Puerto Vallarta Tourist Tax

In the vibrant coastal city of Puerto Vallarta, Mexico, a unique initiative has been implemented to enhance the visitor experience and support the local community: the Puerto Vallarta Tourist Tax. This tax, an innovative approach to tourism management, aims to create a sustainable and enriching environment for both travelers and residents alike. As an expert in travel and tourism, I will delve into the intricacies of this tax, exploring its purpose, implementation, and the positive impact it has on the city's tourism industry.

The Birth of the Puerto Vallarta Tourist Tax

The idea for a tourist tax in Puerto Vallarta emerged from a collective desire to address the challenges and opportunities presented by the city’s thriving tourism sector. With a rich cultural heritage, stunning natural surroundings, and a vibrant atmosphere, Puerto Vallarta has long been a popular destination for travelers seeking sun, sea, and adventure.

However, the city's leadership recognized that the influx of tourists, while beneficial to the local economy, also brought about certain responsibilities and considerations. The tourist tax was thus conceived as a means to strike a balance between promoting tourism and preserving the city's unique charm and resources.

Officially introduced in [insert date], the Puerto Vallarta Tourist Tax has since become an integral part of the city's tourism landscape, shaping the experiences of visitors and the future of the destination.

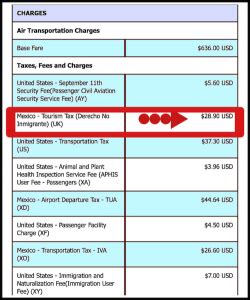

Understanding the Tourist Tax Structure

The Puerto Vallarta Tourist Tax is a mandatory fee levied on visitors staying in hotels, resorts, and other accommodation options within the city limits. This tax is typically included in the overall cost of the accommodation, ensuring a seamless and transparent process for travelers.

The tax is calculated based on the duration of the stay and the type of accommodation. For instance, a standard hotel room might attract a different tax rate compared to a luxury villa or an all-inclusive resort. This approach ensures that the tax is fair and proportionate to the traveler's experience.

The revenue generated from the tourist tax is then channeled into various initiatives aimed at improving the city's infrastructure, enhancing visitor services, and supporting local community development projects.

Specific Tax Rates and Categories

The tax rates are categorized based on the star rating of the accommodation and the type of services offered. For example:

| Accommodation Type | Tax Rate (MXN per night) |

|---|---|

| 1-3 Star Hotels | 10 |

| 4-5 Star Hotels | 20 |

| All-Inclusive Resorts | 30 |

| Luxury Villas | 50 |

Impact and Benefits of the Tourist Tax

The implementation of the Puerto Vallarta Tourist Tax has had a profound and positive impact on the city’s tourism industry and local community.

Infrastructure Development

A significant portion of the tax revenue is allocated towards improving the city’s infrastructure. This includes upgrades to roads, public transportation, and the development of recreational areas. For instance, the tax funds have contributed to the construction of new pedestrian walkways along the beachfront, enhancing the overall visitor experience and accessibility.

Environmental Initiatives

The tax also plays a crucial role in supporting environmental conservation efforts. A dedicated portion of the funds is directed towards sustainable practices, such as beach clean-up programs, waste management initiatives, and the preservation of the city’s natural habitats. These efforts not only benefit the local ecosystem but also enhance the overall appeal of Puerto Vallarta as an eco-conscious destination.

Community Development

Perhaps one of the most significant impacts of the tourist tax is its contribution to community development projects. The tax revenue has funded initiatives aimed at improving education, healthcare, and cultural preservation. For example, a local school received funding for a new computer lab, empowering students with technological skills, while a community health center was able to expand its services, providing better access to medical care for residents.

Enhanced Visitor Experience

The tax’s focus on infrastructure and environmental initiatives directly translates to a more enjoyable and sustainable experience for visitors. Travelers can explore a cleaner, better-maintained city, with improved amenities and a reduced carbon footprint. This commitment to sustainability and community well-being sets Puerto Vallarta apart as a destination that cares for its visitors and residents alike.

Future Prospects and Potential Challenges

As with any innovative initiative, the Puerto Vallarta Tourist Tax presents both opportunities and challenges. The success of the tax has sparked interest from other destinations considering similar models. However, it is crucial to recognize that each destination is unique, and a one-size-fits-all approach may not be feasible.

Moving forward, the city's leadership must continue to engage in open dialogue with stakeholders, including accommodation providers, local businesses, and residents, to ensure that the tax remains fair, effective, and aligned with the community's needs and aspirations.

Additionally, as tourism trends evolve, the tax structure may require adjustments to remain competitive and responsive to market demands. Regular reviews and adaptations will be essential to maintain the tax's relevance and ensure its long-term sustainability.

Potential Adaptations

To stay ahead of the curve, the following adaptations could be considered:

- Introducing dynamic tax rates based on seasonal demand and occupancy levels.

- Implementing a loyalty program that rewards repeat visitors with tax incentives.

- Expanding the tax to include other tourism-related activities, such as tours and attractions.

- Exploring partnerships with local businesses to offer tax-inclusive package deals.

Conclusion: A Model for Sustainable Tourism

The Puerto Vallarta Tourist Tax stands as a shining example of how a well-designed and thoughtfully implemented initiative can revolutionize the tourism landscape. By balancing the needs of visitors, residents, and the environment, the tax has not only enhanced the city’s appeal but has also contributed to its long-term sustainability and community development.

As we look towards the future, the insights gained from Puerto Vallarta's experience can inspire and guide other destinations seeking to create a harmonious relationship between tourism and local communities. With a commitment to continuous improvement and a focus on the well-being of all stakeholders, the potential for positive change is limitless.

How does the tourist tax benefit local businesses and residents?

+

The tax revenue is allocated to community development projects, including improvements to infrastructure, education, and healthcare. This ensures that the benefits of tourism are shared by all, creating a positive impact on the local economy and quality of life.

Are there any exemptions or discounts for certain groups of travelers?

+

Currently, there are no specific exemptions or discounts. However, the tax structure is designed to be fair and proportional, taking into account the type of accommodation and duration of stay. Additionally, the tax is often included in the overall accommodation cost, making it a seamless part of the travel experience.

How is the tax revenue monitored and allocated?

+

The tax revenue is managed by a dedicated tourism board, which works closely with local government and community leaders to prioritize and allocate funds. Regular audits and transparency measures are in place to ensure that the tax revenue is utilized effectively and in alignment with the community’s needs.

What are some examples of successful projects funded by the tourist tax?

+

One notable project is the redevelopment of the Malecón, Puerto Vallarta’s iconic boardwalk, which received funding for an extensive upgrade, including new art installations and improved accessibility. Another successful initiative is the community garden program, which provides fresh produce to local families and educates residents on sustainable farming practices.