T Mobile Plan Tax Fee Change

In the ever-evolving landscape of telecommunications, the recent news about T-Mobile's plan tax and fee changes has sparked curiosity among consumers. This article aims to delve into the intricacies of these modifications, shedding light on their implications and offering a comprehensive understanding of how they might impact subscribers.

Understanding the T-Mobile Tax and Fee Structure

T-Mobile, a leading telecommunications provider, has historically levied various taxes and fees on its customers’ monthly bills. These charges, while often a source of confusion, are essential components of the company’s revenue model and are influenced by a multitude of factors.

To better comprehend the upcoming changes, let's explore the current tax and fee landscape within T-Mobile's services.

Taxes and Fees: A Breakdown

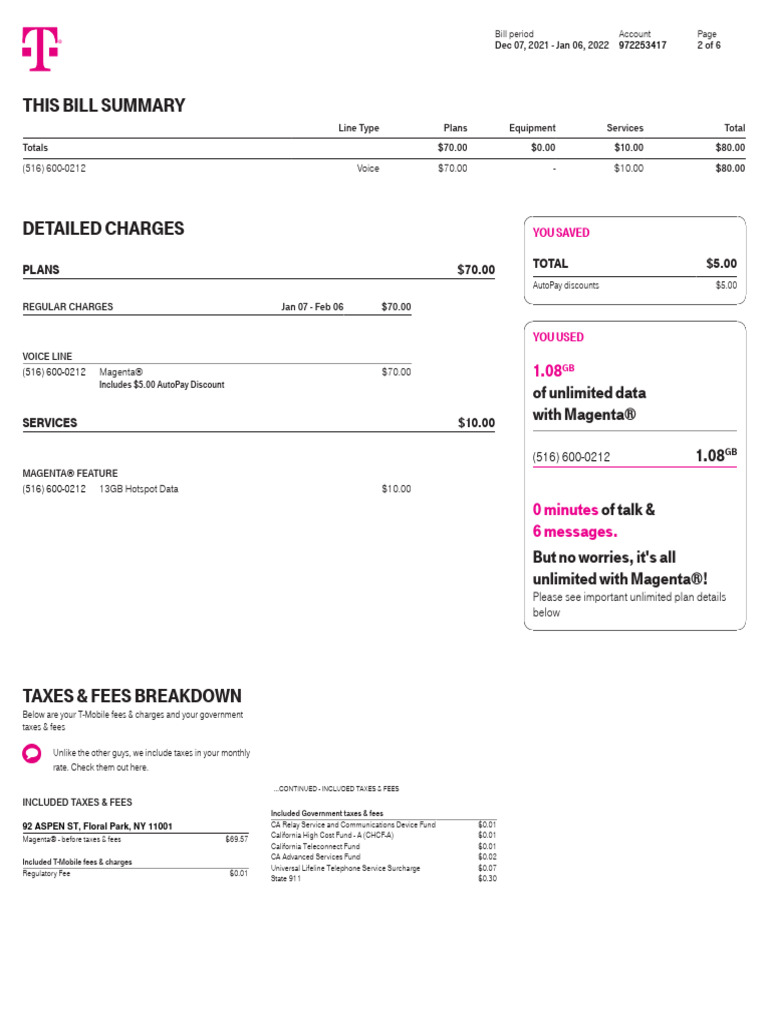

T-Mobile’s tax and fee structure is diverse, encompassing a range of charges that contribute to the overall cost of the service. Here’s a breakdown of some common components:

- Federal and State Taxes: These taxes are mandated by the government and can vary based on the subscriber's location. They include federal excise taxes, state sales taxes, and sometimes even local taxes.

- Regulatory Fees: These fees are imposed by regulatory bodies to support the telecommunications industry's infrastructure and operations. Examples include the Universal Service Fund (USF) and the Federal Universal Service Charge (FUSC).

- Administrative Fees: T-Mobile charges administrative fees to cover the costs associated with managing and administering customer accounts. These fees are typically a flat rate, regardless of the plan's features or data usage.

- Other Fees: Depending on the plan and service, T-Mobile may charge additional fees. For instance, international calling plans may have specific fees associated with long-distance calls, while certain data plans might include charges for data overages.

It's important to note that the exact breakdown of taxes and fees can vary based on the subscriber's plan, location, and other factors. T-Mobile provides detailed billing statements to ensure transparency and help customers understand the charges on their monthly bills.

