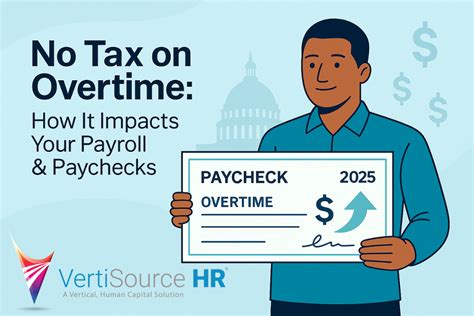

Is There No Tax On Overtime

In the realm of employment and compensation, the concept of overtime pay often arises as a crucial aspect of labor laws and employee rights. While overtime work can provide employees with additional income, the question of whether there is any tax associated with these extra hours is a common concern. In this comprehensive exploration, we delve into the intricate world of overtime taxation, unraveling the complexities and shedding light on the specific mechanisms at play.

Understanding Overtime Pay and Taxation

Overtime pay is a fundamental component of labor regulations aimed at ensuring fair compensation for employees who work beyond their standard workweek. The precise definition of overtime and the associated pay rates can vary depending on the jurisdiction and industry. In most cases, overtime is triggered when an employee works more than a specified number of hours within a defined work period, often a week.

The taxation of overtime pay is a nuanced matter influenced by a multitude of factors, including the employee's tax bracket, the nature of their employment, and the specific tax regulations in their region. Let's delve deeper into these aspects to gain a comprehensive understanding.

Tax Brackets and Overtime Income

The tax implications of overtime pay are closely tied to an individual’s tax bracket, which determines the rate at which their income is taxed. When an employee earns overtime wages, these additional earnings are typically added to their regular income, pushing them into a higher tax bracket if the overtime pay surpasses a certain threshold.

For instance, consider an employee in the United States who is in the 22% tax bracket for their regular income. If their overtime earnings exceed the threshold for the next higher tax bracket, say 24%, they may find themselves paying a higher tax rate on their overtime income. This progressive tax system ensures that as income increases, so does the tax rate, creating a more equitable distribution of tax burden.

| Tax Bracket | Tax Rate |

|---|---|

| Up to $9,950 | 10% |

| $9,951 to $40,525 | 12% |

| $40,526 to $86,375 | 22% |

| $86,376 to $164,925 | 24% |

It's important to note that the above tax rates are illustrative and may vary based on individual circumstances, such as filing status, deductions, and credits. Additionally, the tax brackets and rates can change annually, so it's crucial to stay informed about the latest tax regulations to accurately assess the tax implications of overtime pay.

Employment Status and Tax Considerations

The taxation of overtime pay also hinges on an employee’s employment status, specifically whether they are considered an employee or an independent contractor. Employees, who are typically subject to payroll taxes and have their taxes withheld by their employer, may find that their overtime pay is taxed in a similar manner to their regular income.

On the other hand, independent contractors, who are responsible for their own taxes and often file quarterly estimated tax payments, may face different tax considerations for overtime work. In some cases, overtime income for independent contractors may be subject to self-employment taxes, which include both the employee and employer portions of Social Security and Medicare taxes.

Furthermore, the tax treatment of overtime pay can vary based on the specific industry and the nature of the work. For example, certain industries, such as the entertainment industry, may have unique tax rules and deductions that apply to overtime earnings.

Tax Withholding and Overtime

When it comes to tax withholding, overtime pay can be subject to the same withholding rules as regular income. This means that employers are required to withhold federal income tax, state income tax (if applicable), and other applicable taxes from the employee’s overtime earnings.

However, the withholding process for overtime pay can be more complex due to the variable nature of overtime work. Employers must ensure that the appropriate withholding rates are applied based on the employee's tax bracket and the amount of overtime pay. This often involves adjusting the employee's withholding allowances to account for the additional income.

To simplify the process, some employers may opt to use a flat withholding rate for overtime pay, which can provide a more straightforward approach to tax withholding. However, this method may not always accurately reflect the employee's tax liability, especially if their overtime earnings significantly impact their overall tax situation.

Overtime Pay and Tax Deductions

Overtime pay can also impact an employee’s eligibility for certain tax deductions and credits. For instance, in the United States, the Child Tax Credit and the Earned Income Tax Credit (EITC) have income thresholds that may be affected by overtime earnings.

Additionally, overtime pay can influence the calculation of deductions for expenses related to work, such as uniforms, tools, or professional development. These deductions can help reduce an employee's taxable income, making it essential to accurately track and report overtime expenses to maximize tax benefits.

Maximizing Overtime Earnings and Tax Efficiency

While the taxation of overtime pay can add complexity to an employee’s financial situation, there are strategies to maximize earnings and minimize the tax burden. Here are some key considerations for employees to optimize their overtime income and tax efficiency:

- Understanding Tax Brackets: Employees should familiarize themselves with their tax brackets and the thresholds that trigger higher tax rates. This knowledge can help them plan their overtime work strategically to minimize the impact on their tax liability.

- Adjusting Withholding Allowances: By adjusting their withholding allowances, employees can ensure that their tax withholdings align with their expected tax liability, including overtime earnings. This can prevent under-withholding, which may result in a tax bill at the end of the year.

