI-driven systems will streamline tax filings, reducing manual entry and increasing accuracy through real-time data verification and blockchain-recorded transactions.

What new benefits might residents see from future tax policies?

+Tax incentives tailored through predictive analytics, real-time benefit adjustments, and simplified digital interactions will enhance citizen engagement and optimize resource allocation.

What are potential risks associated with automation in Missouri’s tax system?

+Risks include data privacy breaches, algorithmic bias, and digital exclusion. Addressing these will require robust legal frameworks, cybersecurity measures, and inclusive digital literacy initiatives.