Value Added Tax Identification

The Value Added Tax (VAT) Identification system is a crucial aspect of modern tax administration, particularly in the European Union (EU). It plays a vital role in facilitating cross-border trade and ensuring efficient tax collection. This article aims to delve into the intricacies of VAT Identification, exploring its purpose, functionality, and significance in the global economic landscape.

Understanding VAT Identification

VAT Identification, often denoted as VAT ID or VAT Number, is a unique identifier assigned to businesses and entities registered for VAT purposes. It serves as a critical tool for tax authorities to track and manage the collection of VAT across various jurisdictions. The system is designed to simplify the process of identifying taxpayers, enabling efficient tax administration and reducing the administrative burden on businesses.

The VAT Identification system is an essential component of the EU's VAT Directive, which harmonizes VAT laws across member states. It ensures that businesses can conduct cross-border transactions seamlessly while complying with tax regulations. The VAT ID is a mandatory requirement for businesses engaged in cross-border trade within the EU, and it plays a pivotal role in preventing tax evasion and fraud.

Key Features of VAT Identification

The VAT Identification system offers several key features that enhance its effectiveness and efficiency:

- Uniqueness: Each VAT ID is unique, ensuring that tax authorities can easily identify and distinguish between different businesses and entities. This uniqueness is critical for accurate tax record-keeping and auditing.

- Standardization: The format of VAT IDs is standardized across the EU, making it easier for businesses to recognize and validate VAT numbers. This standardization simplifies the process of cross-border transactions and reduces the risk of errors.

- Online Verification: Many tax authorities provide online tools for businesses to verify the validity of VAT IDs. This facilitates quick and efficient checks, ensuring that transactions are conducted with legitimate entities.

- Cross-Border Recognition: VAT IDs are recognized and accepted across the EU, enabling businesses to operate seamlessly within the single market. This recognition streamlines the tax registration process for businesses expanding into new EU member states.

The implementation of the VAT Identification system has had a profound impact on the EU's tax landscape, enhancing transparency and efficiency in tax collection. It has become an integral part of the bloc's economic integration efforts, fostering a more cohesive and competitive single market.

The Role of VAT Identification in Tax Administration

VAT Identification plays a central role in the effective administration of VAT, a critical tax component for governments worldwide. It serves as a vital tool for tax authorities to manage and monitor the collection of VAT, ensuring compliance and preventing tax evasion.

Tax Registration and Compliance

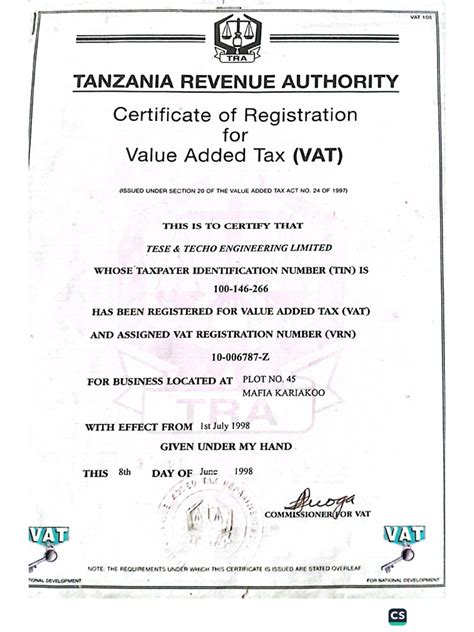

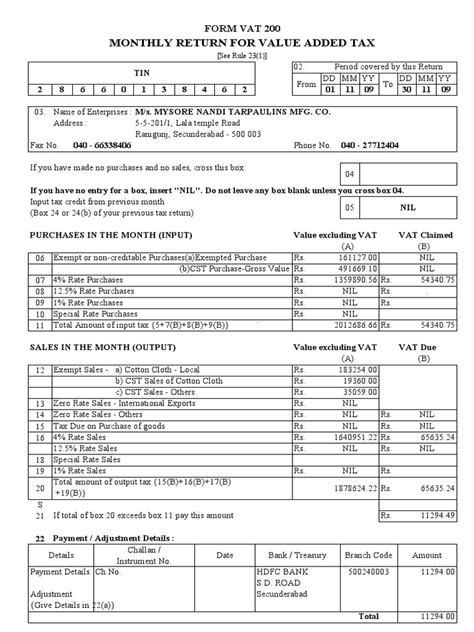

For businesses, obtaining a VAT ID is a mandatory step in registering for VAT. This process involves submitting relevant documentation and information to the tax authorities, who then assign a unique VAT ID. The registration process ensures that businesses are officially recognized as VAT-registered entities, enabling them to charge and account for VAT on their transactions.

