How Long Do I Keep Tax Returns

Managing your tax records is an essential part of financial responsibility, and understanding the appropriate retention period for tax returns is crucial. This article aims to provide an in-depth guide on the topic, offering insights into the recommended durations for keeping tax returns, the legal implications, and best practices to ensure you stay compliant and organized.

The Legal Perspective: Understanding Retention Periods

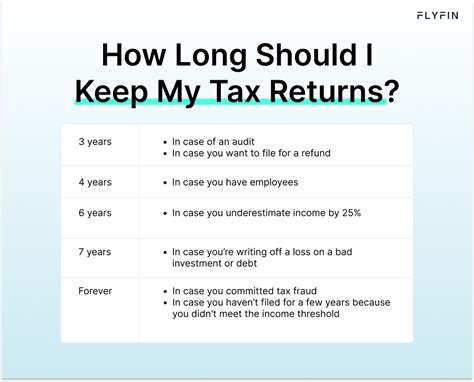

When it comes to tax return retention, legal guidelines are an important consideration. While there is no universal rule, different jurisdictions have their own regulations. Generally, it is recommended to retain your tax returns and supporting documentation for a minimum of three to seven years, depending on your location and specific circumstances.

This timeframe is suggested to cover potential audits or reviews by tax authorities. For instance, in the United States, the Internal Revenue Service (IRS) typically has a three-year statute of limitations for assessing additional tax, which can be extended to six years if your adjusted gross income was underreported by more than 25%.

In the European Union, the retention period can vary from country to country, but a minimum of five years is often recommended. It's important to note that these guidelines may differ for businesses, sole proprietors, or individuals with complex financial situations, so consulting with a tax professional is advised.

| Jurisdiction | Recommended Retention Period |

|---|---|

| United States | 3–7 years |

| European Union | 5–7 years |

| Canada | 6–7 years |

| Australia | 5 years |

Best Practices for Tax Return Storage

Storing your tax returns and related documents securely is essential to ensure compliance and easy access when needed. Here are some best practices to consider:

Digital Storage

In today’s digital age, storing tax returns electronically is a convenient and secure option. You can use cloud-based storage services, external hard drives, or encrypted software to keep your records safe. Make sure to back up your data regularly to prevent loss.

Physical Storage

If you prefer physical copies, consider using a fireproof and waterproof safe or a secure storage box. Label your files clearly with the tax year and keep them in a dry, temperature-controlled environment to prevent damage.

Organizing Your Records

Create a systematic approach to organizing your tax records. You can use a filing system that categorizes your returns and supporting documents by tax year. This makes it easier to retrieve information when needed and ensures a quick response to any tax-related inquiries.

Document Retention Software

For businesses or individuals with extensive tax records, specialized document retention software can be a valuable tool. These programs help manage and track the retention period of various documents, ensuring compliance with legal requirements.

The Benefits of Long-Term Retention

While the legal minimum is important, retaining your tax returns for an extended period can offer several advantages. Here’s why keeping your records for a longer duration can be beneficial:

- Audit Preparation: In the event of an audit, having detailed records can help you respond accurately and efficiently. A longer retention period ensures you have the necessary documentation to support your tax filings.

- Error Correction: If mistakes are discovered in previous tax returns, having access to older records can facilitate corrections and prevent potential penalties.

- Historical Analysis: Long-term retention allows you to analyze your financial trends over time, providing valuable insights for future financial planning and decision-making.

- Legal Protection: In certain situations, such as legal disputes or inheritance matters, older tax records can serve as valuable evidence.

When Can You Dispose of Tax Records?

While it’s important to retain tax returns for a considerable period, there may come a time when you can safely dispose of certain records. Here are some guidelines:

Expiring Returns

Once the legal retention period for a specific tax year has passed, you can consider disposing of that year’s tax return and supporting documents. However, it’s crucial to consult with a tax professional or legal advisor before doing so, especially if you have complex financial affairs.

Record Retention for Specific Documents

Not all tax-related documents need to be retained for the same duration. For instance, receipts for minor purchases may only need to be kept for a year, while more significant expenses, such as property or vehicle purchases, should be retained for a longer period.

Safe Disposal Methods

When disposing of tax records, ensure you do so securely. Shredding or using a document destruction service can help protect your privacy and prevent identity theft. Avoid simply throwing away documents with sensitive financial information.

Conclusion: A Holistic Approach to Tax Record Management

Managing your tax returns and related documents is an essential aspect of financial responsibility. By understanding the legal retention periods, adopting best practices for storage, and recognizing the benefits of long-term retention, you can ensure compliance and have the necessary records readily available when needed.

Remember, tax laws and regulations can vary, so it's always advisable to consult with tax professionals or legal experts to tailor your record-keeping practices to your specific circumstances.

How long should I keep tax returns for in the United States?

+In the US, it is generally recommended to keep tax returns for at least three years. However, for certain situations, such as underreporting income, the statute of limitations can extend to six years. Consult with a tax professional for personalized advice.

Are there differences in tax return retention periods for businesses and individuals?

+Yes, businesses and individuals with complex financial situations may have different retention requirements. Businesses often need to retain records for longer periods due to more complex transactions and potential audits. It’s best to consult with a tax advisor to ensure compliance.

What happens if I don’t keep my tax records for the recommended period?

+Failing to retain tax records for the recommended period can lead to complications if you are audited or need to correct previous tax filings. It may result in penalties, additional fees, or difficulty in resolving tax-related issues.