- Tracking Expenses: Keeping meticulous records of work-related expenses, including those associated with overtime work, can help employees claim deductions and reduce their taxable income. This practice can lead to substantial tax savings.

- Utilizing Tax Credits: Employees should explore the tax credits they may be eligible for, such as the Child Tax Credit or the EITC. These credits can provide significant financial benefits and reduce the overall tax burden.

- Consulting Tax Professionals: Engaging the expertise of a tax professional can be invaluable in navigating the complexities of overtime taxation. Tax advisors can offer personalized guidance, ensuring that employees make informed decisions about their overtime work and tax planning.

The Role of Tax Planning for Overtime Earnings

Effective tax planning is essential for employees who anticipate earning significant overtime income. By proactively considering their tax situation, employees can make informed decisions about their work schedule and tax strategies.

For instance, employees may choose to spread their overtime work throughout the year to avoid pushing their income into higher tax brackets. Alternatively, they may opt to save a portion of their overtime earnings in a tax-advantaged account, such as a retirement plan, to reduce their taxable income and defer taxes until withdrawal.

Additionally, employees should stay informed about any tax law changes that may impact their overtime earnings. Tax laws can evolve, introducing new deductions, credits, or thresholds that can significantly affect an employee's tax liability. Staying up-to-date ensures that employees can adapt their tax planning strategies accordingly.

Overtime Pay and Tax Compliance

In addition to understanding the tax implications of overtime pay, employees and employers must also ensure compliance with tax regulations. Failure to properly report and pay taxes on overtime earnings can result in penalties and legal consequences.

Employers have a responsibility to accurately track and report overtime hours, ensuring that the appropriate taxes are withheld and remitted to the relevant tax authorities. This includes maintaining detailed records of overtime work and ensuring that payroll systems are configured to handle the complex calculations associated with overtime pay.

Employees, on the other hand, must truthfully report their overtime earnings on their tax returns and pay any taxes owed. Failure to do so can lead to audits, penalties, and legal action. It is crucial for employees to maintain accurate records of their overtime work and consult with tax professionals to ensure compliance with tax laws.

The Importance of Accurate Record-Keeping

Accurate record-keeping is paramount when it comes to overtime pay and taxation. Both employers and employees should maintain detailed records of overtime hours worked, rates of pay, and any associated expenses. These records serve as evidence in case of audits or disputes and help ensure accurate tax reporting.

For employers, maintaining accurate records is essential for payroll processing, tax compliance, and employee relations. It allows them to accurately calculate overtime pay, withhold the appropriate taxes, and provide employees with the necessary documentation for their tax returns.

Employees, too, benefit from keeping meticulous records. These records can help them track their overtime earnings, expenses, and deductions, enabling them to prepare their tax returns with precision and avoid potential tax complications.

Future Implications and Trends in Overtime Taxation

The landscape of overtime taxation is subject to ongoing changes and developments. As tax laws evolve and labor regulations adapt, the tax treatment of overtime pay may undergo modifications.

One notable trend is the increasing focus on fair compensation for overtime work. Many jurisdictions are implementing stricter overtime regulations, aiming to ensure that employees are adequately compensated for their extra hours. This can lead to changes in tax laws to align with these labor standards.

Additionally, the rise of remote work and the gig economy has brought about new challenges and opportunities in overtime taxation. As more individuals engage in freelance or contract work, the tax treatment of their overtime earnings may become a subject of scrutiny and reform.

Staying abreast of these developments is crucial for both employers and employees. Employers must stay compliant with changing regulations to avoid legal and financial repercussions, while employees should remain informed to ensure they are not disadvantaged by evolving tax laws.

Conclusion

The taxation of overtime pay is a multifaceted aspect of employment that requires careful consideration and planning. By understanding the tax implications, employees can make informed decisions about their overtime work and maximize their earnings while minimizing their tax burden. Employers, too, play a crucial role in ensuring compliance and accurate tax withholding.

As the world of work continues to evolve, so too will the tax landscape surrounding overtime pay. Staying informed, seeking professional guidance, and maintaining meticulous records will empower employees and employers to navigate the complexities of overtime taxation with confidence and compliance.

What is the definition of overtime pay?

+

Overtime pay refers to the compensation an employee receives for working beyond their standard workweek. It typically applies when an employee works more than a specified number of hours within a defined work period, often a week.

How does overtime pay impact my tax bracket?

+

Overtime pay is added to your regular income, which can push you into a higher tax bracket if the overtime earnings exceed the threshold for the next tax bracket. This can result in a higher tax rate for your overtime income.

Are there different tax considerations for independent contractors and employees regarding overtime pay?

+

Yes, independent contractors are responsible for their own taxes and may face different tax considerations for overtime work, such as self-employment taxes. Employees, on the other hand, typically have their taxes withheld by their employer and may follow similar tax rules as for their regular income.

How can I maximize my overtime earnings while minimizing tax liability?

+

To maximize overtime earnings and minimize tax liability, consider understanding your tax brackets, adjusting withholding allowances, tracking work-related expenses, utilizing tax credits, and consulting tax professionals for personalized guidance.