The Upcoming Changes

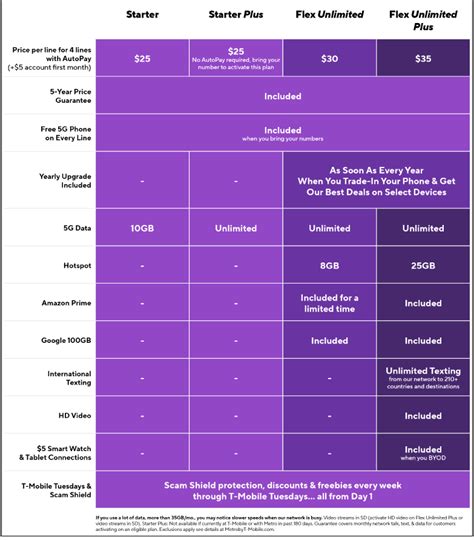

T-Mobile has recently announced an impending alteration to its tax and fee structure. While the specifics are still unfolding, early indications suggest that the company aims to simplify and potentially reduce certain fees while maintaining a competitive pricing strategy.

One of the key changes expected is a consolidation of regulatory fees. Currently, T-Mobile bills customers for various regulatory fees, each with its own designation and purpose. By consolidating these fees, the company aims to provide a more straightforward and transparent billing experience for its subscribers.

Additionally, T-Mobile is rumored to be exploring ways to reduce certain administrative fees. This move could lead to a more favorable billing scenario for customers, especially those with high-value plans or long-standing accounts. However, it's important to note that the reduction in administrative fees may not apply uniformly across all plans and services.

Impact on Subscribers: A Comprehensive Analysis

The changes to T-Mobile’s tax and fee structure are likely to have a mixed impact on subscribers, depending on their specific circumstances and plan choices.

Potential Benefits

The consolidation of regulatory fees and potential reduction in administrative costs could lead to more straightforward and transparent billing. This simplification can make it easier for subscribers to understand their monthly charges, reducing confusion and potential disputes.

Furthermore, if T-Mobile successfully reduces certain fees, it could result in lower overall costs for subscribers. This is especially beneficial for those who have been with the company for an extended period or have high-value plans, as they may experience a more significant reduction in their monthly bills.

Potential Challenges

While the changes may bring benefits, there are also potential challenges to consider. Firstly, not all subscribers may experience the same level of fee reduction. T-Mobile’s strategy may focus on specific plans or customer segments, leaving others with little to no change in their monthly charges.

Additionally, the simplification of the tax and fee structure could lead to increased costs for certain services. While T-Mobile aims to reduce administrative fees, it may offset these reductions by increasing charges in other areas, such as data overage fees or international calling rates. This shift could result in a net increase in costs for subscribers who frequently utilize these services.

Performance Analysis and Industry Comparisons

To understand the potential impact of T-Mobile’s tax and fee changes, it’s essential to analyze the company’s performance and compare it with its competitors.

T-Mobile’s Market Position

T-Mobile has consistently been a disruptor in the telecommunications industry, known for its innovative plans and competitive pricing. The company’s recent growth and market share gains are a testament to its successful strategies.

By focusing on customer-centric plans and transparent pricing, T-Mobile has attracted a loyal customer base. The upcoming tax and fee changes can be seen as a continuation of this strategy, aiming to further enhance customer satisfaction and loyalty.

Competitor Analysis

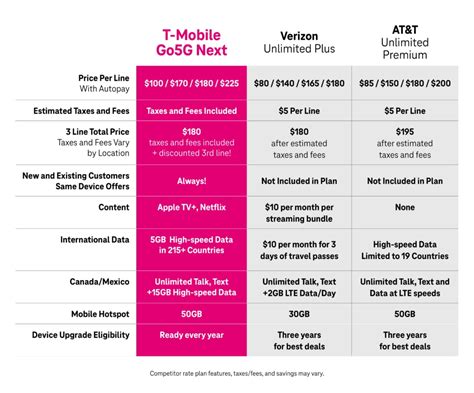

In the highly competitive telecommunications market, T-Mobile’s rivals, such as Verizon and AT&T, also levy taxes and fees on their customers. However, the approach and structure of these charges can vary significantly.

