Darlington County Taxes

Welcome to our comprehensive guide on Darlington County Taxes, where we delve into the intricacies of tax obligations and management within this vibrant region. Darlington County, known for its rich history and diverse economy, presents a unique landscape when it comes to tax matters. From understanding the tax rates to exploring effective strategies for compliance and optimization, this article aims to provide valuable insights for residents, businesses, and anyone interested in the financial aspects of this captivating county.

Unraveling the Tax Landscape of Darlington County

Darlington County boasts a dynamic economy, with a mix of agricultural, industrial, and service sectors contributing to its fiscal landscape. The county’s tax structure is designed to support its growth and development while ensuring a fair and efficient tax system. Let’s explore the key aspects that define the tax scenario in Darlington County.

Tax Rates and Assessments

The tax rates in Darlington County are competitive and designed to attract investment while generating revenue for essential public services. Here’s a breakdown of the primary tax rates applicable to residents and businesses:

- Property Taxes: Darlington County levies a property tax based on the assessed value of real estate. The current millage rate is set at [XX mills], which translates to [XX%] of the assessed value. This rate is subject to annual adjustments by the county government.

- Income Taxes: Residents of Darlington County are subject to state income tax, which is currently set at [XX%] for individuals and [XX%] for businesses. The county also has a local income tax rate of [XX%] for certain types of income.

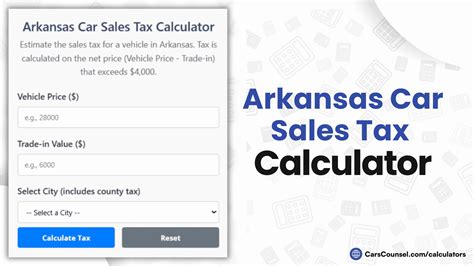

- Sales and Use Taxes: The county’s sales tax rate stands at [XX%], applicable to most retail transactions. Additionally, a use tax of [XX%] is levied on goods purchased outside the county but used within Darlington County.

- Business Taxes: Businesses operating in Darlington County are subject to various taxes, including business license fees, occupational taxes, and specific industry-related taxes. The rates vary depending on the nature of the business and its revenue.

| Tax Type | Rate |

|---|---|

| Property Tax | [XX mills] |

| State Income Tax | [XX%] (Individuals), [XX%] (Businesses) |

| Local Income Tax | [XX%] |

| Sales Tax | [XX%] |

| Use Tax | [XX%] |

It's important to note that tax rates and assessments are subject to change annually, so it's advisable to consult the Darlington County Tax Assessor's Office for the most up-to-date information.

Tax Compliance and Management

Ensuring tax compliance is crucial for individuals and businesses in Darlington County. Here are some key considerations for effective tax management:

- Filing Deadlines: Stay informed about the deadlines for tax filings. The county typically has specific timelines for property tax assessments, income tax returns, and business tax payments.

- Online Services: Darlington County offers online platforms for convenient tax management. Residents and businesses can access their tax records, make payments, and submit necessary documentation through the county’s official website.

- Professional Guidance: For complex tax situations, consider seeking advice from tax professionals or accountants who specialize in local tax laws. They can provide tailored strategies to optimize tax liabilities and ensure compliance.

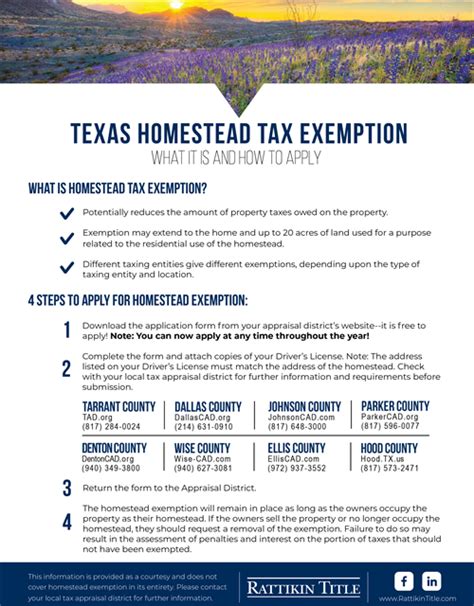

- Tax Relief Programs: The county offers various tax relief programs to support eligible residents and businesses. These programs may include property tax deferrals, homestead exemptions, and tax credits. It’s worthwhile to explore these options to reduce tax burdens.

