Colorado State Tax Refund

The Colorado State Tax Refund is a crucial aspect of financial planning for residents of the Centennial State. Understanding the process, eligibility, and potential outcomes is essential for individuals and families to maximize their tax refunds and make informed decisions regarding their financial well-being. This comprehensive guide will delve into the intricacies of the Colorado State Tax Refund, providing valuable insights and practical tips for navigating the system.

Understanding the Colorado State Tax System

Colorado’s tax system operates on a progressive income tax structure, which means that as your income increases, so does the tax rate applied to your earnings. The state levies taxes on various sources of income, including wages, salaries, business profits, interest, and dividends. The tax rates are determined by the state’s revenue department and are subject to change annually, reflecting the economic landscape and legislative decisions.

The current tax structure in Colorado consists of five tax brackets, each with its own rate. As of the 2023 tax year, these brackets and their corresponding tax rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $5,950 | 2.55% |

| $5,951 - $11,900 | 3.54% |

| $11,901 - $23,800 | 4.54% |

| $23,801 - $47,600 | 5.44% |

| Over $47,600 | 6.9% |

It's important to note that these tax rates are subject to change, and taxpayers should refer to the official Colorado Department of Revenue website for the most up-to-date information.

Tax Credits and Deductions

Colorado offers a range of tax credits and deductions to help residents lower their tax liability. These include the Child Tax Credit, dependent care credits, education credits, and deductions for medical expenses, charitable contributions, and certain business expenses. Understanding the eligibility criteria and how to claim these credits is crucial for maximizing your tax refund.

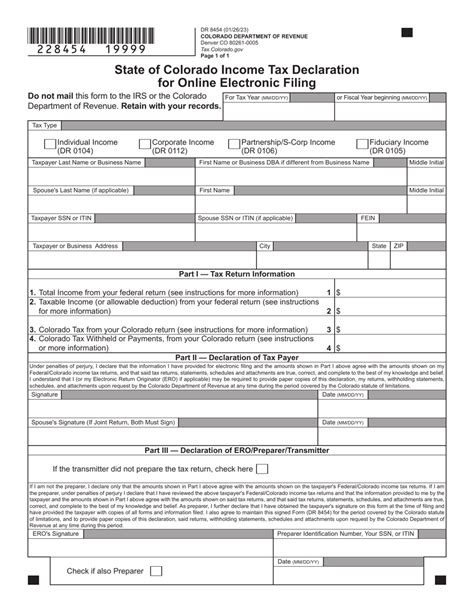

The Process of Filing for a Colorado State Tax Refund

Filing for a state tax refund in Colorado involves several steps, and being familiar with the process can make it smoother and more efficient. Here’s a step-by-step guide to help you navigate the procedure:

Step 1: Gather Your Documents

Before you begin the filing process, ensure you have all the necessary documents. This includes your federal tax return (if you’ve already filed), W-2 forms from your employer(s), 1099 forms for any additional income, and any relevant receipts or documentation for deductions and credits you plan to claim.

Step 2: Choose Your Filing Method

Colorado offers multiple ways to file your state tax return, including online filing through the Colorado Department of Revenue’s website, using tax preparation software, or opting for traditional paper filing. Each method has its advantages and considerations, so choose the one that best suits your needs and comfort level.

Step 3: Calculate Your Refund

Utilize the state’s tax calculators or your chosen tax preparation software to estimate your tax refund. This step is crucial for understanding how much you can expect to receive and helps in financial planning.

Step 4: File Your Return

Follow the instructions provided by your chosen filing method to submit your state tax return. Ensure all information is accurate and complete to avoid delays or penalties.

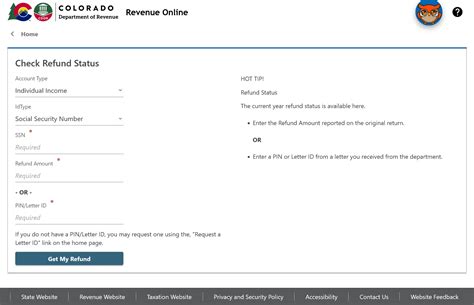

Step 5: Track Your Refund

Once you’ve filed, you can track the status of your refund through the Colorado Department of Revenue’s website or by calling their toll-free number. This step ensures you stay informed about the progress of your refund and can plan accordingly.

Maximizing Your Colorado State Tax Refund

Maximizing your state tax refund involves more than just accurate filing. It requires a strategic approach to take advantage of all the deductions and credits available to you. Here are some tips to help you get the most out of your refund:

Explore Deductions and Credits

Familiarize yourself with the various deductions and credits offered by the state. This includes the Colorado Child Tax Credit, which provides a refundable credit for each qualifying child, and the Dependent Care Tax Credit, which can help offset the cost of childcare. Additionally, if you’ve made charitable contributions, you may be eligible for the Colorado Charitable Contributions Credit.

Take Advantage of Tax Breaks for Homeowners

Colorado offers several tax breaks for homeowners, including the Property Tax Exemption for Owner-Occupied Homes, which can significantly reduce your property tax liability. Additionally, if you’ve made energy-efficient improvements to your home, you may qualify for the Energy Conservation Credit.

