Tax Haven Countries

Tax havens have long been a topic of intrigue and interest, often associated with secrecy, wealth, and strategic financial planning. These countries and territories offer unique tax structures and regulations that make them attractive destinations for individuals and businesses seeking to minimize their tax liabilities. However, the concept of a tax haven is multifaceted and carries significant implications for global economics and international relations.

Unveiling the Secrets of Tax Haven Countries

Tax havens, also known as offshore financial centers, are jurisdictions that provide favorable tax treatments and regulations to non-residents and foreign entities. While the idea of a “tax haven” often conjures images of small, remote islands, the reality is far more diverse and complex. This comprehensive guide delves into the world of tax havens, exploring their historical roots, modern-day practices, and the potential consequences they bring.

The Historical Origins and Evolution

The concept of tax havens has its roots in the historical development of international trade and commerce. In the early days of global trade, certain regions offered advantages to merchants and traders, including favorable tax policies, to encourage economic activity. Over time, these practices evolved, and some jurisdictions began to actively promote their tax structures to attract foreign investment and business.

One of the earliest recorded instances of tax-friendly jurisdictions can be traced back to the medieval era, where certain European cities, known as "free imperial cities," offered tax exemptions and incentives to attract merchants and foster trade. This set a precedent for the idea of using tax policies to stimulate economic growth.

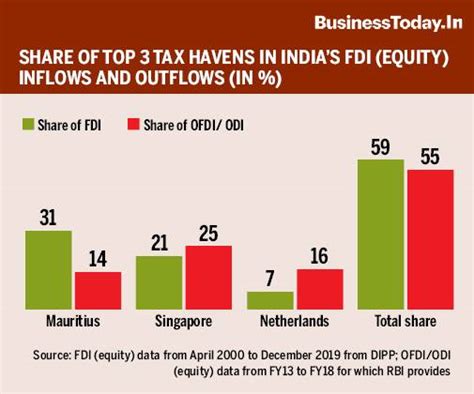

In the 20th century, the emergence of modern tax havens gained momentum. Countries like Switzerland, with its renowned banking secrecy laws, became synonymous with tax havens. The post-World War II era saw a rise in international trade and the establishment of multinational corporations, further fueling the demand for jurisdictions that could offer tax efficiency and privacy.

Key Characteristics of Tax Haven Countries

Tax haven countries exhibit a range of characteristics that make them appealing to those seeking to optimize their tax obligations. Here are some of the key features:

- Low or Zero Taxes: The most obvious attraction is the low or zero tax rates on income, capital gains, and corporate profits. Some tax havens have no income tax, while others have minimal corporate tax rates, making them attractive for businesses looking to reduce their tax burdens.

- Banking Secrecy: Many tax havens have stringent banking secrecy laws, ensuring that financial information remains confidential. This anonymity attracts individuals and entities seeking privacy and protection for their assets.

- Lack of Exchange Controls: Tax havens often have minimal or no restrictions on the movement of capital, allowing for free flow of funds across borders.

- Efficient Company Incorporation: The process of setting up a company in a tax haven is often straightforward and rapid, with minimal bureaucracy. This ease of incorporation makes it attractive for startups and businesses seeking a quick and seamless setup.

- Double Taxation Treaties: Many tax havens have entered into double taxation treaties with other countries, which ensure that income is taxed only once, reducing the overall tax burden for multinational corporations.

The Global Impact and Controversies

While tax havens offer significant advantages to those who utilize them, their existence has sparked debates and controversies on the global stage. Critics argue that tax havens facilitate tax avoidance and evasion, leading to a loss of revenue for governments and contributing to inequality.

The OECD (Organisation for Economic Co-operation and Development) has been at the forefront of efforts to combat harmful tax practices and promote transparency. The BEPS (Base Erosion and Profit Shifting) project aims to address the challenges posed by tax havens and ensure a fair and sustainable global tax system.