Maximizing Tax Benefits and Strategies

Understanding the tax landscape is just the first step. To truly navigate the tax system effectively, it’s essential to explore strategies that can maximize benefits and optimize tax obligations. Here are some approaches to consider:

Tax Planning for Individuals

For residents of Darlington County, tax planning can involve a range of strategies to minimize tax liabilities. Some key considerations include:

- Maximizing Deductions: Explore eligible deductions to reduce taxable income. Common deductions may include mortgage interest, property taxes, charitable contributions, and certain medical expenses.

- Retirement Planning: Contributions to retirement accounts, such as 401(k)s or IRAs, can offer tax advantages. These contributions are often tax-deductible, and the earnings grow tax-free until withdrawal.

- Education Savings: Consider setting up education savings plans, such as 529 plans, which offer tax benefits for college savings. These plans provide tax-free growth and, in some cases, tax-free withdrawals for qualified educational expenses.

- Tax Credits: Research and take advantage of tax credits for which you may be eligible. This could include credits for energy-efficient home improvements, childcare expenses, or even specific tax credits for certain life events.

Tax Strategies for Businesses

Businesses operating in Darlington County can employ various strategies to optimize their tax positions. Here are some key approaches:

- Business Structure: Choose the right business structure, such as sole proprietorship, partnership, or corporation, which can impact tax liabilities and legal protections. Consult with a legal professional to determine the best structure for your business.

- Tax Deductions: Businesses can deduct a range of expenses, including rent, utilities, employee salaries, and marketing costs. Ensure that all eligible expenses are properly documented and claimed to reduce taxable income.

- Investment Incentives: Explore tax incentives offered by the county or state for business investments. These may include tax credits for job creation, research and development, or specific industry investments.

- Tax-Efficient Accounting: Implement tax-efficient accounting practices, such as depreciation strategies, to optimize tax liabilities. Consult with a tax professional to ensure compliance and take advantage of available deductions.

The Future of Taxation in Darlington County

As Darlington County continues to evolve, so does its tax landscape. Here are some insights into the potential future directions of taxation in the county:

Sustainable Tax Policies

Darlington County is increasingly focusing on sustainable development and environmental initiatives. This trend is likely to influence future tax policies, with potential incentives for green technologies, renewable energy, and sustainable business practices.

Digital Transformation

The county is embracing digital technologies to enhance tax management and compliance. Expect continued development of online platforms and digital tools to streamline tax processes, making them more efficient and accessible for residents and businesses.

Community Development

Darlington County’s commitment to community development is evident in its tax policies. The county may continue to offer tax incentives and programs to support local businesses, encourage economic growth, and promote community initiatives.

Frequently Asked Questions

What is the current property tax rate in Darlington County?

+

The current property tax rate is set at [XX mills], which equates to [XX%] of the assessed property value. This rate is subject to annual review and adjustment by the county government.

Are there any tax relief programs available for seniors in Darlington County?

+

Yes, Darlington County offers tax relief programs for eligible seniors. These programs may include property tax deferrals or homestead exemptions. Contact the Darlington County Tax Assessor’s Office for more information on eligibility criteria and application processes.

How can I stay updated on tax changes and deadlines in Darlington County?

+

You can stay informed by regularly visiting the official website of the Darlington County Tax Assessor’s Office, which provides up-to-date information on tax rates, changes, and important deadlines. Additionally, you can subscribe to their newsletter or follow their social media channels for timely updates.

Are there any tax incentives for businesses investing in renewable energy projects in Darlington County?

+

Yes, Darlington County recognizes the importance of renewable energy and offers tax incentives for businesses investing in such projects. These incentives may include tax credits or reductions. Contact the Darlington County Economic Development Office for detailed information on available incentives and eligibility criteria.

How can I access my tax records and make payments online in Darlington County?

+

Darlington County provides an online platform for tax management. You can access your tax records, view your account balance, and make payments securely through the Darlington County Online Tax Portal. Visit the county’s official website for instructions on how to register and use the portal.