Richland County Real Estate Taxes

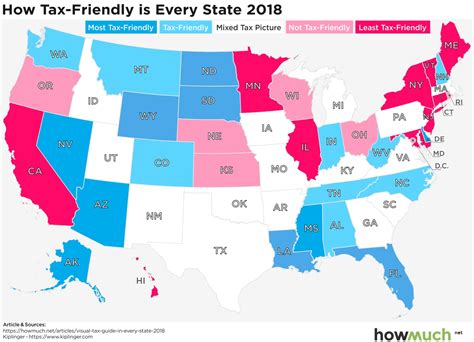

When it comes to property ownership, understanding the intricacies of real estate taxes is essential. Richland County, a vibrant and diverse community in the state of [State], presents its own unique tax landscape for homeowners and investors. This comprehensive guide delves into the specifics of Richland County real estate taxes, providing valuable insights and information to help navigate this critical aspect of property ownership.

Understanding Richland County’s Real Estate Tax System

Richland County operates under a comprehensive real estate tax system that plays a pivotal role in funding various public services and infrastructure development. The tax structure is designed to support the county’s growth and ensure the continuous improvement of its communities. Here’s a breakdown of the key components:

Tax Rates and Assessments

The real estate tax rate in Richland County is determined annually by the County Council and the Richland County Auditor’s Office. The tax rate is expressed as a millage rate, where one mill equals 1 of tax for every 1,000 of assessed property value. The county typically announces the new tax rate in the early part of the year, providing homeowners with an accurate assessment of their upcoming tax obligations.

Property assessments, which are conducted by the Richland County Assessor's Office, play a crucial role in determining the tax liability for each property owner. Assessments are based on a variety of factors, including the property's location, size, improvements, and overall market value. The assessment process aims to ensure fairness and equity among all property owners within the county.

| Year | Tax Rate (Mills) |

|---|---|

| 2023 | 10.2 |

| 2022 | 10.1 |

| 2021 | 9.9 |

Note: Tax rates are subject to change and may vary based on specific circumstances and property types.

Tax Exemptions and Credits

Richland County offers a range of tax exemptions and credits to eligible property owners. These incentives aim to support specific demographics and promote community development. Some of the notable exemptions and credits include:

- Homestead Exemption: This exemption reduces the assessed value of a property owner's primary residence, providing a tax savings benefit. To qualify, homeowners must meet residency and income criteria as outlined by the county.

- Senior Citizen Exemption: Richland County recognizes the contributions of its senior citizens by offering a tax exemption based on age and income. This exemption aims to ease the financial burden of real estate taxes for eligible seniors.

- Military Service Exemption: Active-duty military personnel and veterans can benefit from a partial or full exemption on their real estate taxes. This exemption honors the service and sacrifice of those who have served or are currently serving in the armed forces.

- Disability Exemption: Property owners with disabilities may be eligible for a tax exemption, reducing their tax liability. The criteria for this exemption are based on the severity of the disability and the impact it has on the property owner's ability to work.

Tax Payment Options and Deadlines

Richland County offers a variety of convenient payment options for real estate taxes. Property owners can choose from the following methods:

- Online Payment: The Richland County Treasurer's Office provides an online payment portal, allowing homeowners to securely pay their taxes using a credit/debit card or electronic check. This option is available 24/7 and offers a quick and efficient way to settle tax obligations.

- Mail-In Payment: Property owners can mail their tax payments to the Richland County Treasurer's Office. This traditional method requires a check or money order, along with the appropriate remittance form, to ensure accurate processing.

- In-Person Payment: For those who prefer face-to-face transactions, the Richland County Treasurer's Office accepts walk-in payments during regular business hours. Property owners can visit the office, located at [Address], to make their tax payments.

- Automatic Payment Plans: Richland County offers automatic payment plans, which allow property owners to have their taxes automatically deducted from their bank account on the due date. This option eliminates the need for manual payments and ensures timely tax settlements.

Tax payment deadlines are typically set for two installments per year. The exact dates may vary, but generally, the first installment is due in January, and the second installment is due in June. Late payments may incur penalties and interest, so it's crucial for property owners to stay informed about the specific deadlines to avoid additional costs.

