Alameda County Property Tax Lookup

Welcome to the comprehensive guide on the Alameda County Property Tax Lookup system. This resource is designed to empower property owners, real estate professionals, and interested individuals with the knowledge and tools to navigate the complex world of property taxation in Alameda County. By the end of this article, you'll have a thorough understanding of the process, the key players involved, and the steps you can take to ensure a smooth and efficient experience.

Understanding Property Taxes in Alameda County

Property taxes are a vital source of revenue for local governments, including counties like Alameda. These taxes are used to fund essential services such as schools, fire protection, public safety, and infrastructure development. The Alameda County Assessor’s Office plays a pivotal role in this process, as it is responsible for assessing the value of properties within the county and ensuring that taxes are levied fairly and accurately.

The Role of the Assessor’s Office

The Assessor’s Office is an independent entity, separate from the county government, ensuring impartiality in property valuation. Their primary functions include:

- Property Valuation: Assessing the market value of properties to determine the basis for taxation.

- Equalization: Ensuring that all properties within the county are assessed at the same level of value.

- Tax Roll Preparation: Creating the tax roll, which lists all taxable properties and their assessed values.

- Tax Collection: While not directly responsible for collection, the Assessor’s Office provides critical data for the Alameda County Treasurer-Tax Collector’s Office, which handles the actual collection process.

Tax Rates and Assessments

Property taxes in Alameda County are calculated based on the assessed value of a property and the applicable tax rate. The assessed value is determined by the Assessor’s Office and is typically updated every three years, or upon a change of ownership. The tax rate, on the other hand, is set by various taxing agencies, including the county, cities, special districts, and schools.

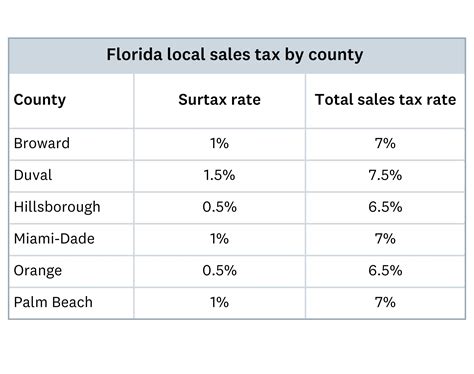

The standard tax rate in Alameda County is set at 1% of the assessed value, in accordance with Proposition 13, a landmark California law. However, there are additional rates and assessments that can be applied, such as:

- Supplemental Taxes: These are levied when there is a change in ownership or new construction, and they reflect the increased value of the property.

- Mello-Roos Taxes: Named after the legislation that authorized them, these taxes fund specific community improvements and are often applied in newly developed areas.

- Bond Assessments: These are used to repay bonds issued by local agencies for various public projects.

The Property Tax Lookup Process

The Alameda County Property Tax Lookup system provides a user-friendly platform for property owners and the public to access tax-related information. Here's a step-by-step guide to using this system:

Step 1: Access the Property Tax Lookup Portal

Begin by visiting the official website of the Alameda County Treasurer-Tax Collector’s Office. This is the primary gateway to tax-related services and information.

The portal URL is typically structured as follows: https://www.alamedactc.org. From the homepage, navigate to the "Property Tax Lookup" section, which is usually prominently displayed.

Step 2: Search for Your Property

Once you’ve accessed the Property Tax Lookup portal, you’ll be presented with a search interface. There are several ways to locate your property:

- Assessor Parcel Number (APN): If you have the APN, which is a unique identifier for each property, enter it into the search field. This is the fastest and most accurate way to find your property.

- Address Search: You can also search by street address. Simply enter the street number, name, and city. Note that this method may yield multiple results if there are multiple properties at the same address.

- Owner Search: If you’re researching multiple properties owned by the same individual or entity, you can search by owner name.

Step 3: Review Property Details

After locating your property, you’ll be directed to a detailed page that provides an array of information, including:

- Property Address: The physical location of the property.

- Assessed Value: The value upon which taxes are calculated.

- Tax Rates: The applicable tax rates for the current year.

- Tax Amount: The total amount of taxes due for the current fiscal year.

- Payment Status: Whether the taxes are current or delinquent.

- Assessment History: A record of changes in assessed value over time.

Step 4: Explore Additional Resources

The Property Tax Lookup portal often provides additional resources and tools. These may include:

- Tax Bill Information: Access to detailed tax bill information, including due dates and payment options.

- Tax Payment History: A record of past tax payments, which can be useful for budgeting and financial planning.

- Tax Appeals: Information on how to file an appeal if you believe your property has been over-assessed.

- Exemptions and Credits: Details on available exemptions and credits, such as the Homeowner’s Property Tax Exemption or the Senior Citizen’s Property Tax Postponement Program.

Key Considerations and Best Practices

When navigating the world of property taxes in Alameda County, there are several key considerations and best practices to keep in mind:

Stay Informed

Property tax laws and regulations can be complex and subject to change. Stay updated by regularly visiting the official websites of the Alameda County Assessor’s Office and the Treasurer-Tax Collector’s Office. Subscribe to their newsletters or follow their social media accounts for the latest news and announcements.

Understand Your Rights

As a property owner, you have certain rights and protections. Familiarize yourself with these, including the right to appeal your assessed value if you believe it is inaccurate or excessive. Know the timelines and procedures for appeals to ensure a timely and successful process.

Plan for Tax Payments

Property taxes are due twice a year, typically in February and November. Set reminders and plan your finances accordingly to ensure timely payments. Late payments can result in penalties and interest, which can quickly accumulate.

Explore Exemptions and Credits

Alameda County offers various exemptions and credits to eligible property owners. These can significantly reduce your tax liability. Research and apply for any programs for which you may qualify, such as the Homeowner’s Property Tax Exemption or the Disabled Veterans’ Property Tax Exemption.

Seek Professional Advice

If you have complex property holdings, are facing financial difficulties, or have questions about the tax process, consider seeking advice from a tax professional or accountant. They can provide personalized guidance and ensure you’re taking advantage of all available benefits and protections.

Conclusion

Navigating the world of property taxes can be daunting, but with the right tools and knowledge, it becomes a manageable process. The Alameda County Property Tax Lookup system is a valuable resource, providing transparency and accessibility to tax information. By understanding the assessment and collection process, staying informed, and taking advantage of available resources, property owners can ensure they are fairly and accurately assessed, and can plan their finances accordingly.

Frequently Asked Questions

How often are property taxes assessed in Alameda County?

+

Property taxes are assessed annually, and the assessed value is typically updated every three years or upon a change of ownership.

What happens if I miss a property tax payment deadline?

+

Late payments are subject to penalties and interest. It’s crucial to pay your taxes on time to avoid these additional charges.

Can I appeal my property’s assessed value?

+

Yes, you have the right to appeal your assessed value if you believe it is inaccurate or excessive. The appeal process is handled by the Alameda County Assessment Appeals Board.

Are there any exemptions or credits available to reduce my property taxes?

+

Absolutely! Alameda County offers several exemptions and credits, including the Homeowner’s Property Tax Exemption and the Senior Citizen’s Property Tax Postponement Program. Explore these options to potentially reduce your tax liability.

Where can I find more information about the property tax process in Alameda County?

+

The official websites of the Alameda County Assessor’s Office and the Treasurer-Tax Collector’s Office are excellent resources. You can also contact their offices directly for personalized assistance.