Sales Tax Florida Miami

The topic of sales tax in Florida, particularly in the city of Miami, is an important aspect of understanding the financial landscape for both residents and businesses in the area. Sales tax regulations can have a significant impact on the cost of goods and services, influencing consumer behavior and business strategies. In this comprehensive article, we will delve into the specifics of sales tax in Miami, exploring the rates, exemptions, and implications for various industries and consumers.

Understanding Sales Tax in Miami, Florida

Miami, situated in the vibrant state of Florida, is renowned for its diverse culture, stunning beaches, and thriving business environment. However, alongside its attractions, it is essential for residents and entrepreneurs to grasp the intricacies of sales tax, which plays a crucial role in the city’s economic ecosystem.

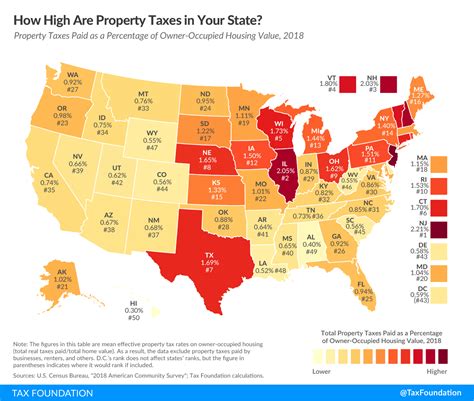

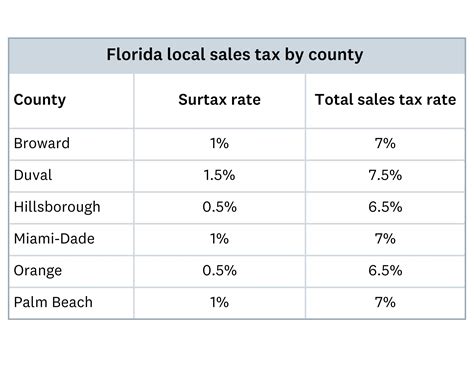

Sales tax in Miami, like the rest of Florida, operates under a complex yet well-defined system. The state of Florida imposes a uniform sales tax rate, which serves as a foundation for local governments and municipalities to build upon. This base rate is then subject to additional surcharges and variations, resulting in a unique tax landscape for each region.

Sales Tax Rates in Miami

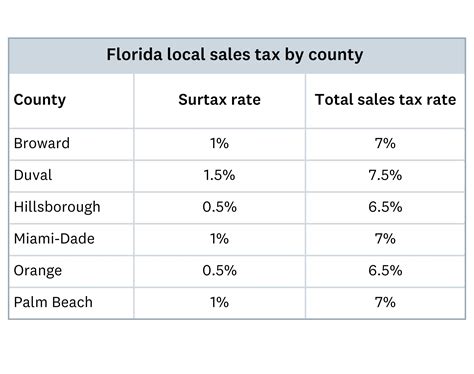

As of the latest data, the sales tax rate in Miami stands at 7%. This rate is applicable to most tangible goods and certain services within the city limits. It is important to note that Miami’s sales tax rate is slightly higher than the state’s standard rate due to additional local surcharges.

| Sales Tax Category | Rate |

|---|---|

| General Sales Tax Rate (Miami) | 7% |

| State Sales Tax Rate (Florida) | 6% |

| Local Surcharge (Miami) | 1% |

The local surcharge of 1% is a crucial distinction for Miami residents and businesses, as it sets the city apart from other areas in Florida. This additional tax contributes to the city's revenue and is often used to fund local initiatives and infrastructure projects.

Sales Tax Exemptions in Miami

While the sales tax rate in Miami is relatively straightforward, there are certain exemptions and special considerations that businesses and consumers should be aware of. Understanding these exemptions can help individuals and businesses navigate the tax landscape more efficiently.

Some notable sales tax exemptions in Miami include:

- Grocery Exemptions: Certain food items and groceries are exempt from sales tax in Miami, providing a much-needed relief for households and grocery stores alike. This exemption encourages healthy eating habits and supports the local food industry.

- Prescription Drugs: Sales tax is not applicable to prescription medications, making healthcare more affordable for residents and ensuring that necessary medical treatments are accessible.

- Educational Resources: Books, educational supplies, and certain school-related items are exempt from sales tax, promoting education and making learning resources more accessible to students and educators.

- Industrial Machinery: To support the growth of industries, sales tax is waived on purchases of industrial machinery and equipment, encouraging businesses to invest in technology and infrastructure.

