Medical Expenses Tax Deductible

Medical expenses can be a significant financial burden for individuals and families, especially when unexpected illnesses or injuries occur. However, many countries and jurisdictions provide tax deductions or credits to ease the financial strain associated with healthcare costs. Understanding which medical expenses are tax-deductible can help individuals maximize their tax benefits and potentially reduce their overall tax liabilities. In this comprehensive guide, we will delve into the world of medical expenses tax deductions, exploring the eligibility criteria, common deductions, and best practices to ensure compliance and maximize savings.

Understanding Medical Expenses Tax Deductions

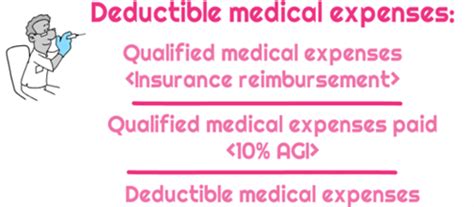

Medical expenses tax deductions, also known as medical expense tax credits or medical expense deductions, allow taxpayers to claim a portion of their qualified healthcare costs as a deduction on their income tax returns. These deductions can be claimed on a personal income tax return or, in some cases, on a business tax return if the expenses are related to a self-employed individual’s business.

The primary objective of medical expense tax deductions is to provide relief to individuals who incur substantial out-of-pocket expenses for medical care. By offering tax benefits, governments aim to encourage access to healthcare services and support individuals and families facing financial challenges due to medical needs.

Eligibility and Qualifying Criteria

Not all medical expenses are automatically tax-deductible. Taxpayers must meet specific eligibility criteria and adhere to certain guidelines to qualify for medical expense deductions. Here are some common requirements and considerations:

-

Tax Residency: Eligibility often depends on the taxpayer's residence or citizenship. Different countries and regions have varying rules, so it's essential to understand the specific guidelines applicable to your tax jurisdiction.

-

Tax Year: Medical expenses must be incurred within the relevant tax year to be eligible for deductions. It's crucial to keep accurate records and organize expenses accordingly.

-

Minimum Threshold: Many jurisdictions impose a minimum threshold or a certain percentage of the taxpayer's income that must be exceeded before medical expenses become deductible. This threshold helps prevent minor expenses from overwhelming the tax system.

-

Qualified Medical Expenses: Not all healthcare-related costs qualify for deductions. Governments typically provide a list of eligible expenses, which may include doctor's fees, hospital stays, prescription medications, medical equipment, and certain over-the-counter remedies. It's essential to review the official guidelines to ensure the expenses are covered.

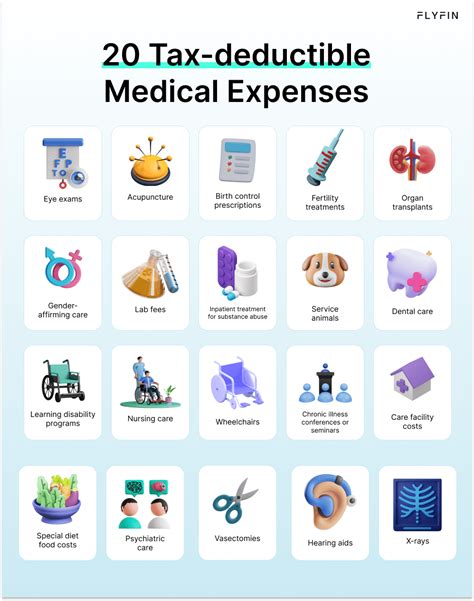

Common Medical Expenses Deductions

The range of medical expenses that can be deducted varies depending on the jurisdiction and the taxpayer’s specific circumstances. Here are some common categories of expenses that often qualify for deductions:

Doctor and Specialist Fees

Consultation fees charged by physicians, surgeons, psychiatrists, and other medical specialists are typically eligible for deductions. This includes fees for routine check-ups, specialized treatments, and procedures.

Hospitalization Costs

Expenses incurred during hospital stays, such as room and board, nursing care, and diagnostic tests, are generally deductible. This category also covers emergency room visits and ambulance services.

Prescription Medications

The cost of prescription drugs, including medication for chronic conditions, can be claimed as a medical expense deduction. It’s important to retain receipts and prescriptions to support these claims.

Medical Equipment and Supplies

Purchases of medical equipment, such as wheelchairs, crutches, and assistive devices, are often deductible. Additionally, expenses for medical supplies like bandages, glucose monitors, and incontinence products may be eligible.

Mental Health Services

Many jurisdictions recognize the importance of mental health and include expenses for psychological counseling, therapy sessions, and psychiatric treatment in their list of deductible medical expenses.

Preventive Care

Certain preventive measures, such as vaccinations, annual check-ups, and cancer screenings, are commonly included in the list of deductible expenses. These costs promote early detection and prevention of diseases.

Dental and Vision Care

Dental treatments, including routine check-ups, fillings, root canals, and orthodontics, are often deductible. Similarly, expenses for eye exams, glasses, and contact lenses are typically eligible.

Maximizing Deductions and Compliance

To maximize tax savings and ensure compliance with medical expense deductions, taxpayers should consider the following best practices:

-

Maintain Detailed Records: Keep a comprehensive record of all medical expenses, including receipts, invoices, and prescriptions. Digital record-keeping systems can streamline this process and make it easier to retrieve information when needed.

-

Review Official Guidelines: Familiarize yourself with the specific guidelines and eligible expenses provided by your tax authority. Stay updated on any changes or amendments to ensure compliance with the latest regulations.

-

Consult Tax Professionals: If you have complex medical expenses or are uncertain about your eligibility, consider seeking advice from tax professionals or certified public accountants (CPAs) who specialize in medical expense deductions. They can provide personalized guidance and ensure you maximize your deductions while adhering to tax laws.

-

Explore Additional Deductions: In some cases, certain medical expenses may also be eligible for additional tax benefits, such as itemized deductions or credits for the disabled. Researching and understanding these opportunities can further enhance your tax savings.

Conclusion

Medical expenses tax deductions offer a valuable opportunity for individuals to mitigate the financial impact of healthcare costs. By understanding the eligibility criteria, qualified expenses, and best practices for record-keeping and compliance, taxpayers can maximize their deductions and potentially reduce their tax liabilities. Remember, it’s essential to consult official guidelines and, if necessary, seek professional advice to ensure accurate and ethical tax planning.

Can I deduct over-the-counter medications without a prescription?

+In most cases, over-the-counter medications without a prescription are not eligible for medical expense deductions. However, certain jurisdictions may allow deductions for specific over-the-counter items, such as insulin or glucose monitoring supplies for diabetics. It’s crucial to review the official guidelines or consult a tax professional for clarification.

Are travel expenses to medical appointments deductible?

+Travel expenses related to medical treatments, such as mileage or public transportation costs, may be deductible in some jurisdictions. However, the rules can vary, and taxpayers should verify their eligibility by referring to official guidelines or consulting a tax advisor.

Can I claim deductions for alternative therapies or treatments?

+Alternative therapies and treatments, such as acupuncture or chiropractic care, are often included in the list of deductible medical expenses. However, eligibility may depend on the jurisdiction and the specific treatment. It’s advisable to check the official guidelines or seek professional advice to confirm deductibility.