Consider Tax-Efficient Retirement Savings

Contributions to certain retirement accounts, such as 401(k)s and IRAs, may be eligible for tax deductions. By maximizing your contributions, you can reduce your taxable income and potentially increase your refund.

Utilize Tax Software or Professional Assistance

If you’re unsure about navigating the complex world of tax deductions and credits, consider using tax preparation software or seeking the assistance of a professional tax preparer. They can help you identify all the deductions and credits you’re eligible for and ensure accurate filing.

Common Misconceptions and Pitfalls

While the process of filing for a Colorado State Tax Refund can be straightforward, there are several misconceptions and pitfalls that taxpayers should be aware of. Addressing these can help ensure a smooth and successful filing experience.

Misconception: Refunds are Guaranteed

Many taxpayers believe that filing their taxes will always result in a refund. However, this is not always the case. Depending on your financial situation, you may owe taxes or break even. It’s important to understand your tax liability and plan accordingly.

Pitfall: Late Filing and Payment Penalties

Failing to file your state tax return on time can result in penalties and interest charges. Additionally, if you owe taxes and fail to pay by the deadline, these penalties can accumulate quickly. It’s crucial to stay on top of filing deadlines and make timely payments to avoid unnecessary fees.

Misconception: Tax Refunds are a Windfall

Some taxpayers view their tax refund as a bonus or unexpected windfall. However, it’s essential to remember that a tax refund is simply the return of your own money, which you’ve overpaid throughout the year. It’s a good idea to use your refund wisely, such as paying off debt, building an emergency fund, or investing in your future.

Future Implications and Changes

The world of taxes is ever-evolving, and it’s essential to stay informed about potential changes that may impact your state tax refund. Here are some future implications and changes to keep an eye on:

Potential Tax Reform

Legislative changes at the state level can significantly impact tax rates and brackets. Stay informed about any proposed or upcoming tax reforms that may affect your tax liability.

Inflation and Cost of Living Adjustments

Inflation and cost of living adjustments can impact the value of deductions and credits. It’s crucial to stay updated on these adjustments to ensure you’re maximizing your refund accurately.

Technology and Filing Methods

The Colorado Department of Revenue is continuously improving its online filing systems and tax software. Stay updated on these advancements to ensure you’re utilizing the most efficient and secure filing methods.

Economic Factors and Tax Policy

Economic conditions and tax policy decisions can influence tax rates and brackets. Stay informed about the economic landscape and any potential changes to state tax policy that may impact your refund.

Conclusion

The Colorado State Tax Refund is a valuable financial tool for residents to optimize their financial well-being. By understanding the state’s tax system, navigating the filing process efficiently, and maximizing your deductions and credits, you can make the most of your refund. Remember to stay informed about potential changes and seek professional assistance when needed. With the right knowledge and strategies, you can ensure a successful and rewarding tax refund experience.

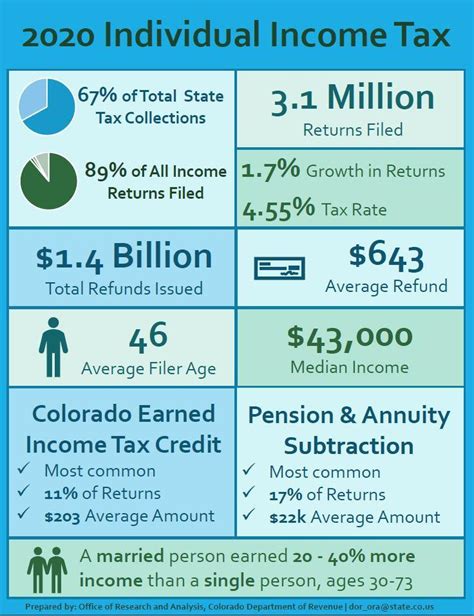

What is the average Colorado State Tax Refund?

+

The average state tax refund varies each year and depends on various factors, including income level and deductions claimed. As of the 2022 tax year, the average refund in Colorado was approximately $650.

When can I expect my Colorado State Tax Refund?

+

The processing time for state tax refunds in Colorado typically ranges from 21 to 35 days after filing. However, factors like the filing method, payment method, and the complexity of your return can impact the timeline. It’s best to track your refund status using the official state tax website.

Can I file my Colorado State Tax Return online?

+

Yes, Colorado offers an online filing system through its Department of Revenue website. This method is secure, efficient, and allows you to track your refund status conveniently.

Are there any special considerations for military personnel or seniors when filing for a Colorado State Tax Refund?

+

Yes, Colorado offers specific tax credits and deductions for military personnel and seniors. These include the Military Spouse Residency Relief Act, which provides tax relief for military spouses, and the Senior Property Tax Exemption, which reduces property taxes for eligible seniors.

What should I do if I receive a larger or smaller refund than expected?

+

If your refund is larger or smaller than expected, it’s essential to review your tax return carefully. Ensure that all the information is accurate and that you’ve claimed all eligible deductions and credits. If you have concerns, consider seeking the advice of a tax professional.