These exemptions, among others, demonstrate Miami's commitment to supporting its residents and fostering a robust business environment. By providing tax relief in specific areas, the city encourages economic growth and enhances the overall quality of life for its citizens.

The Impact of Sales Tax on Miami’s Economy

Sales tax in Miami plays a pivotal role in shaping the city’s economic landscape, influencing both consumer behavior and business strategies. Understanding the impact of sales tax is crucial for businesses looking to establish themselves in the region and for residents seeking to make informed financial decisions.

Consumer Perspective

For consumers in Miami, sales tax can significantly affect their purchasing power and overall spending habits. The 7% sales tax rate means that every purchase, from groceries to luxury items, carries an additional cost. This can influence consumer choices, with some individuals opting for online shopping or traveling to neighboring areas with lower tax rates to save on their purchases.

However, the presence of sales tax also encourages consumers to support local businesses, as shopping locally often provides a more convenient and personalized experience. Additionally, the tax revenue generated benefits the community, funding essential services and infrastructure improvements that directly impact residents' daily lives.

Business Implications

Businesses operating in Miami must carefully consider the impact of sales tax on their operations and pricing strategies. The additional 1% local surcharge, for instance, can affect a business’s profitability, especially for those with thin margins. As a result, companies may need to adjust their pricing models or seek ways to minimize the tax burden.

On the other hand, sales tax can also be leveraged as a strategic tool. By offering tax-inclusive pricing or highlighting tax savings, businesses can attract customers and differentiate themselves from competitors. Moreover, understanding the sales tax landscape can help businesses plan their inventory and supply chain more efficiently, ensuring compliance and minimizing tax-related surprises.

Industry-Specific Considerations

The impact of sales tax extends beyond general consumer goods and services. Different industries in Miami face unique challenges and opportunities when it comes to sales tax.

- Retail: Retailers in Miami must navigate the complexities of sales tax, ensuring accurate taxation on various products. From clothing to electronics, each item may have different tax implications, requiring precise record-keeping and tax compliance.

- Tourism and Hospitality: Miami's vibrant tourism industry must consider sales tax when pricing accommodations, dining, and attractions. The tax rate can influence the overall cost of a tourist's stay, affecting their spending habits and potentially impacting the local economy.

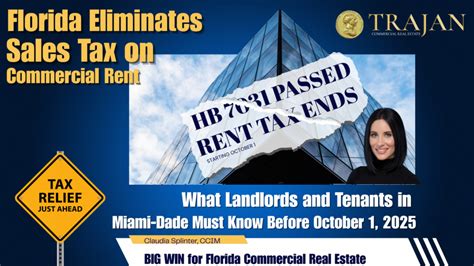

- Construction and Real Estate: The construction and real estate sectors in Miami are subject to sales tax on materials and services. Understanding these tax obligations is crucial for developers and contractors, as it can impact project costs and profitability.

In conclusion, sales tax in Miami is a critical aspect of the city's economic framework. It influences consumer behavior, shapes business strategies, and contributes to the city's revenue. By understanding the rates, exemptions, and implications, residents and businesses can make informed decisions, ensuring their financial well-being and contributing to Miami's continued growth and prosperity.

Are there any upcoming changes to the sales tax rate in Miami?

+As of the latest information, there are no confirmed plans for an immediate change in the sales tax rate. However, it is essential to stay updated, as tax policies can evolve over time. Monitoring local news and official government announcements is advisable to stay informed about any potential adjustments.

How does Miami’s sales tax compare to other major cities in Florida?

+Miami’s sales tax rate of 7% is slightly higher than the state’s standard rate due to the additional local surcharge. While other cities in Florida may have different surcharges, Miami’s rate is competitive and reflects the city’s unique needs and initiatives.

Are there any sales tax holidays in Miami?

+Yes, Miami, like other areas in Florida, occasionally observes sales tax holidays. These are designated periods when certain items, often back-to-school supplies or hurricane preparedness goods, are exempt from sales tax. These holidays provide a great opportunity for consumers to save on essential purchases.

How can businesses ensure compliance with sales tax regulations in Miami?

+Businesses should consult with tax professionals and utilize reliable accounting software to stay compliant with sales tax regulations. Regularly updating their knowledge of tax laws, keeping accurate records, and seeking guidance when needed are essential practices to avoid penalties and maintain a positive relationship with tax authorities.