Tax Topic 152 Meaning

Tax Topic 152, a critical component of the U.S. Internal Revenue Service (IRS) publication system, serves as an indispensable resource for taxpayers seeking comprehensive guidance on specific tax-related matters. This topic covers a wide range of tax issues, offering clear and detailed explanations to ensure compliance and facilitate the efficient filing of tax returns.

Unraveling the Complexities of Tax Topic 152

Diving into the intricacies of Tax Topic 152 reveals a wealth of information designed to assist taxpayers in navigating the complex world of tax regulations. This topic is particularly relevant for individuals and businesses dealing with various tax scenarios, providing clarity on key aspects such as eligibility, reporting requirements, and potential deductions or credits.

Eligibility and Qualifications

Understanding the eligibility criteria is a fundamental step when considering Tax Topic 152. The IRS has established specific guidelines that outline who qualifies for the benefits and provisions outlined within this topic. For instance, individuals must meet certain income thresholds and residency requirements to be eligible for certain tax credits or deductions.

Businesses, on the other hand, have their own set of criteria to consider. Factors such as the type of business, its legal structure, and its annual revenue can all influence the applicability of Tax Topic 152. For example, sole proprietorships may have different reporting obligations compared to corporations or partnerships.

| Entity Type | Eligibility Criteria |

|---|---|

| Sole Proprietorship | Must meet income and residency requirements; may qualify for specific business deductions. |

| Corporation | Subject to corporate tax rates and reporting obligations; may benefit from tax incentives for research and development. |

| Partnership | Partners' personal income tax rates apply; potential for pass-through entities to benefit from lower tax rates. |

Reporting Requirements and Compliance

Tax Topic 152 also delves into the detailed reporting requirements that taxpayers must adhere to. This includes guidelines on what information to include, how to calculate tax liabilities, and the specific forms and schedules to utilize. Non-compliance with these reporting requirements can lead to penalties and interest charges, so it’s essential to understand the intricacies.

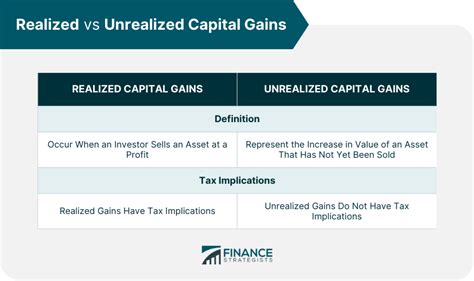

For example, when reporting income from investments, taxpayers must differentiate between short-term and long-term capital gains, as the tax rates and reporting methods differ. Additionally, certain types of income, such as rental income, may require the completion of specific schedules to ensure accurate reporting.

Maximizing Tax Benefits and Deductions

One of the key advantages of Tax Topic 152 is the guidance it provides on maximizing tax benefits and deductions. This topic outlines various tax credits and deductions that can significantly reduce a taxpayer’s overall tax liability. From education credits to business expenses, there are numerous opportunities to minimize tax obligations.

Take, for instance, the American Opportunity Tax Credit, which is available to eligible students and their families. This credit can offset a significant portion of the costs associated with higher education, making it an essential consideration for taxpayers pursuing advanced degrees.

Real-World Applications and Case Studies

To illustrate the practical applications of Tax Topic 152, let’s explore a few real-world scenarios and how this topic guides taxpayers through these situations.

Scenario 1: Small Business Start-Up

John, a recent college graduate, decides to start his own consulting business. As a sole proprietor, he needs to understand his tax obligations. Tax Topic 152 provides guidance on the tax implications of starting a business, including the eligibility for the New Markets Tax Credit, which can provide much-needed capital for businesses operating in low-income communities.

Scenario 2: Investment Portfolio Management

Emily, an experienced investor, has a diverse portfolio of stocks and bonds. Tax Topic 152 helps her navigate the complex world of investment taxes. By understanding the differences between ordinary dividends and qualified dividends, she can optimize her tax strategy and minimize her tax liability.

Scenario 3: Education Financing

David, a parent with two children in college, is concerned about the financial burden of higher education. Tax Topic 152 offers a solution in the form of the Lifetime Learning Credit and the American Opportunity Tax Credit, which can significantly reduce the tax liability associated with education expenses.

Conclusion: The Importance of Staying Informed

Tax Topic 152 serves as a vital resource for taxpayers, offering clarity and guidance on a wide range of tax-related issues. By understanding the eligibility criteria, reporting requirements, and potential tax benefits, taxpayers can navigate the complex tax landscape with confidence. Staying informed is key to optimizing tax strategies and ensuring compliance with IRS regulations.

How often are IRS Tax Topics updated?

+IRS Tax Topics are regularly updated to reflect changes in tax laws and regulations. The IRS aims to keep its publications current, so taxpayers should check for updates annually or whenever they are preparing their tax returns.

Are there any resources available for further guidance on Tax Topic 152?

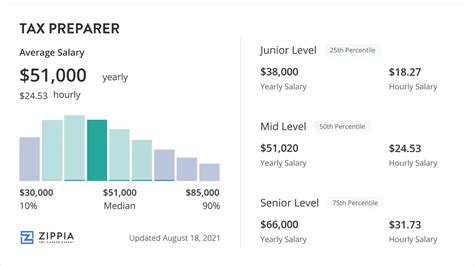

+Absolutely! The IRS website provides additional resources, including publications, forms, and frequently asked questions. Additionally, consulting with a tax professional can offer personalized guidance based on your specific circumstances.

What are some common pitfalls to avoid when dealing with Tax Topic 152?

+One common pitfall is failing to understand the eligibility criteria for certain tax benefits. Always review the requirements carefully to ensure you qualify. Another pitfall is not staying updated with the latest tax laws, as regulations can change frequently.