King County Sales Tax

King County, nestled in the picturesque Pacific Northwest region of the United States, is home to vibrant cities, diverse landscapes, and a thriving economy. Among the various aspects that contribute to its economic growth, the King County Sales Tax plays a significant role. This article aims to delve into the intricacies of the King County Sales Tax, exploring its history, structure, impact on businesses and consumers, and its overall significance within the county's economic landscape.

Understanding the King County Sales Tax

The King County Sales Tax is a consumption tax imposed on the sale of goods and certain services within the county’s boundaries. It is a crucial revenue source for local government, contributing to the funding of essential public services, infrastructure development, and community initiatives. With a rich history spanning several decades, the sales tax has evolved to meet the changing needs of the county’s residents and businesses.

The tax structure in King County is designed to promote economic growth while ensuring fairness and efficiency. It is a cumulative tax, meaning that the tax is applied at each stage of the production and distribution process, from manufacturers to retailers. This approach allows for a more equitable distribution of tax responsibilities and encourages businesses to pass on the tax burden to consumers.

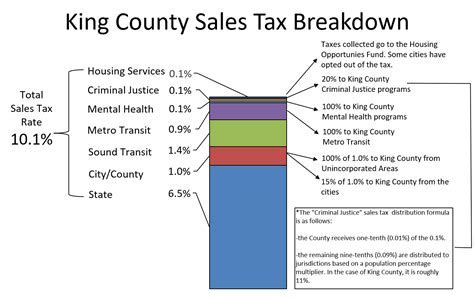

The sales tax rate in King County consists of both a state and a local component. The state sales tax rate, which is uniform across Washington, currently stands at 6.5%. On top of this, King County imposes an additional 2.0% local sales tax, bringing the total combined rate to 8.5% for most transactions within the county.

However, it's important to note that not all transactions are subject to the full tax rate. Certain items, such as groceries, prescription medications, and some services, are exempt from the sales tax or have a reduced rate. These exemptions aim to alleviate the tax burden on essential goods and services, making them more affordable for consumers.

Historical Perspective

The origins of the King County Sales Tax can be traced back to the early 20th century when the state of Washington first implemented a sales tax to generate revenue for its burgeoning public infrastructure projects. Over the years, the tax rate has undergone several adjustments, both at the state and local levels, to adapt to changing economic conditions and community needs.

One notable milestone in the history of King County's sales tax was the passage of the Voter-Approved Sales and Car Tab Tax in 2019. This initiative, approved by county residents, increased the local sales tax rate by 0.5% and introduced a vehicle registration fee to fund critical transportation projects. The additional revenue generated has played a pivotal role in improving the county's transportation infrastructure, enhancing mobility, and reducing congestion.

Impact on Businesses and Consumers

The King County Sales Tax has a significant impact on both businesses and consumers within the county. For businesses, the tax serves as a source of revenue to support their operations and contribute to the local economy. It provides funding for essential public services, such as public safety, education, and healthcare, which in turn create a favorable business environment and attract investment.

However, the sales tax also presents challenges for businesses, particularly those operating on thin margins. The tax adds to the cost of doing business, impacting pricing strategies and potentially affecting competitiveness. To mitigate these challenges, businesses often pass on a portion of the tax to consumers, which can influence consumer behavior and purchasing decisions.

For consumers, the sales tax is a visible component of their purchasing experience. It adds to the overall cost of goods and services, and consumers must consider it when making purchasing decisions. The tax can impact household budgets, particularly for lower-income individuals and families, as it represents a significant portion of their disposable income. However, the exemptions and reduced rates for essential items help alleviate this burden to some extent.

Tax Compliance and Administration

Ensuring compliance with the King County Sales Tax is crucial for both businesses and the government. Businesses are responsible for collecting and remitting the tax to the appropriate authorities, often requiring dedicated resources and expertise. The Washington State Department of Revenue plays a key role in administering and enforcing the sales tax, providing guidance and support to businesses and consumers alike.

The department offers a range of resources, including online tools and publications, to assist businesses in understanding their tax obligations and ensuring accurate tax collection and remittance. Regular audits and enforcement measures are also conducted to maintain compliance and prevent tax evasion. This comprehensive approach to tax administration helps ensure a fair and transparent system for all stakeholders.

Economic Significance and Future Outlook

The King County Sales Tax is a vital component of the county’s economic ecosystem, contributing to its overall fiscal health and stability. The revenue generated from the tax supports a wide range of public services and infrastructure projects, which in turn drive economic growth and enhance the quality of life for residents.

Looking ahead, the future of the King County Sales Tax is closely tied to the county's economic trajectory and community priorities. As the county continues to evolve and adapt to changing demographics and technological advancements, the sales tax may undergo further adjustments to meet emerging needs. For instance, the rise of e-commerce and online sales presents new challenges and opportunities for tax administration, which the county will need to navigate effectively.

Furthermore, the ongoing debate surrounding tax fairness and equity is likely to influence future decisions regarding the sales tax. As policymakers and community leaders consider the impact of the tax on different socioeconomic groups, they may explore alternative revenue sources or adjust existing tax structures to promote a more equitable distribution of the tax burden.

Diversifying Revenue Streams

Recognizing the limitations of relying solely on sales tax revenue, King County has been proactive in exploring and implementing additional revenue streams. One notable initiative is the Commercial Rent Tax, which imposes a tax on commercial rental income, providing a stable source of revenue to support essential services. This approach not only diversifies the county’s revenue portfolio but also helps distribute the tax burden more equitably across different sectors of the economy.

| Sales Tax Rate in King County | Rate |

|---|---|

| State Sales Tax | 6.5% |

| Local Sales Tax | 2.0% |

| Total Combined Rate | 8.5% |

Conclusion

In conclusion, the King County Sales Tax is a multifaceted and essential component of the county’s economic landscape. It serves as a crucial revenue source, funding vital public services and infrastructure, while also presenting challenges and opportunities for businesses and consumers. As King County continues to thrive and evolve, the sales tax will remain a key driver of its economic growth and prosperity, shaping the county’s future in significant ways.

How does the King County Sales Tax compare to other counties in Washington State?

+The sales tax rate in King County is slightly higher than the average sales tax rate in Washington State. While the state sales tax rate is uniform at 6.5%, King County imposes an additional 2.0% local sales tax, resulting in a combined rate of 8.5%. This rate is comparable to other urban counties in the state, reflecting the higher demand for public services and infrastructure in more densely populated areas.

What are the main exemptions or reduced rates in the King County Sales Tax?

+The King County Sales Tax exempts certain items to alleviate the tax burden on essential goods and services. These exemptions include groceries, prescription medications, and some services like medical and dental care. Additionally, there are reduced rates for specific items like residential rent and some business-to-business transactions.

How does the sales tax revenue benefit King County residents?

+The revenue generated from the King County Sales Tax supports a wide range of public services and infrastructure projects that directly benefit residents. This includes funding for education, public safety, healthcare, transportation improvements, and community initiatives. By investing in these areas, the sales tax revenue enhances the overall quality of life and economic prosperity within the county.