The Impact of Real Estate Taxes on Property Owners

Real estate taxes are a significant consideration for property owners in Richland County. Understanding how these taxes impact their financial obligations and overall property ownership experience is essential. Here’s a deeper look at the implications:

Financial Planning and Budgeting

Real estate taxes contribute to a property owner’s overall financial obligations. When purchasing a property, it’s crucial to consider the tax liability as part of the long-term financial planning. The tax rate, assessment value, and potential exemptions or credits should be factored into the budget to ensure a sustainable and manageable ownership experience.

For existing homeowners, real estate taxes are a recurring expense that requires careful budgeting. Incorporating tax payments into the monthly or annual budget helps property owners stay prepared and avoid financial surprises. It's advisable to set aside funds specifically for tax obligations to maintain a healthy financial outlook.

Property Value and Market Trends

The real estate market in Richland County is influenced by a variety of factors, including economic conditions, local development projects, and, of course, real estate taxes. While taxes are just one piece of the puzzle, they can impact property values and market trends. Lower tax rates or the availability of exemptions can make a property more attractive to buyers, potentially increasing its value over time.

Conversely, higher tax rates or limited exemptions may affect the desirability of a property, impacting its resale value. Property owners should stay informed about market trends and consult with real estate professionals to understand how real estate taxes fit into the overall market dynamics of Richland County.

Community Development and Public Services

Real estate taxes play a crucial role in funding essential public services and community development projects. The revenue generated from these taxes is allocated to various areas, including:

- Education: Supporting local schools and ensuring quality education for the county's youth.

- Public Safety: Funding police, fire, and emergency response services to maintain a safe community.

- Infrastructure: Upgrading and maintaining roads, bridges, and other critical infrastructure.

- Social Services: Providing assistance to vulnerable populations and promoting community well-being.

- Economic Development: Investing in initiatives that stimulate business growth and create job opportunities.

By understanding the direct correlation between real estate taxes and community development, property owners can appreciate the role their tax contributions play in shaping a thriving and sustainable Richland County.

Navigating the Real Estate Tax Process

The real estate tax process in Richland County involves several key steps and considerations. Being familiar with these steps can help property owners navigate the process with confidence and efficiency.

Property Assessment and Appeal

Property assessments are conducted by the Richland County Assessor’s Office, as mentioned earlier. If a property owner believes their assessment is inaccurate, they have the right to appeal. The appeal process typically involves the following steps:

- Review the assessment notice: Property owners should carefully review the assessment notice they receive, noting any discrepancies or concerns.

- Gather supporting documentation: Gather evidence, such as recent sales of comparable properties or professional appraisals, to support your case.

- Submit an appeal: Property owners can submit an appeal to the Richland County Board of Assessment Appeals. The appeal should include a detailed explanation of why the assessment is inaccurate and the supporting documentation.

- Attend a hearing: If the appeal is accepted, a hearing will be scheduled. Property owners have the opportunity to present their case and provide additional evidence to the board.

- Receive a decision: After the hearing, the board will make a decision and notify the property owner of the outcome. If the appeal is successful, the assessed value may be adjusted, resulting in a lower tax liability.

Tax Billing and Payment

Once the tax rate and assessments are finalized, property owners will receive their tax bills. These bills outline the total tax liability, payment due dates, and available payment options. It’s crucial for property owners to carefully review their tax bills to ensure accuracy and take note of the payment deadlines.

Richland County provides various payment options, as discussed earlier, to accommodate different preferences and needs. Property owners should choose the method that suits them best and ensure timely payments to avoid late fees and penalties.

Resources and Support

Richland County offers a range of resources and support to help property owners navigate the real estate tax process. These resources include:

- County Websites: The official websites of Richland County and its relevant departments, such as the Assessor's Office and Treasurer's Office, provide valuable information, forms, and contact details. Property owners can find detailed explanations of the tax process, exemption guidelines, and frequently asked questions.

- Tax Professionals: Engaging the services of tax professionals, such as accountants or tax consultants, can provide expert guidance and support throughout the tax process. These professionals can help with tax planning, exemption applications, and appeal strategies.

- Community Workshops: Richland County may organize community workshops or educational events to inform property owners about real estate taxes. These workshops provide an opportunity to learn directly from county officials and ask questions in a group setting.

