7 Key Ways to Understand & Manage Unrealized Gain Tax

Unrealized gain tax stands as a nuanced aspect of contemporary investment management, intricately connected to the dynamic landscape of fiscal policies and individual wealth strategy. Its intricacies often confound both novice investors and seasoned financial advisors alike, necessitating a comprehensive approach to understanding, monitoring, and managing these potential tax liabilities. This guide delves into seven pivotal methods for mastering the terrain of unrealized gains, transforming an opaque concept into a strategic asset for optimizing investment outcomes while maintaining regulatory compliance.

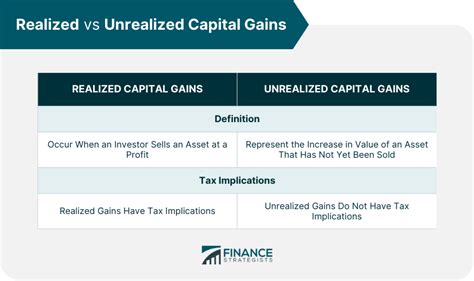

Understanding Unrealized Gains and Their Tax Implications

Before exploring specific strategies, it’s essential to grasp what constitutes an unrealized gain. When an asset increases in value but has not yet been sold, it is said to have an unrealized gain. Unlike realized gains, which are subject to taxation upon sale, unrealized gains are not immediately taxable, leading to complex tax planning opportunities and challenges. The impending recognition of these gains can trigger a variety of tax liabilities, especially in jurisdictions with specific provisions for "deferred" or "phantom" taxes.

The Role of Carried Interest and Tax Deferral

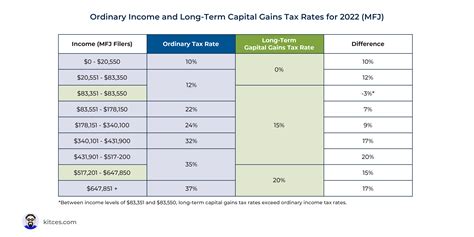

In certain sectors such as private equity or hedge funds, unrealized gains often play a strategic role in tax deferral and income distribution. Managing these positions requires a nuanced understanding of how jurisdictional tax laws treat unrealized gains, often necessitating sophisticated planning mechanisms such as step-up in basis, exchange-traded funds (ETFs), or specific asset location strategies.

| Relevant Category | Substantive Data |

|---|---|

| Typical Tax Rate on Unrealized Gains | Generally not taxed until realization, but some jurisdictions impose annual taxes on certain unrealized gains (e.g., Venezuela or some U.S. states) |

Seven Effective Strategies to Manage Unrealized Gain Tax

1. Keep Track of Cost Basis and Gains Accurately

Accurate record-keeping of an asset’s cost basis and subsequent gains is the bedrock of effective unrealized gain management. Utilizing sophisticated software or professional bookkeeping ensures real-time monitoring, which becomes indispensable when planning tax-efficient sales or transfers.

2. Implement Strategic Asset Location and Diversification

Placing tax-inefficient assets—such as those generating high unrealized gains, like taxable bonds—in tax-advantaged accounts (IRAs, 401(k)s) preserves liquidity and minimizes taxable events. Conversely, holdings with low or no unrealized gains can be allocated to taxable accounts to optimize tax exposure.

3. Use Tax-Loss Harvesting to Offset Unrealized Gains

Tax-loss harvesting involves selling assets at a loss to offset unrealized or realized gains elsewhere. This practice requires careful timing, as one must distinguish between realized and unrealized gains, but it can significantly reduce overall tax liability, especially in volatile markets.

| Relevant Category | Substantive Data |

|---|---|

| Typical Annual Loss Harvesting Limitations | In the U.S., up to $3,000 of net capital losses can offset ordinary income annually; excess losses can be carried forward indefinitely. |

4. Explore Tax-Deferred Exchanges and Like-Kind Exchanges

1031 exchanges—permissible under U.S. IRS code—allow for the deferral of capital gains taxes when swapping like-kind property. While more common in real estate, similar principles can apply across other asset classes, offering a pathway to defer unrealized gain recognition during portfolio restructuring.

5. Defer Realization Through Charitable Gifts or Donor-Advised Funds

Gifting appreciated assets directly to charities can eliminate capital gains taxes on unrealized gains and provide tax deductions. Donor-advised funds further enhance flexibility, allowing donors to manage timing and amounts of charitable distributions strategically.

6. Leverage Tax-Advantaged Accounts Collaboratively

Maximizing contributions to IRAs, Roth IRAs, and other tax-advantaged vehicles enables investors to house assets with significant unrealized gains, deferring taxes until withdrawal or, in the case of Roth accounts, potentially eliminating future taxes altogether.

7. Monitor (and Anticipate) Legislative Changes

Tax policies concerning unrealized gains are subject to legislative shifts, as seen in recent debates over wealth taxes and mark-to-market proposals. Staying informed through credible sources ensures proactive adjustments to strategies, maintaining tax efficiency amid evolving legal frameworks.

Key Points

- Precise tracking: Maintain detailed records of cost basis and appreciation to inform strategic decision-making.

- Tax-efficient placement: Use account structures to optimize the tax impact of unrealized gains.

- Tax-loss harvesting: Offset gains methodically to reduce tax obligations.

- Asset exchanges: Consider deferred exchange methods to manage timing of gains.

- Charitable strategies: Utilize donations to mitigate tax liability on appreciated assets.

How do I accurately calculate the unrealized gain on my assets?

+Calculate unrealized gains by subtracting the cost basis—the original purchase price plus any adjustments—from the current market value. Using financial software or professional appraisals ensures precision and compliance with reporting standards.

Can unrealized gains be taxed immediately in any jurisdictions?

+Yes, certain jurisdictions like Venezuela impose annual taxes on unrealized gains, especially in the context of specific asset classes or economic policies. Most common tax systems, however, defer taxation until realization.

What are the risks of delaying recognition of unrealized gains?

+Delaying recognition may lead to tax policy changes, legislative risks, or unforeseen liabilities if the gains are ultimately realized under less favorable conditions. Strategic planning must include assessments of potential legal reforms.