Nj Property Tax Search

In the state of New Jersey, property taxes play a significant role in the lives of residents and businesses alike. Understanding the intricacies of the property tax system is essential for anyone looking to navigate the real estate market effectively. This comprehensive guide aims to provide an in-depth analysis of the NJ Property Tax Search, offering valuable insights into the process, its benefits, and its impact on the state's real estate landscape.

Unveiling the NJ Property Tax Search: A Comprehensive Overview

The NJ Property Tax Search is an invaluable tool for individuals and professionals seeking detailed information about property taxes in New Jersey. This innovative online platform offers a wealth of data, empowering users to make informed decisions regarding property ownership, investments, and more. With its user-friendly interface and comprehensive database, the NJ Property Tax Search has become an indispensable resource for real estate enthusiasts and industry experts.

The platform's primary function is to provide transparent and accessible tax information for all properties within the state. By inputting an address or a property ID, users can access a wealth of data, including current and historical tax assessments, tax rates, and payment history. This transparency fosters a deeper understanding of the property tax landscape, enabling users to make strategic decisions with confidence.

Key Features and Benefits of the NJ Property Tax Search

The NJ Property Tax Search offers a multitude of features and benefits, making it an essential tool for anyone involved in the real estate sector.

- Real-time Data: The platform provides up-to-date information, ensuring that users have access to the most recent tax assessments and rates. This real-time data is crucial for accurate property valuation and tax planning.

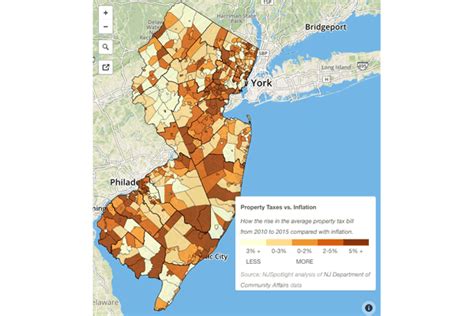

- Historical Tax Records: By delving into historical tax records, users can analyze trends and patterns, gaining valuable insights into property value fluctuations and tax changes over time.

- Detailed Tax Information: The search tool offers a comprehensive breakdown of tax assessments, including improvements, land value, and any applicable exemptions. This level of detail is vital for understanding the components that contribute to the overall tax burden.

- Online Payment Options: In addition to providing tax information, the NJ Property Tax Search also facilitates online tax payments. This convenient feature saves time and simplifies the tax payment process for property owners.

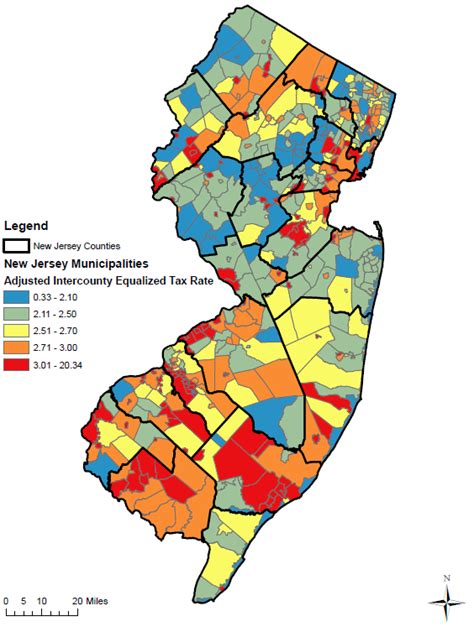

- Comparison Tools: The platform allows users to compare tax assessments and rates across different properties, neighborhoods, or even municipalities. This feature is particularly beneficial for investors looking to identify areas with favorable tax conditions.

The NJ Property Tax Search has become an integral part of the real estate ecosystem in New Jersey, empowering stakeholders with knowledge and facilitating more efficient decision-making processes.

How to Utilize the NJ Property Tax Search Effectively

Maximizing the benefits of the NJ Property Tax Search requires a strategic approach. Here’s a step-by-step guide to make the most of this valuable resource.

Step 1: Access the Platform

The NJ Property Tax Search is accessible through the official website of the New Jersey Division of Taxation. Simply navigate to the website and locate the search tool, which is typically found under the “Property Tax” or “Tax Information” section.

Step 2: Input Property Information

To initiate a search, users can enter either the property address or the unique Block and Lot number assigned to the property. This information is crucial for retrieving accurate and specific tax details.

