Rental Taxes In Utah

Utah, known for its stunning natural landscapes and thriving tourism industry, has a unique approach to rental taxes. This state's tax system for rentals differs significantly from many other regions, offering a distinct set of rules and regulations that landlords, property managers, and tenants should be well-versed in. In this comprehensive guide, we will delve into the intricacies of rental taxes in Utah, covering everything from the types of taxes applicable to rentals to strategies for effective tax management.

Understanding Rental Taxes in Utah

Utah imposes a range of taxes on rental properties, which can be broadly categorized into two main types: property taxes and rental income taxes. These taxes contribute to the state’s revenue and help fund various public services and infrastructure projects.

Property Taxes

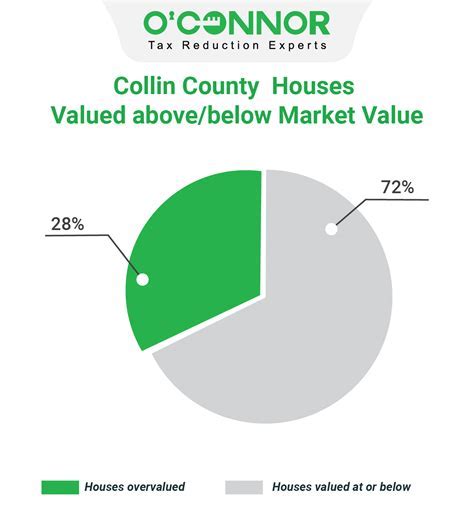

Property taxes in Utah are assessed at the county level and are based on the assessed value of the property. The Utah State Tax Commission oversees the valuation process, ensuring fairness and accuracy across the state. The assessed value is typically lower than the market value of the property and is used as the basis for calculating property taxes.

The property tax rate in Utah varies by county, with some counties having higher rates than others. For instance, Salt Lake County has a tax rate of 0.004964 for the year 2023, while neighboring Davis County has a slightly lower rate of 0.004755. These rates are subject to change annually and are determined by the county commissioners and school boards.

Landlords are responsible for paying property taxes on their rental properties, and these expenses can significantly impact their bottom line. It is essential for property owners to understand the tax assessment process and stay updated on any changes in tax rates to effectively manage their financial obligations.

| County | Tax Rate (2023) |

|---|---|

| Salt Lake County | 0.004964 |

| Davis County | 0.004755 |

| Weber County | 0.005426 |

Rental Income Taxes

In addition to property taxes, landlords in Utah must also navigate rental income taxes. The state of Utah imposes a state income tax on rental income, which is separate from federal income tax. The Utah State Tax Commission is responsible for collecting and administering these taxes.

The state income tax rate in Utah is progressive, meaning it increases as the taxable income rises. For the tax year 2023, the tax rates range from 4.95% to 5.30%, with higher income levels subject to a higher tax rate. This progressive tax structure ensures that those with higher incomes contribute a larger share of their earnings to the state’s revenue.

Landlords must carefully track their rental income and expenses to accurately calculate their taxable income. Deductions, such as mortgage interest, property taxes, and maintenance expenses, can help reduce the taxable income and, consequently, the amount of state income tax owed.

| Taxable Income Range (2023) | Tax Rate |

|---|---|

| $0 - $4,999 | 4.95% |

| $5,000 - $9,999 | 4.95% |

| $10,000 - $29,999 | 4.95% |

| $30,000 - $49,999 | 5.00% |

| $50,000 - $99,999 | 5.10% |

| $100,000 - $149,999 | 5.20% |

| $150,000 and above | 5.30% |

Tax Management Strategies for Landlords

Effectively managing rental taxes in Utah requires a strategic approach. Here are some key strategies that landlords can employ to navigate the state’s tax system successfully:

Understand Tax Laws and Regulations

Staying informed about Utah’s tax laws and regulations is crucial. Landlords should familiarize themselves with the state’s tax code, especially the sections related to rental properties and income taxes. This knowledge will help them comply with tax obligations and avoid potential penalties.

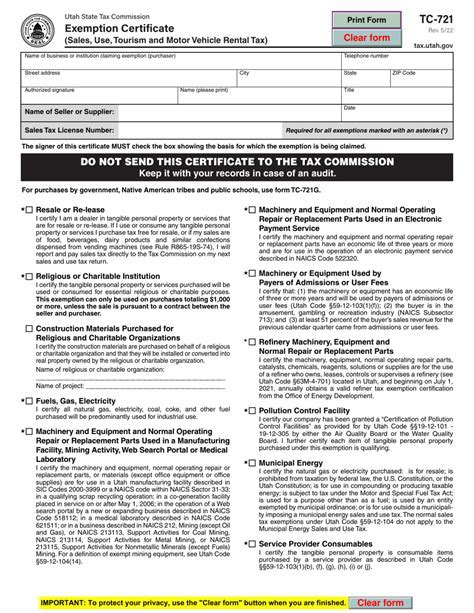

The Utah State Tax Commission provides comprehensive resources and guidelines on its website, including tax forms, instructions, and publications. Landlords can also seek guidance from tax professionals or consult with legal experts to ensure they are interpreting and applying the tax laws correctly.

