Property Tax In Hawaii

The beautiful islands of Hawaii are not only a popular tourist destination but also a desirable place to call home. However, with the allure of Hawaii's tropical paradise comes the responsibility of understanding the property tax system. Hawaii's unique geography and diverse real estate market make its property tax landscape intriguing and worth exploring. In this comprehensive guide, we will delve into the intricacies of property tax in Hawaii, providing valuable insights for homeowners, investors, and anyone interested in understanding this essential aspect of Hawaiian real estate.

Understanding Property Tax in Hawaii

Property tax, also known as real estate tax, is a significant source of revenue for local governments and municipalities in Hawaii. It plays a crucial role in funding various public services, including education, infrastructure, and community development. The property tax system in Hawaii is designed to ensure that property owners contribute fairly to the overall prosperity and maintenance of their communities.

Tax Assessment Process

The property tax assessment process in Hawaii is overseen by the Department of Taxation, which is responsible for evaluating the value of real estate properties across the state. This assessment determines the tax liability for each property owner. The Department of Taxation utilizes a variety of methods to determine the assessed value, including recent sales data, market trends, and property characteristics.

The assessed value of a property is typically based on its market value, which is the price it would likely fetch in an open and competitive market. This market value is then multiplied by the applicable assessment rate to arrive at the assessed value for tax purposes. The assessment rate can vary depending on the type of property and its location within Hawaii.

| Property Type | Assessment Rate |

|---|---|

| Residential Property | 4% |

| Commercial Property | 5% |

| Vacant Land | 8% |

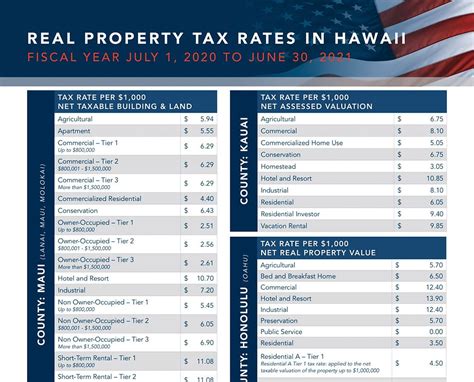

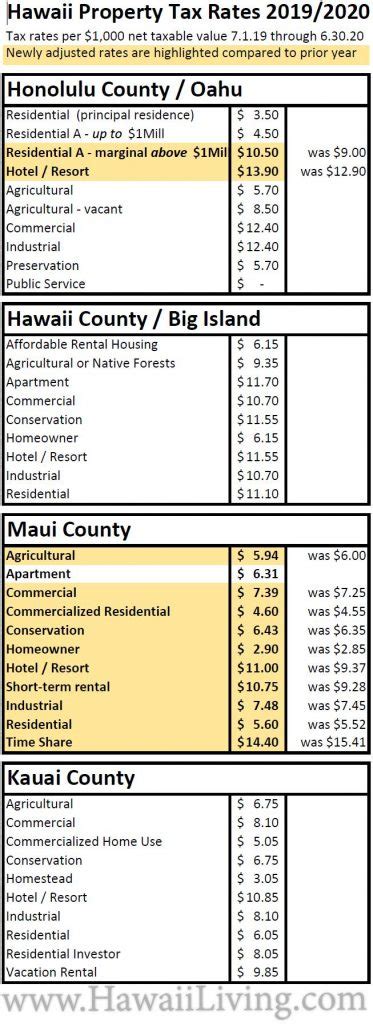

Tax Rates and Millage Rates

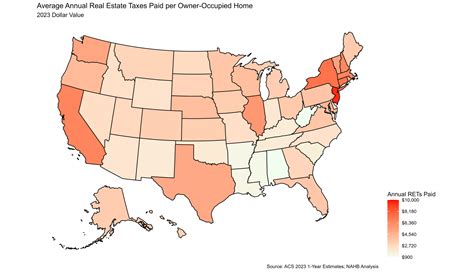

Once the assessed value of a property is determined, the applicable tax rate is applied to calculate the property tax liability. In Hawaii, property tax rates are set by local governments, typically at the county level. Each county has its own millage rate, which is the tax rate expressed in mills. One mill represents one-tenth of a percent, so a millage rate of 10 mills would equate to 1%.

The millage rate is applied to the assessed value of the property to calculate the annual property tax. This means that properties with higher assessed values will generally owe more in property taxes. However, it’s important to consider that millage rates can vary significantly between counties, even within the same state.

| Hawaii County | Millage Rate |

|---|---|

| Hawaii County (Big Island) | 7.8 mills |

| Maui County | 8.5 mills |

| Kauai County | 9.5 mills |

| City and County of Honolulu | 8.2 mills |

Tax Relief Programs

Hawaii recognizes the importance of providing tax relief to certain property owners. The state offers a variety of tax relief programs designed to ease the burden of property taxes for eligible individuals and organizations. These programs aim to promote homeownership, support seniors, and encourage economic development.

