Glendale Sales Tax

Understanding sales tax is essential for businesses and consumers alike, as it plays a significant role in the economic landscape of any region. In the vibrant city of Glendale, Arizona, sales tax regulations are a crucial aspect of doing business. This article aims to delve into the specifics of Glendale's sales tax, providing an in-depth analysis and a comprehensive guide for those operating within this dynamic market.

Unraveling the Complexity of Glendale’s Sales Tax

The sales tax landscape in Glendale, like many other cities, is a complex interplay of federal, state, and local regulations. As of [current date], Glendale’s sales tax rate stands at [current rate]%, which is composed of various tax components.

The Breakdown: State, County, and City Taxes

Glendale’s sales tax rate is a combination of the state sales tax, county tax, and city tax. The Arizona state sales tax currently sits at [state tax rate]%, a standard rate applicable across the state. However, the county and city of Glendale impose additional taxes to fund local initiatives and services.

The Maricopa County sales tax, where Glendale is located, adds [county tax rate]% to the total sales tax. This county tax is crucial for funding various county-wide projects and services. On top of that, the Glendale city sales tax contributes [city tax rate]%, which is specifically allocated for the city's development and maintenance.

| Tax Component | Rate |

|---|---|

| Arizona State Sales Tax | [state tax rate]% |

| Maricopa County Sales Tax | [county tax rate]% |

| Glendale City Sales Tax | [city tax rate]% |

| Total Sales Tax in Glendale | [total tax rate]% |

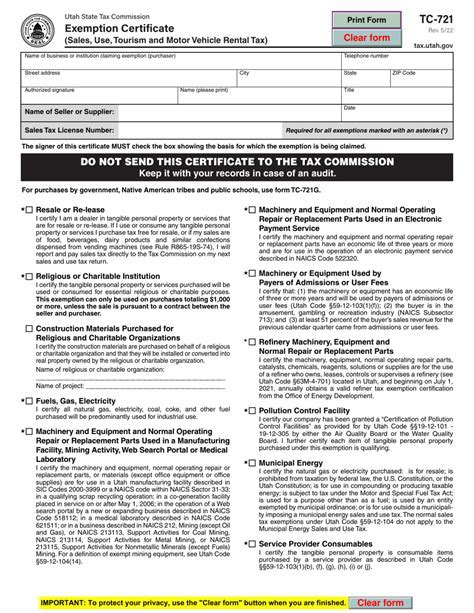

Sales Tax Exemptions: Navigating the Fine Print

While sales tax is a common feature of retail transactions, it’s not applicable to all goods and services. Glendale, like many jurisdictions, offers sales tax exemptions for specific items. These exemptions are designed to encourage certain behaviors or support particular industries.

Some common sales tax exemptions in Glendale include:

- Grocery items: Essential food items are often exempt from sales tax, making grocery shopping more affordable for residents.

- Prescription medications: Sales tax is typically waived for pharmaceutical products, ensuring that healthcare remains accessible.

- Educational materials: Textbooks, school supplies, and other educational resources may be exempt, supporting the city's commitment to education.

- Manufacturing equipment: Sales tax exemptions for certain machinery and equipment can incentivize businesses to invest in manufacturing within the city.

Sales Tax Collection: Best Practices for Businesses

For businesses operating in Glendale, effective sales tax collection and remittance are essential. Here are some key considerations to ensure compliance:

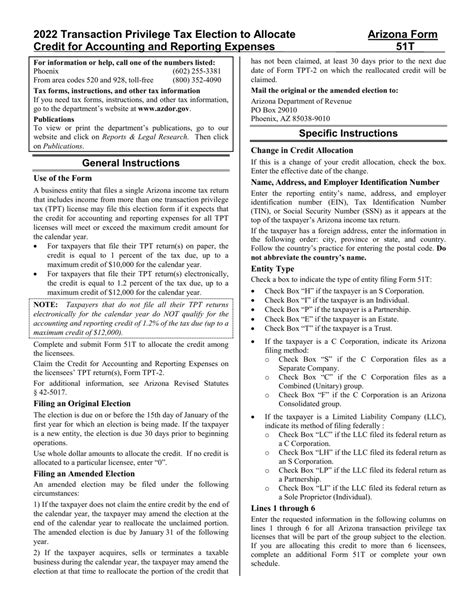

- Registration and Permits: All businesses must register with the Arizona Department of Revenue to obtain a Transaction Privilege Tax (TPT) License. This license is crucial for legally conducting business within the state and city.