Additionally, tax havens have been associated with money laundering, illicit activities, and the concealment of illicitly obtained funds. International organizations and governments have implemented measures to enhance transparency and combat these illicit practices, such as the implementation of beneficial ownership registers and the exchange of financial information.

| Tax Haven | Key Features |

|---|---|

| Switzerland | Banking secrecy, low corporate tax rates |

| Cayman Islands | No corporate or income tax, efficient company incorporation |

| Luxembourg | Double taxation treaties, low withholding tax rates |

| Singapore | Efficient corporate tax structure, favorable for international trade |

A Look into the Future of Tax Havens

The world of tax havens is evolving rapidly, driven by changing global dynamics and increasing regulatory pressures. As countries strive to enhance tax fairness and combat tax evasion, tax havens must adapt to maintain their appeal and legitimacy.

The Rise of Transparency and Compliance

In recent years, there has been a notable shift towards transparency and compliance in the world of tax havens. International organizations, such as the OECD, have led the charge in promoting global tax standards and cracking down on harmful tax practices. The Common Reporting Standard (CRS), for instance, has become a global benchmark for the automatic exchange of financial information, ensuring greater transparency and accountability.

Many tax havens have responded to these developments by introducing reforms and initiatives to enhance their reputation and remain competitive. Some have voluntarily adopted the CRS, demonstrating their commitment to international tax cooperation. Others have implemented beneficial ownership registers, allowing authorities to identify the ultimate beneficiaries of companies and trusts, thus tackling the issue of shell companies and anonymous ownership.

The Future of Tax Competition

As tax havens adapt to the changing landscape, the concept of tax competition remains a driving force. Countries will continue to offer competitive tax structures to attract investment and businesses, especially in a post-pandemic world where economic recovery is a priority. However, the future of tax competition may lean towards a more collaborative approach, with countries working together to establish fair and sustainable tax systems.

The rise of digital economies and remote work also presents new challenges and opportunities for tax havens. With an increasing number of individuals and businesses operating remotely, tax jurisdictions may need to adapt their regulations to accommodate this new reality. This could involve rethinking tax residency rules and addressing issues related to the digital economy, such as the taxation of cross-border digital services.

Potential Impact on Global Tax Reform

The existence and practices of tax havens have been a driving force behind global tax reform efforts. As countries strive to address tax avoidance and ensure a level playing field, the role of tax havens will remain a key focus. The OECD’s BEPS project, for example, has already led to significant changes in international tax rules, such as the introduction of country-by-country reporting and the development of minimum tax standards.

Looking ahead, global tax reform may see further efforts to address the challenges posed by tax havens. This could involve the establishment of a global minimum corporate tax rate, ensuring that multinational corporations pay a fair share of taxes regardless of where they operate. Additionally, there may be increased pressure on tax havens to enhance transparency and information exchange, further reducing the appeal of tax avoidance strategies.

Conclusion

Tax havens have long been a fascinating and complex aspect of the global financial landscape. While they offer unique advantages, their existence has sparked debates and prompted international efforts to ensure a fair and transparent tax system. As we navigate the post-pandemic world, the role of tax havens will continue to evolve, shaped by global dynamics and regulatory pressures. The future of tax havens lies in adapting to these changes, embracing transparency, and contributing to a sustainable global tax environment.

How do tax havens impact global tax revenue and fairness?

+Tax havens can lead to a significant loss of revenue for governments, as individuals and businesses shift their tax liabilities to these jurisdictions. This can result in an uneven playing field and contribute to tax inequality. However, it’s important to note that tax havens are just one aspect of a complex global tax system, and addressing these issues requires comprehensive reform efforts.

Are tax havens illegal?

+Tax havens themselves are not inherently illegal. They offer legitimate tax structures and incentives that can be utilized by individuals and businesses. However, the use of tax havens for tax avoidance or evasion, especially through illicit means, can be illegal and subject to penalties.

How do tax havens affect small businesses and startups?

+Tax havens can provide significant benefits to small businesses and startups, especially in terms of tax efficiency and ease of incorporation. However, it’s important for these entities to ensure they comply with all relevant laws and regulations, as non-compliance can lead to legal issues and reputational damage.