- Online Tools: Online tools and calculators are available to help property owners estimate their tax liability based on the current tax rate and their property's assessed value. These tools can aid in financial planning and provide a preliminary estimate of tax obligations.

Future Implications and Trends

Understanding the current state of Richland County’s real estate tax system is crucial, but staying informed about potential future developments is equally important. Here’s a look at some of the trends and implications that may shape the real estate tax landscape in the years to come:

Economic Factors and Tax Rates

The economic climate of Richland County plays a significant role in determining future tax rates. As the county’s economy grows and evolves, so too may its tax structure. Economic factors such as inflation, employment rates, and local business growth can influence the tax base and, consequently, the tax rates.

While it's challenging to predict exact tax rate changes, property owners should stay attuned to economic developments and engage with local government representatives to understand potential tax implications. Being proactive in understanding economic trends can help property owners prepare for any future adjustments in their tax obligations.

Population Growth and Development

Richland County’s population growth and development initiatives can have a direct impact on real estate taxes. As the county attracts new residents and businesses, the demand for public services and infrastructure increases. This growing demand may lead to adjustments in tax rates to accommodate the expanded needs of the community.

Additionally, new development projects, such as residential or commercial construction, can impact property values and tax assessments. Property owners should stay informed about local development plans and their potential impact on their own properties and the overall tax landscape.

Legislative Changes and Policy Updates

Changes in state and local legislation can bring about alterations to the real estate tax system. Policy updates may introduce new tax exemptions, modify existing ones, or adjust the tax calculation methods. Property owners should stay abreast of any legislative developments that could affect their tax obligations.

Richland County's government and relevant departments regularly communicate policy changes and provide updates on their official websites. Property owners can subscribe to newsletters, follow social media accounts, or attend public meetings to stay informed about potential tax-related legislative changes.

Community Engagement and Advocacy

Property owners have a vested interest in the real estate tax system and its future direction. Engaging with local government representatives and advocating for fair and equitable tax policies is an important aspect of community involvement. By participating in public meetings, providing feedback, and staying informed, property owners can influence the tax landscape and ensure it remains beneficial to all stakeholders.

Richland County encourages community engagement and provides various avenues for property owners to have their voices heard. By actively participating in the democratic process, property owners can contribute to shaping a tax system that supports the growth and well-being of the entire community.

Conclusion

Richland County’s real estate tax system is a critical component of property ownership, influencing financial planning, market trends, and community development. By understanding the intricacies of tax rates, assessments, exemptions, and payment options, property owners can navigate the tax process with confidence and make informed decisions.

Staying informed about economic factors, population growth, legislative changes, and community engagement opportunities allows property owners to adapt to future developments and ensure their tax obligations remain manageable. Richland County provides a wealth of resources and support to help property owners navigate the real estate tax landscape, ensuring a positive and sustainable ownership experience.

Frequently Asked Questions

How often are real estate tax rates updated in Richland County?

+

Real estate tax rates in Richland County are typically updated annually. The County Council and the Richland County Auditor’s Office review and set the new tax rate each year, taking into account economic factors and the county’s budgetary needs.

Are there any online resources to estimate my real estate tax liability?

+

Yes, Richland County provides online tools and calculators on its official website. These tools allow property owners to estimate their tax liability based on the current tax rate and their property’s assessed value. It’s a convenient way to get a preliminary estimate before receiving the official tax bill.

What happens if I miss the real estate tax payment deadline?

+

Missing the real estate tax payment deadline can result in late fees and penalties. Richland County imposes interest charges on late payments, which accumulate over time. It’s important to stay informed about the payment deadlines and take advantage of the various payment options to avoid any additional costs.

Can I apply for a real estate tax exemption online?

+

Yes, Richland County offers an online application process for certain real estate tax exemptions. Property owners can access the necessary forms and submit their applications electronically. However, it’s important to review the eligibility criteria and gather the required documentation before initiating the online application.

How can I stay informed about real estate tax changes and community developments in Richland County?

+

Richland County provides multiple channels for property owners to stay informed. Subscribing to the county’s official newsletter, following its social media accounts, and attending public meetings are excellent ways to receive updates on real estate tax changes, community developments, and legislative proposals. Additionally, the county’s websites often feature dedicated sections for real estate tax information and news.