- Sales Tax Calculation: Ensure that your point-of-sale systems are configured to accurately calculate the total sales tax, taking into account the various tax rates and exemptions.

- Record-Keeping: Maintain detailed records of all sales transactions, including the tax breakdown. This is essential for audits and ensures that your business remains in good standing with the tax authorities.

- Remittance Schedule: Timely remittance of sales tax is critical. Businesses typically remit sales tax on a monthly or quarterly basis, depending on their sales volume. Stay updated with the remittance deadlines to avoid penalties.

The Impact of Sales Tax on Local Economy

Sales tax is a vital revenue stream for the city of Glendale, contributing significantly to its economic health and development. The funds generated from sales tax are allocated towards various public services and infrastructure projects, shaping the city’s future.

Some key areas where sales tax revenue is invested include:

- Public safety: Funding for police, fire, and emergency services.

- Education: Supporting local schools and educational initiatives.

- Infrastructure: Upgrading roads, parks, and public spaces.

- Community development: Investing in economic growth and job creation.

Future Trends and Considerations

The sales tax landscape is dynamic, and Glendale is no exception. As the city continues to grow and evolve, sales tax regulations may undergo changes to adapt to the evolving economic needs. Here are some future considerations:

- E-commerce and Online Sales: With the rise of online shopping, the collection and remittance of sales tax for e-commerce transactions is a growing focus for tax authorities. Businesses operating in this space should stay updated with the latest regulations.

- Tax Reform Initiatives: The city and state may explore tax reform measures to streamline the sales tax system, improve compliance, and potentially offer incentives for certain industries.

- Community Engagement: Sales tax revenue is a direct reflection of the community's spending habits. As such, understanding consumer behavior and preferences can influence the allocation of these funds to meet the community's needs.

Conclusion: Navigating Glendale’s Sales Tax Landscape

Glendale’s sales tax system is a complex yet crucial aspect of the city’s economic framework. For businesses, understanding and complying with sales tax regulations is essential for legal operations and community engagement. For consumers, it’s a reminder of the vital role they play in shaping their city through their spending choices.

As Glendale continues to thrive and develop, its sales tax regulations will evolve to support its growth. Staying informed and adapting to these changes will be key for both businesses and residents alike.

What is the penalty for not remitting sales tax on time in Glendale?

+

Late remittance of sales tax can result in penalties and interest charges. The exact penalty amount varies based on the delay and the total amount due. It’s crucial to stay updated with the remittance schedule to avoid these additional costs.

Are there any special sales tax rates for tourism-related businesses in Glendale?

+

Yes, businesses involved in tourism and hospitality may be subject to a transient occupancy tax (also known as a hotel or lodging tax) in addition to the standard sales tax. This tax is typically applied to the rental of hotel rooms and similar accommodations.

How often do sales tax rates change in Glendale, and how are they determined?

+

Sales tax rates can change periodically, often as a result of legislative decisions at the state and local levels. These changes are typically made to adjust for economic factors, fund specific projects, or address budgetary concerns. It’s important for businesses and consumers to stay updated with any changes to the sales tax rates.

Can individuals claim a refund for sales tax paid in Glendale if they are exempt?

+

Yes, individuals who are exempt from sales tax, such as certain charitable organizations or government entities, can claim a refund for any sales tax paid inadvertently. The process involves completing the necessary forms and providing documentation to support the exemption.