Sales Tax Rate Seattle

Sales tax rates in the United States can vary significantly from state to state and even within different jurisdictions of a state. These rates are an essential consideration for both businesses and consumers, as they directly impact the final cost of goods and services. In this comprehensive guide, we will delve into the sales tax rates in Seattle, Washington, providing an in-depth analysis and practical insights.

Understanding Sales Tax in Seattle

Seattle, the vibrant hub of the Pacific Northwest, has a unique sales tax structure that consists of several components. The sales tax in Seattle is made up of a combination of state, county, and local taxes, each serving a specific purpose and contributing to the overall tax rate.

State Sales Tax

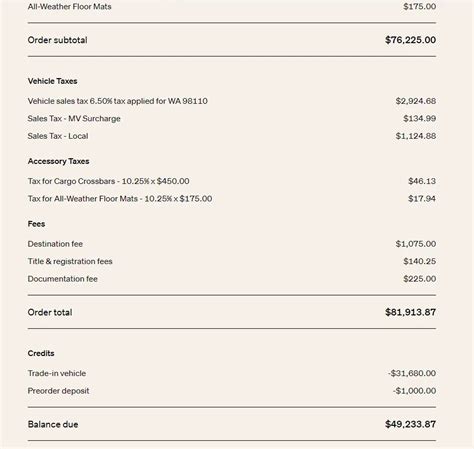

The state of Washington imposes a 6.5% sales tax rate on most tangible goods and certain services. This base rate is a crucial component of the overall tax structure and is applicable across the state, including Seattle.

| Category | Sales Tax Rate |

|---|---|

| General Merchandise | 6.5% |

| Restaurant Meals | 6.5% |

| Certain Services | 6.5% |

County Sales Tax

In addition to the state sales tax, King County, where Seattle is located, imposes its own 0.5% sales tax. This county tax is specifically allocated for funding transportation projects and initiatives within the county.

| Category | Sales Tax Rate |

|---|---|

| King County Tax | 0.5% |

City Sales Tax

The city of Seattle further adds to the sales tax with a 2.25% city tax. This tax is utilized to fund various city-wide projects, including infrastructure development and essential services.

| Category | Sales Tax Rate |

|---|---|

| Seattle City Tax | 2.25% |

Specialty Taxes

Seattle also has specific sales taxes for certain products or services. For example, there is a 0.1% tax for solid waste and a 0.5% tax for emergency medical services. These specialty taxes are designed to support specific city initiatives and services.

| Category | Sales Tax Rate |

|---|---|

| Solid Waste Tax | 0.1% |

| Emergency Medical Services Tax | 0.5% |

Calculating the Total Sales Tax in Seattle

To determine the total sales tax rate applicable in Seattle, we need to combine the various components. The total sales tax rate in Seattle is calculated as follows:

- State Tax (6.5%) + County Tax (0.5%) + City Tax (2.25%) + Specialty Taxes (0.6%) = 9.85%

Therefore, the total sales tax rate in Seattle is 9.85%, which is applied to most goods and services purchased within the city limits.

Example of Sales Tax Calculation

Let’s consider an example to illustrate how the sales tax is applied in Seattle. Suppose you purchase a laptop priced at $1,000 from a local retailer in Seattle.

- State Tax: $1,000 x 6.5% = $65

- County Tax: $1,000 x 0.5% = $5

- City Tax: $1,000 x 2.25% = $22.50

- Specialty Taxes: $1,000 x 0.6% = $6

The total sales tax on the laptop would be the sum of these components: $65 + $5 + $22.50 + $6 = $98.50. So, the final cost of the laptop, including sales tax, would be $1,098.50.

Impact on Businesses and Consumers

The sales tax rate in Seattle has a significant impact on both businesses and consumers. For businesses, especially those involved in retail, it is crucial to understand and accurately calculate the sales tax to ensure compliance with tax regulations. Mismanagement of sales tax can lead to legal issues and financial penalties.

From a consumer perspective, being aware of the sales tax rate is essential for making informed purchasing decisions. It allows individuals to budget effectively and understand the true cost of goods and services in Seattle. Additionally, the sales tax rate can influence consumer behavior, as higher taxes may encourage shoppers to seek alternatives or make purchases online to avoid the tax.

Tips for Businesses

- Stay Informed: Keep up-to-date with any changes in sales tax rates and regulations. Seattle’s tax structure can evolve, so it’s vital to monitor for updates.

- Accurate Calculation: Implement robust systems to ensure precise sales tax calculations. This helps maintain compliance and prevents errors that could lead to penalties.

- Pricing Strategies: Consider the impact of sales tax on your pricing strategy. Adjusting prices to accommodate the tax rate can make your products more competitive.

Advice for Consumers

- Research Before Purchasing: Be mindful of the sales tax rate when comparing prices. Understanding the tax can help you make cost-effective choices.

- Budget Planning: Factor the sales tax into your budget to ensure you can afford the items you need or want. This prevents financial surprises at the checkout.

- Online Shopping: If you’re looking to avoid sales tax, consider online retailers, but be cautious of shipping costs and potential delivery delays.

Conclusion

The sales tax rate in Seattle is a crucial aspect of the city’s economic landscape, impacting both businesses and consumers. By understanding the breakdown of the tax rates and their implications, individuals and businesses can make informed decisions. It is essential to stay informed about tax regulations to ensure compliance and take advantage of any available resources to navigate the tax landscape effectively.

FAQ

Are there any items exempt from sales tax in Seattle?

+

Yes, certain items are exempt from sales tax in Seattle. These typically include groceries, prescription medications, and certain medical devices. However, it’s important to check the specific exemptions provided by the Washington State Department of Revenue to ensure compliance.

How often do sales tax rates change in Seattle?

+

Sales tax rates can change periodically, usually as a result of legislative actions or ballot initiatives. It’s recommended to check for updates annually or whenever significant changes are expected.

Do tourists have to pay sales tax in Seattle?

+

Yes, tourists are subject to the same sales tax rates as local residents when making purchases in Seattle. It’s important for visitors to be aware of the tax rates to budget accordingly during their travels.