Compliance with VAT regulations is a legal obligation for VAT-registered businesses. The VAT ID serves as a constant reminder of this obligation, as it is required to be displayed on all relevant documents, including invoices, receipts, and tax returns. This visibility enhances tax compliance and encourages businesses to maintain accurate records.

Facilitating Cross-Border Trade

The VAT Identification system is particularly crucial for businesses engaged in cross-border trade. When conducting transactions with counterparts in other EU member states, businesses must provide their VAT ID to their trading partners. This allows for the proper accounting of VAT, ensuring that the correct tax rates are applied and that the appropriate tax authorities receive the revenue.

The standardized format of VAT IDs across the EU simplifies the process of identifying and validating VAT numbers, reducing the administrative burden on businesses operating in multiple jurisdictions. This efficiency promotes smoother cross-border transactions and enhances the overall competitiveness of the EU's single market.

Preventing Tax Evasion

VAT Identification is a powerful tool in the fight against tax evasion and fraud. By assigning unique identifiers to businesses, tax authorities can easily track and monitor VAT payments. This transparency makes it difficult for businesses to conceal their transactions or underreport their VAT liabilities.

The online verification tools provided by tax authorities further enhance the system's effectiveness. Businesses can quickly validate the VAT IDs of their trading partners, ensuring that they are dealing with legitimate entities. This reduces the risk of engaging in transactions with fraudulent or non-compliant businesses, safeguarding both the tax authorities and honest businesses.

VAT Identification: A Global Perspective

While the VAT Identification system is most prominently associated with the EU, similar systems exist in various countries and regions worldwide. These systems serve a similar purpose, facilitating tax administration and cross-border trade.

VAT Systems Worldwide

Many countries have implemented VAT or similar value-added taxes, each with its own unique identification system. For instance, in the United States, the equivalent system is known as the Taxpayer Identification Number (TIN), which serves a similar function for federal and state tax purposes.

In the United Kingdom, the VAT Registration Number is used, while in Canada, the Business Number (BN) serves as a comprehensive identifier for various tax purposes, including VAT (known as Goods and Services Tax, or GST, in Canada). These systems, although varying in nomenclature and format, share the common goal of simplifying tax administration and promoting compliance.

International Trade and VAT Identification

In the context of international trade, VAT Identification systems play a crucial role in ensuring that businesses comply with tax regulations across borders. When a business imports goods or services from another country, it is often required to provide its domestic VAT ID to the exporting entity.

This exchange of VAT IDs facilitates the proper accounting of VAT, allowing the exporting business to charge the appropriate tax rate and ensuring that the importing business can claim any applicable VAT refunds or credits. This process is essential for maintaining fair competition and preventing tax distortions in the global marketplace.

Future Developments and Innovations

As technology advances, VAT Identification systems are likely to undergo further innovations to enhance their efficiency and security. The integration of blockchain technology, for instance, could provide an immutable and transparent record of VAT transactions, reducing the risk of fraud and improving overall tax compliance.

Additionally, the development of digital VAT IDs and online registration processes could streamline the tax registration experience for businesses, making it more accessible and user-friendly. These advancements would not only benefit tax authorities but also contribute to a more seamless and efficient tax administration system, ultimately supporting economic growth and development.

Conclusion

The Value Added Tax Identification system is a cornerstone of modern tax administration, particularly within the EU. Its standardized and unique identifiers facilitate efficient tax collection, enhance cross-border trade, and contribute to a more transparent and competitive economic landscape. As global trade continues to evolve, the role of VAT Identification will remain crucial in ensuring fair and compliant tax practices worldwide.

What is the purpose of VAT Identification in the EU?

+VAT Identification is designed to facilitate cross-border trade within the EU while ensuring efficient tax collection. It provides a standardized and unique identifier for businesses, enabling tax authorities to track and manage VAT payments accurately.

How does VAT Identification enhance tax compliance for businesses?

+VAT Identification is a mandatory requirement for businesses engaged in cross-border trade. By displaying their VAT ID on relevant documents, businesses are constantly reminded of their tax obligations, encouraging compliance and accurate record-keeping.

What are the benefits of online VAT ID verification tools?

+Online verification tools provided by tax authorities allow businesses to quickly validate the VAT IDs of their trading partners. This enhances trust and reduces the risk of engaging in transactions with fraudulent or non-compliant entities, protecting both the business and the tax authorities.

How do VAT Identification systems vary across different countries?

+VAT Identification systems, while serving a similar purpose, vary in nomenclature and format across countries. For instance, the United States uses the Taxpayer Identification Number (TIN), while Canada employs the Business Number (BN) for various tax purposes, including VAT.