Fl Tax Free Weekend 2025

Get ready for a shopping extravaganza! The Florida Tax-Free Weekend, a highly anticipated event for thrifty shoppers and families, is just around the corner in 2025. This annual tradition offers a golden opportunity to save big on various items, making it a perfect time to stock up on essentials and treat yourself to some new goodies. In this comprehensive guide, we'll dive into the ins and outs of the 2025 Florida Tax-Free Weekend, providing you with all the details you need to make the most of this exciting event.

Understanding the Florida Tax-Free Weekend

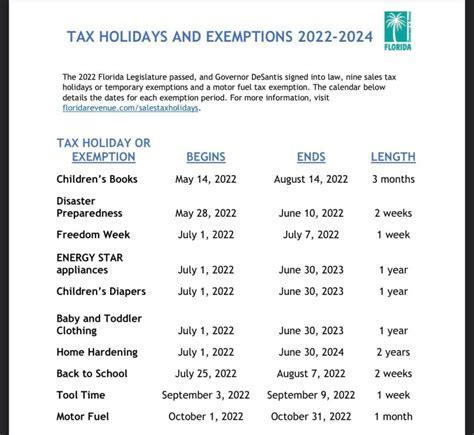

The Florida Tax-Free Weekend, also known as the Sales Tax Holiday, is a designated period when certain items are exempt from state sales tax. This initiative is designed to provide relief to consumers and encourage spending, benefiting both shoppers and local businesses. In 2025, this exciting event is set to take place from Friday, August 7th to Sunday, August 9th, giving Floridians three full days to take advantage of the tax-free shopping bonanza.

Tax-Free Items and Categories

The tax-free weekend covers a wide range of products, ensuring there’s something for everyone. Here’s a breakdown of the categories and items typically included:

- Clothing and Accessories: Enjoy tax-free shopping on a variety of apparel items, including shirts, pants, dresses, jackets, and shoes. The tax exemption applies to clothing priced at 100 or less per item.</li> <li><strong>School Supplies</strong>: Get ready for the new school year with tax-free purchases of notebooks, pens, pencils, backpacks, and other essential school items. The exemption covers supplies priced at 15 or less per item.

- Computers and Electronic Devices: Whether you’re a student, a professional, or just tech-savvy, you can save on computers, tablets, printers, and related accessories. The tax exemption applies to items priced at $1,000 or less per item.

- Hurricane Preparedness Items: Florida’s tax-free weekend also focuses on preparedness, offering tax exemptions on flashlights, batteries, generators, and other essential hurricane supplies. This category is crucial for residents to stock up on necessary items without the burden of sales tax.

| Category | Tax-Free Items | Price Limit |

|---|---|---|

| Clothing | Shirts, Pants, Dresses, etc. | $100 or less per item |

| School Supplies | Notebooks, Pens, Backpacks | $15 or less per item |

| Computers/Electronics | Laptops, Tablets, Printers | $1,000 or less per item |

| Hurricane Supplies | Flashlights, Batteries, Generators | N/A (Exempt regardless of price) |

Maximizing Your Tax-Free Shopping Experience

To ensure you make the most of the Florida Tax-Free Weekend, here are some expert tips and strategies:

- Plan Ahead: Create a shopping list in advance, taking into account the categories and price limits. This way, you can prioritize your purchases and ensure you stay within the tax-free limits.

- Compare Prices: Research and compare prices online or through various retailers’ apps and websites. This will help you identify the best deals and ensure you’re getting the most value for your money.

- Shop Early: The tax-free weekend can get crowded, especially on the first day. Consider shopping early in the morning to beat the rush and ensure you get your hands on the items you want.

- Check Store Hours: Be aware of the extended hours or special opening times during the tax-free weekend. Some stores may adjust their operating hours to accommodate the increased foot traffic.

- Consider Online Shopping: If you prefer the convenience of shopping from home, many retailers offer online tax-free shopping during this period. Just be mindful of shipping costs and delivery times.

- Take Advantage of Bundles and Deals: Retailers often offer special bundles or package deals during the tax-free weekend. These can provide additional savings and help you maximize your tax-free purchases.

Staying Informed and Avoiding Pitfalls

While the Florida Tax-Free Weekend is an exciting event, it’s essential to stay informed and avoid potential pitfalls:

- Be aware of the specific guidelines and rules set by the Florida Department of Revenue. These guidelines may change from year to year, so always refer to the official sources for the most accurate information.

- Some retailers may offer additional discounts or promotions during the tax-free weekend. However, be cautious of misleading sales tactics. Always double-check the actual savings and ensure the deal is legitimate.

- Keep an eye out for any special offers or incentives from your favorite retailers. Many stores send out newsletters or post updates on their social media channels to announce exclusive deals.

The Impact of the Florida Tax-Free Weekend

The Florida Tax-Free Weekend has a significant impact on both consumers and local businesses. For shoppers, it provides an excellent opportunity to save money on essential items and treat themselves without the burden of sales tax. This event not only benefits individual consumers but also has a positive economic impact on the state.

During the tax-free weekend, retailers often experience a surge in sales, leading to increased revenue and a boost in local economies. This event encourages spending and supports small businesses, fostering a vibrant shopping environment across Florida. Additionally, the tax-free initiative promotes financial literacy and empowers consumers to make informed purchasing decisions.

The Future of Tax-Free Shopping in Florida

As we look ahead to the 2025 Florida Tax-Free Weekend and beyond, it’s worth exploring the potential future developments and trends in tax-free shopping:

- The popularity of the tax-free weekend is likely to continue, with more consumers recognizing the benefits of this initiative. As a result, we can expect increased participation and awareness among shoppers.

- With the rise of e-commerce, the future may see a greater emphasis on online tax-free shopping. Retailers may offer more comprehensive online deals and promotions to cater to the changing preferences of consumers.

- There may be opportunities for expansion or diversification of the tax-free categories. This could include additional items related to sustainability, renewable energy, or other emerging trends, making the event even more relevant and appealing to a wider audience.

The Florida Tax-Free Weekend is a highly anticipated event that offers a unique shopping experience and significant savings for Floridians. By understanding the categories, planning effectively, and staying informed, you can make the most of this exciting annual tradition. So mark your calendars for August 2025 and get ready to enjoy a tax-free shopping extravaganza!

Can I combine tax-free items with other discounts or promotions during the weekend?

+Yes, you can! Many retailers offer additional discounts and promotions during the tax-free weekend, allowing you to stack savings. However, always check the terms and conditions to ensure the discounts apply to the tax-free items.

Are there any restrictions on the number of tax-free items I can purchase?

+There are no restrictions on the quantity of items you can purchase during the tax-free weekend. However, each item must meet the specific price limit for its category to qualify for the tax exemption.

Can I shop online for tax-free items if I live outside Florida?

+Yes, many retailers offer online tax-free shopping for out-of-state residents. However, it’s essential to check the retailer’s policies and shipping terms to ensure you can take advantage of the tax exemption.