For instance, Verizon tends to have a more straightforward tax and fee structure, with a focus on federal and state taxes. On the other hand, AT&T offers a range of plans with varying fee structures, often including regulatory and administrative fees similar to T-Mobile.

By comparing these competitors, T-Mobile can gauge the potential impact of its tax and fee changes and ensure that its strategies remain competitive and attractive to subscribers.

Future Implications and Strategies

The upcoming tax and fee changes at T-Mobile are not isolated incidents but part of a broader strategy to enhance customer satisfaction and retain subscribers.

Customer-Centric Approach

T-Mobile’s decision to simplify and potentially reduce fees aligns with its customer-centric approach. By making its billing structure more transparent and reducing certain costs, the company aims to foster a positive customer experience.

This strategy is especially crucial in today's highly competitive market, where customer loyalty is hard-earned and easily lost. By prioritizing customer satisfaction, T-Mobile can differentiate itself and build a strong reputation.

Long-Term Growth Strategies

While the immediate focus is on fee simplification and reduction, T-Mobile’s long-term growth strategies are multifaceted. The company continues to invest in its network infrastructure, enhancing coverage and reliability to meet the growing demands of its subscribers.

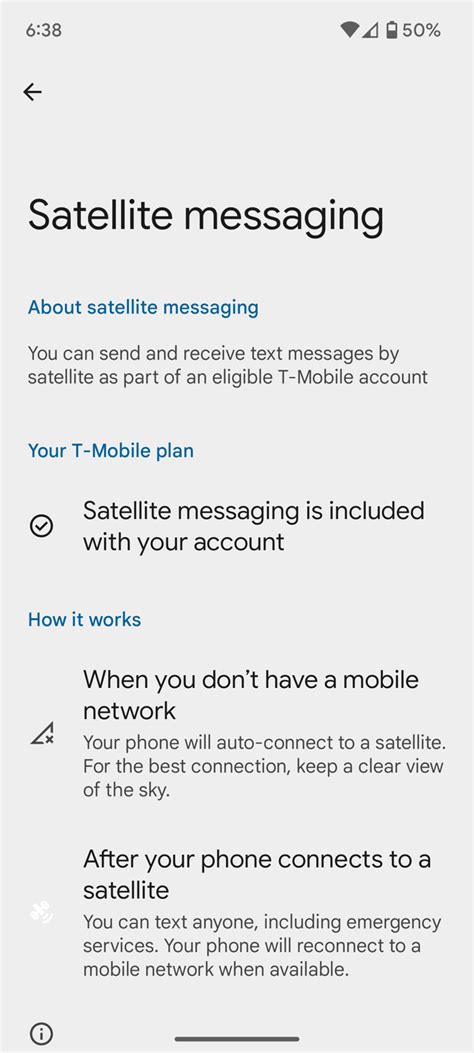

Additionally, T-Mobile is actively exploring new technologies and services, such as 5G networks and innovative data plans. By staying at the forefront of technological advancements, the company can offer its subscribers a future-proof experience and maintain its competitive edge.

| Metric | Value |

|---|---|

| Network Coverage | T-Mobile's network covers over 99% of the US population, with a focus on urban and suburban areas. |

| 5G Deployment | T-Mobile has deployed its 5G network in over 3,500 cities and towns, with plans to expand further. |

| Customer Satisfaction | T-Mobile consistently ranks highly in customer satisfaction surveys, with a focus on transparent billing and innovative plans. |

Conclusion

The T-Mobile plan tax and fee changes are part of a larger strategy to enhance customer experience and maintain competitiveness. While the specifics are still evolving, the company’s commitment to transparency and cost reduction is evident.

As T-Mobile continues to innovate and adapt, subscribers can expect a more straightforward and potentially more affordable billing experience. This evolution is a testament to the company's customer-centric approach and its dedication to staying at the forefront of the telecommunications industry.

When will the tax and fee changes take effect?

+The exact implementation date is not yet known, but T-Mobile has indicated that the changes will be implemented gradually over the coming months.

Will all subscribers benefit from the fee reductions?

+While the company aims to reduce fees, the extent of the reduction may vary based on the plan and customer segment. Some subscribers may see a significant decrease, while others might experience minimal changes.

How can I stay informed about these changes?

+T-Mobile typically communicates such changes through official channels, including its website, mobile app, and customer service. Subscribers can also opt into receiving updates and notifications to stay informed.