Maintain Accurate Records

Proper record-keeping is essential for effective tax management. Landlords should maintain detailed records of all rental-related transactions, including income, expenses, and any improvements made to the property. These records should be organized and easily accessible, making tax preparation and filing more efficient.

Utilizing accounting software or spreadsheets can help landlords track income and expenses throughout the year. By regularly updating their records, landlords can identify potential tax deductions and ensure they have the necessary documentation to support their tax returns.

Explore Tax Deductions and Credits

Utah offers various tax deductions and credits that landlords can take advantage of to reduce their tax liability. For instance, landlords can deduct mortgage interest, property taxes, insurance costs, maintenance expenses, and depreciation on rental properties. These deductions can significantly lower the taxable income and the amount of tax owed.

Additionally, Utah provides specific tax credits for energy-efficient improvements and certain types of rehabilitation projects. Landlords should explore these opportunities to further reduce their tax burden and contribute to sustainable development.

Consider Hiring a Tax Professional

For landlords with multiple rental properties or complex tax situations, hiring a tax professional can be a wise investment. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, have the expertise to navigate the intricacies of Utah’s tax system and provide valuable advice.

A tax professional can help landlords maximize their deductions, minimize their tax liability, and ensure compliance with all tax regulations. They can also assist with tax planning strategies, such as deferring income or accelerating deductions, to optimize the landlord’s tax position.

Tenant Responsibility and Withholding

While landlords bear the primary responsibility for paying property and income taxes, tenants also have a role to play in the rental tax system. Tenants in Utah may be required to withhold a portion of their rent payments to cover the landlord’s tax obligations.

This withholding requirement is typically triggered when a landlord has not provided the tenant with a valid W-9 form or when the landlord’s tax obligations are in question. In such cases, the tenant may be required to withhold a percentage of the rent and remit it to the Utah State Tax Commission. The specific withholding rate and procedures are outlined in the state’s tax regulations.

It is essential for tenants to understand their rights and responsibilities regarding rental taxes. They should be aware of any withholding requirements and ensure that they are compliant with the law. Tenants can obtain more information and guidance from the Utah State Tax Commission or consult with legal professionals if needed.

Future Implications and Trends

The rental tax landscape in Utah is subject to change, and landlords and tenants should stay informed about any upcoming tax reforms or adjustments. Here are some potential future implications and trends to watch:

Tax Rate Adjustments

Utah’s tax rates, both for property taxes and state income taxes, are subject to periodic review and adjustment. County commissioners and school boards have the authority to modify property tax rates, while the state legislature can adjust the income tax rates. Landlords and tenants should stay updated on any proposed changes to ensure they are prepared for potential increases or decreases in tax obligations.

Expansion of Tax Credits and Deductions

Utah has shown a commitment to encouraging sustainable development and supporting small businesses. In the future, the state may introduce new tax credits or expand existing ones to promote energy efficiency, renewable energy adoption, or affordable housing initiatives. Landlords should keep an eye on these potential incentives and consider how they can benefit from them.

Technological Advancements in Tax Administration

The Utah State Tax Commission is continuously improving its online services and technological infrastructure. Landlords and tenants can expect to see enhanced digital platforms for tax filing, payment, and record-keeping. These advancements will streamline the tax process, making it more efficient and user-friendly for all stakeholders.

Impact of Economic Trends

Economic fluctuations can significantly impact the rental market and, consequently, rental taxes. As Utah’s economy evolves, landlords may face changing market conditions, such as shifts in rental demand, property values, or vacancy rates. These economic trends can influence the overall tax burden on landlords and tenants, affecting their financial strategies and decision-making.

Conclusion

Rental taxes in Utah are a complex yet essential aspect of the state’s tax system. Landlords, property managers, and tenants must understand their respective roles and responsibilities to navigate this landscape successfully. By staying informed, maintaining accurate records, and exploring tax-saving strategies, landlords can effectively manage their tax obligations and contribute to the state’s revenue while ensuring the sustainability of their rental businesses.

What is the current state income tax rate in Utah for rental income?

+For the tax year 2023, the state income tax rate in Utah ranges from 4.95% to 5.30%, depending on the taxable income bracket.

How often do property tax rates change in Utah?

+Property tax rates in Utah can change annually. County commissioners and school boards have the authority to adjust the rates based on various factors, including budget requirements and property valuations.

Are there any tax incentives for landlords in Utah?

+Yes, Utah offers various tax incentives for landlords, including deductions for mortgage interest, property taxes, and depreciation. Additionally, the state provides specific tax credits for energy-efficient improvements and certain rehabilitation projects.

Can tenants be responsible for withholding rent for tax purposes in Utah?

+Yes, in certain circumstances, tenants in Utah may be required to withhold a portion of their rent payments to cover the landlord’s tax obligations. This typically occurs when the landlord has not provided a valid W-9 form or if there are concerns about the landlord’s tax compliance.