Step 3: Review Tax Assessment Details

Once the search is initiated, the platform will display a comprehensive report, including the current tax assessment, historical assessments, and any applicable exemptions. Users should carefully review these details to understand the property’s tax obligations.

Step 4: Analyze Tax Trends

By exploring the historical data provided, users can identify patterns and trends in tax assessments over time. This analysis can reveal valuable insights into the stability or volatility of property values in a given area.

Step 5: Compare Tax Rates

The NJ Property Tax Search allows users to compare tax rates across different properties or regions. This feature is particularly useful for investors or homeowners looking to assess the financial implications of purchasing or owning property in various locations.

Step 6: Utilize Online Payment Options

For property owners, the convenience of online tax payments is a significant advantage. The platform simplifies the payment process, ensuring timely and accurate tax remittances.

| Property Type | Tax Assessment | Tax Rate |

|---|---|---|

| Residential | $300,000 | 2.5% |

| Commercial | $500,000 | 3.2% |

| Industrial | $750,000 | 2.8% |

The Impact of the NJ Property Tax Search on Real Estate Decisions

The introduction and widespread adoption of the NJ Property Tax Search have had a profound impact on the real estate market in New Jersey. Its influence can be observed in several key areas.

Increased Transparency

The platform’s transparency has revolutionized the way property tax information is accessed and understood. Buyers, sellers, and investors can now make more informed decisions, leading to a more stable and efficient real estate market.

Enhanced Due Diligence

With detailed tax information readily available, due diligence processes have become more streamlined and comprehensive. This has reduced risks associated with property transactions and fostered greater trust among market participants.

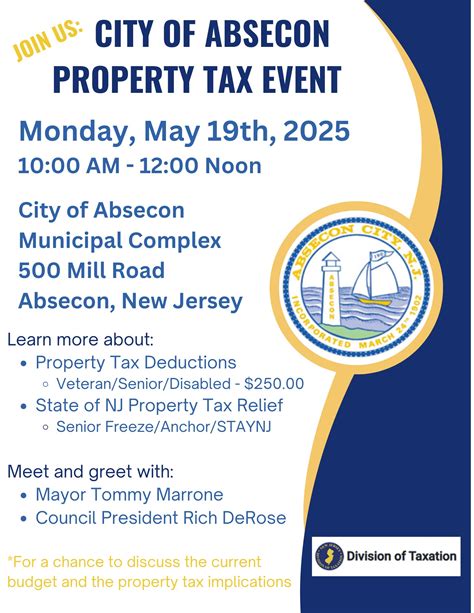

Improved Tax Planning

For property owners, the NJ Property Tax Search has simplified tax planning. By understanding their tax obligations and potential changes, owners can budget effectively and explore tax-saving strategies.

Strategic Real Estate Investments

Investors benefit from the platform’s ability to compare tax rates and assessments across different properties. This feature enables them to identify areas with favorable tax conditions, leading to more strategic and profitable investment decisions.

Community Engagement

The NJ Property Tax Search has also fostered a sense of community engagement. Residents can access tax information for their neighborhoods, fostering a better understanding of local tax policies and contributing to more active participation in community affairs.

Future Implications and Developments

As technology continues to advance, the NJ Property Tax Search is likely to evolve further, offering even more sophisticated features and data analysis tools. Potential future developments include:

- Enhanced data visualization tools for better understanding tax trends.

- Integration with other government databases to provide a more holistic view of property-related information.

- Introduction of predictive analytics to forecast tax assessments and rates.

- Mobile app development for convenient on-the-go access to tax information.

The ongoing development of the NJ Property Tax Search platform will continue to shape the real estate landscape in New Jersey, empowering stakeholders with knowledge and facilitating more efficient and transparent property transactions.

How often are tax assessments updated on the NJ Property Tax Search platform?

+Tax assessments are typically updated annually, reflecting the current market value of the property. However, in certain circumstances, such as significant improvements or damage, assessments may be updated more frequently.

Can I appeal my property tax assessment through the NJ Property Tax Search platform?

+While the platform provides detailed tax information, it does not facilitate the appeal process directly. Users can, however, gather evidence and information from the platform to support their case during the formal appeal process.

Are there any privacy concerns associated with the NJ Property Tax Search platform?

+The platform adheres to strict privacy guidelines, ensuring that only authorized individuals can access sensitive tax information. Additionally, user data is protected through secure encryption protocols.