- Real Property Tax Credit (RPT Credit): This credit provides a direct reduction in the property tax liability for qualifying homeowners. Eligibility is based on income and residency requirements.

- Senior Exemption: Hawaii offers a partial exemption from property taxes for homeowners aged 65 and older. The exemption applies to a portion of the assessed value of the property, providing seniors with financial relief.

- Low Income Rental Housing Tax Credit: This program encourages the development of affordable housing by offering tax credits to developers and investors who create or preserve low-income rental units.

The Impact of Property Taxes on Real Estate in Hawaii

Property taxes play a significant role in shaping the real estate market in Hawaii. They influence investment decisions, homeownership rates, and overall economic growth within the state.

Investment Opportunities

Hawaii’s relatively low assessment rates and diverse property tax landscape create attractive investment opportunities. Investors can analyze the potential returns on their investments by considering the property’s assessed value, applicable tax rates, and any available tax relief programs.

For example, an investor considering a commercial property in Maui County would calculate the property tax liability using the assessed value and the millage rate of 8.5 mills. They could then factor in the potential benefits of tax relief programs, such as the Low Income Rental Housing Tax Credit, to enhance their investment strategy.

Homeownership and Affordability

Property taxes can significantly impact the affordability of homeownership in Hawaii. While the state’s tax rates are generally lower than in many other regions, they still represent a substantial cost for homeowners. The availability of tax relief programs, such as the Real Property Tax Credit and Senior Exemption, helps make homeownership more accessible to a wider range of individuals.

Additionally, the varying millage rates between counties can influence homeownership patterns. Homeowners may consider relocating to counties with lower millage rates to reduce their property tax burden, especially if they are eligible for tax relief programs.

Economic Development and Community Growth

Property taxes contribute to the overall economic health and development of communities in Hawaii. The revenue generated from property taxes is used to fund essential services, improve infrastructure, and enhance the quality of life for residents. This, in turn, attracts businesses, creates job opportunities, and fosters community growth.

Moreover, the availability of tax relief programs, particularly those targeting affordable housing, can help address housing affordability challenges and promote sustainable economic development.

Future Implications and Considerations

As Hawaii continues to evolve and adapt to changing economic and demographic conditions, the property tax landscape may also undergo transformations. Here are some key considerations and potential future implications:

Tax Rate Adjustments

Local governments in Hawaii have the authority to adjust millage rates based on budgetary needs and economic conditions. While millage rates have remained relatively stable in recent years, future adjustments could impact property tax liabilities. Property owners and investors should stay informed about any proposed changes to millage rates to assess their potential impact.

Population Growth and Real Estate Development

Hawaii’s population is projected to grow in the coming years, which may lead to increased demand for housing and commercial spaces. This growth could drive up property values, potentially resulting in higher assessed values and, consequently, higher property taxes. Developers and investors should consider the long-term implications of population growth on the real estate market and property tax landscape.

Sustainable Housing Initiatives

Hawaii is known for its commitment to sustainability and environmental stewardship. As the state continues to prioritize sustainable development, there may be an increased focus on tax incentives and relief programs that support green building practices and energy-efficient housing. Property owners and developers should stay informed about these initiatives to leverage potential tax benefits.

Community Engagement and Tax Policy

Engaging with local government officials and community leaders is essential for understanding the nuances of Hawaii’s property tax system. Participating in public hearings and staying informed about proposed tax policies can empower individuals to voice their opinions and potentially influence tax-related decisions that affect their communities.

Conclusion

Understanding property tax in Hawaii is a critical aspect of navigating the state’s real estate market. From the assessment process to tax rates and relief programs, this comprehensive guide has provided valuable insights into the intricacies of Hawaii’s property tax system. By considering the impact of property taxes on investment opportunities, homeownership, and community development, individuals and investors can make informed decisions that align with their financial goals and contribute to the vibrant economy of Hawaii.

What is the average property tax rate in Hawaii?

+The average property tax rate in Hawaii varies by county, with rates ranging from 7.8 mills to 9.5 mills. It’s important to check the specific millage rate for the county where the property is located.

Are there any tax relief programs for homeowners in Hawaii?

+Yes, Hawaii offers several tax relief programs, including the Real Property Tax Credit for qualifying homeowners and a Senior Exemption for homeowners aged 65 and older.

How often are property taxes assessed in Hawaii?

+Property taxes in Hawaii are typically assessed annually. The assessed value of a property is determined based on its market value as of January 1st of the tax year.

Can I appeal my property tax assessment in Hawaii?

+Yes, if you believe your property has been overvalued or there has been an error in the assessment, you have the right to appeal. The process involves submitting an appeal to the applicable county’s Board of Review within a specified timeframe.

How do property taxes impact the real estate market in Hawaii?

+Property taxes influence investment decisions, homeownership rates, and overall economic growth. They can impact the affordability of housing and attract or deter potential buyers and investors.