Pay Excise Tax Online

Paying excise tax online has become an increasingly popular and convenient option for businesses and individuals alike. With the advancement of digital payment systems and government initiatives, online excise tax payment portals offer a streamlined and efficient way to fulfill tax obligations. This article will delve into the process of paying excise tax online, highlighting the benefits, providing step-by-step guides, and offering insights into the future of digital tax payment systems.

Understanding Excise Tax and Online Payment Platforms

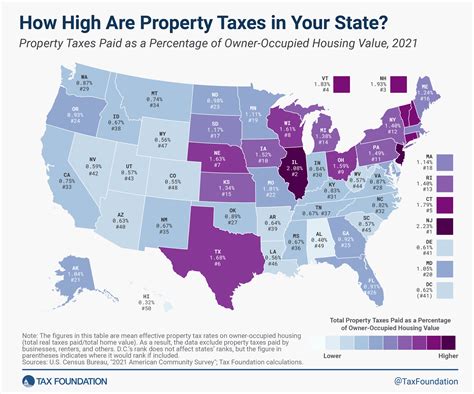

Excise tax is an indirect tax levied on specific goods and services, often aimed at controlling consumption or generating revenue for specific purposes. It is distinct from income tax, which is a direct tax imposed on individuals and businesses based on their earnings. Excise taxes are commonly applied to items such as alcohol, tobacco, fuel, and certain luxury goods.

In recent years, many countries have implemented online platforms to facilitate the payment of excise taxes. These platforms are designed to enhance convenience, efficiency, and transparency in tax administration. By offering an online interface, taxpayers can access their tax-related information, calculate and pay their excise taxes, and even receive real-time updates on their tax compliance status.

Benefits of Paying Excise Tax Online

The shift towards online excise tax payment systems offers a myriad of advantages for taxpayers and tax administrators alike.

- Convenience and Accessibility: Online payment platforms eliminate the need for taxpayers to visit physical tax offices, saving time and travel expenses. Taxpayers can access the platform from anywhere, at any time, as long as they have an internet connection.

- Efficiency and Speed: Digital payment systems streamline the tax payment process, reducing paperwork and manual data entry. This efficiency translates to faster tax compliance, enabling businesses to focus more on their core operations.

- Improved Transparency: Online platforms provide a clear and transparent view of tax obligations and payments. Taxpayers can easily track their payment history, view pending taxes, and receive notifications about upcoming due dates.

- Reduced Administrative Burden: By automating many tax-related processes, online systems reduce the administrative burden on both taxpayers and tax authorities. This leads to cost savings and increased efficiency in tax administration.

- Enhanced Security: Reputable online payment platforms employ robust security measures to protect sensitive financial and tax-related information. This ensures that taxpayers' data remains secure during the payment process.

Step-by-Step Guide: Paying Excise Tax Online

Here’s a comprehensive guide to help you navigate the process of paying excise tax online, using the hypothetical example of an online excise tax payment platform named “TaxPayOnline.”

- Register and Create an Account:

- Visit the official website of TaxPayOnline or the designated government tax portal.

- Locate the registration section and provide the required personal or business details, such as name, address, and tax identification number.

- Create a secure password and verify your account through an email or SMS confirmation.

- Access Your Tax Dashboard:

- Log in to your TaxPayOnline account using your credentials.

- You will be directed to your personalized tax dashboard, which displays your tax-related information, including pending taxes, payment history, and notifications.

- Calculate and View Excise Tax Obligations:

- Navigate to the "Excise Tax" section of your dashboard.

- Provide the necessary details about the goods or services you are taxing, such as quantity, type, and value.

- The platform will automatically calculate the excise tax due based on the applicable tax rates and display the total amount payable.

- Select Payment Method:

- TaxPayOnline offers a range of secure payment options, including credit/debit cards, e-wallets, and bank transfers.

- Choose the payment method that suits your preference and provide the required payment details.

- Make the Payment:

- Review the payment summary, ensuring the accuracy of the tax amount and payment details.

- Proceed with the payment by confirming the transaction. The platform will guide you through the payment process specific to your chosen method.

- Receive Payment Confirmation:

- Once the payment is successfully processed, you will receive an instant confirmation on the platform.

- You may also receive an email or SMS notification as an additional confirmation of your excise tax payment.

- Access Payment Receipt and Records:

- Return to your tax dashboard, where you can view and download the payment receipt for future reference.

- The receipt will contain important details such as the tax payment amount, date, and a unique transaction ID.

Future Implications and Innovations

The future of excise tax payment systems is poised for further innovation and improvement. Here are some insights into potential developments:

- Integration with Accounting Software: Online excise tax payment platforms may integrate with popular accounting software, enabling seamless data transfer and automation of tax calculations and payments.

- Blockchain Technology: Blockchain's secure and transparent nature could be leveraged to enhance the security and efficiency of excise tax payment systems, ensuring the integrity of tax data and transactions.

- Artificial Intelligence (AI) and Machine Learning: AI-powered systems can analyze vast amounts of tax data, identify patterns, and provide insights to improve tax compliance and efficiency. Machine learning algorithms can automate tax calculations and reduce human error.

- Mobile Payment Integration: With the increasing popularity of mobile payments, excise tax payment platforms may integrate with mobile wallets and payment apps, making tax payments even more accessible and convenient.

- Real-Time Tax Compliance Monitoring: Advanced analytics and data visualization tools can enable taxpayers and tax authorities to monitor tax compliance in real-time, identifying potential issues and facilitating timely interventions.

| Platform | Payment Methods |

|---|---|

| TaxPayOnline | Credit/Debit Cards, E-Wallets, Bank Transfers |

| GovTaxPay | Mobile Payments, Direct Debit, Cash Cards |

| eTaxHub | Cryptocurrency, Digital Wallets, Bank Wire Transfers |

What is excise tax, and how does it differ from other taxes?

+Excise tax is an indirect tax levied on specific goods and services, such as alcohol, tobacco, and fuel. Unlike income tax, which is a direct tax based on earnings, excise tax is imposed on the production, sale, or consumption of certain items. Excise taxes are often used to control consumption or generate revenue for specific purposes.

Are there any advantages to paying excise tax online compared to traditional methods?

+Absolutely! Paying excise tax online offers several advantages, including convenience, as it eliminates the need for physical visits to tax offices. It also provides real-time updates on tax compliance, reduces paperwork, and enhances security through robust data protection measures.

Can I access my tax history and payment records online?

+Yes, reputable online excise tax payment platforms provide users with access to their tax history and payment records. This feature allows taxpayers to track their compliance, view previous payments, and download payment receipts for future reference.

Are there any security concerns when paying excise tax online?

+Online payment platforms employ robust security measures to protect sensitive financial and tax-related information. However, it is important to ensure that you are using a legitimate and secure platform. Look for platforms with encryption protocols, secure payment gateways, and privacy policies that align with industry standards.